EUR/USD

The EUR/USD pair gapped lower at the open on Monday, and then slammed into the 1.10 level. This is an area that has quite a bit of psychological significance to it though, so it’s not a huge surprise that could’ve offered a little bit of a bounce. At this point in time though, I think that this pair does continue to go lower and short-term rallies should be nice selling opportunities as there are quite a few concerns about the European Union now that the United Kingdom has decided to leave. With this, we have to worry about whether or not other member states may find it prudent to leave the European Union, and therefore it causes an inordinate amount of instability in this currency. I believe selling short-term rallies will continue to be the way going forward as the Euro will fall over the longer term.

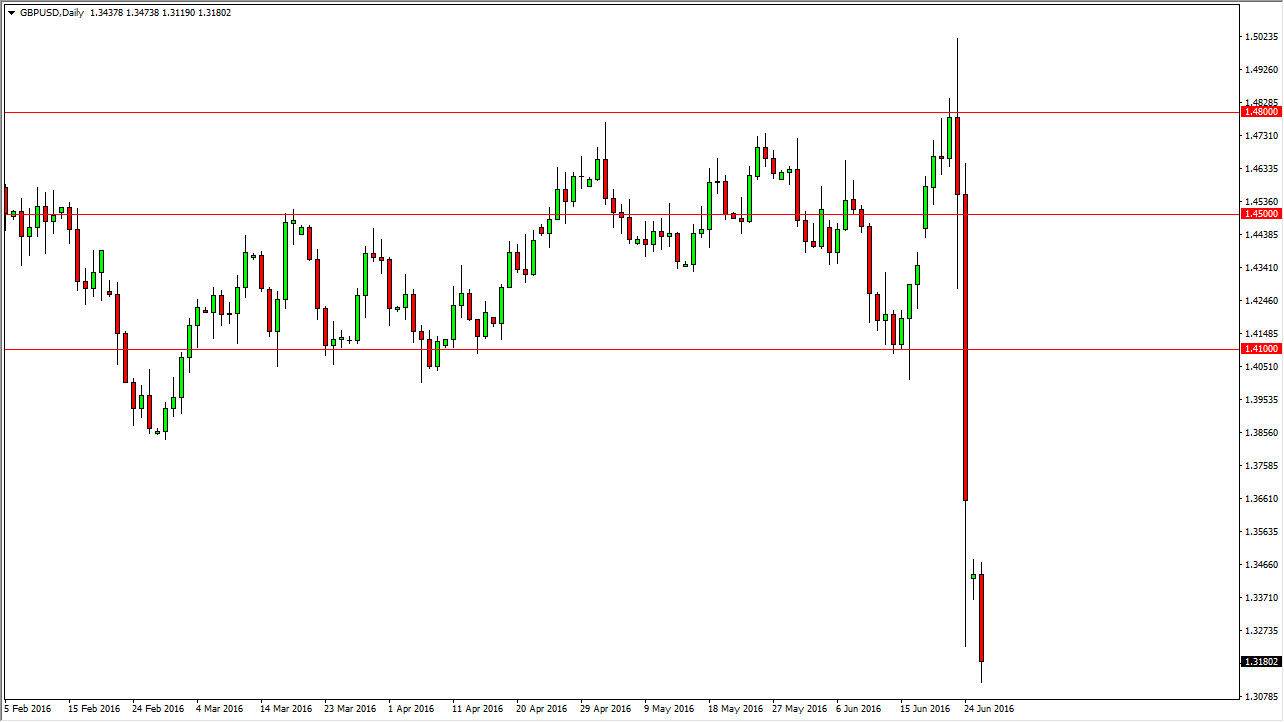

GBP/USD

The GBP/USD pair gapped lower at the open on Monday and then continued to fall. We have reached fresh, new lows, so it makes sense that we could continue to see selling pressure. Ultimately, there is a gap above that may have to be filled, but those rally should continue to be selling opportunities as this market will more than likely continue to favor the downside as there is a lot of uncertainty when it comes to the financial markets and that always seems to favor the US dollar.

On top of that, most of that uncertainty continues to focus on the British economy and the Pound of course, so it’s likely that the market will continue to favor the US dollar over the British pound in general. With this, I look at rallies as opportunities to pick up “value” in the US dollar by selling. The break down below the bottom of the candle for the day is also bearish, and I believe that we are heading towards the 1.30 level next to try to find support.