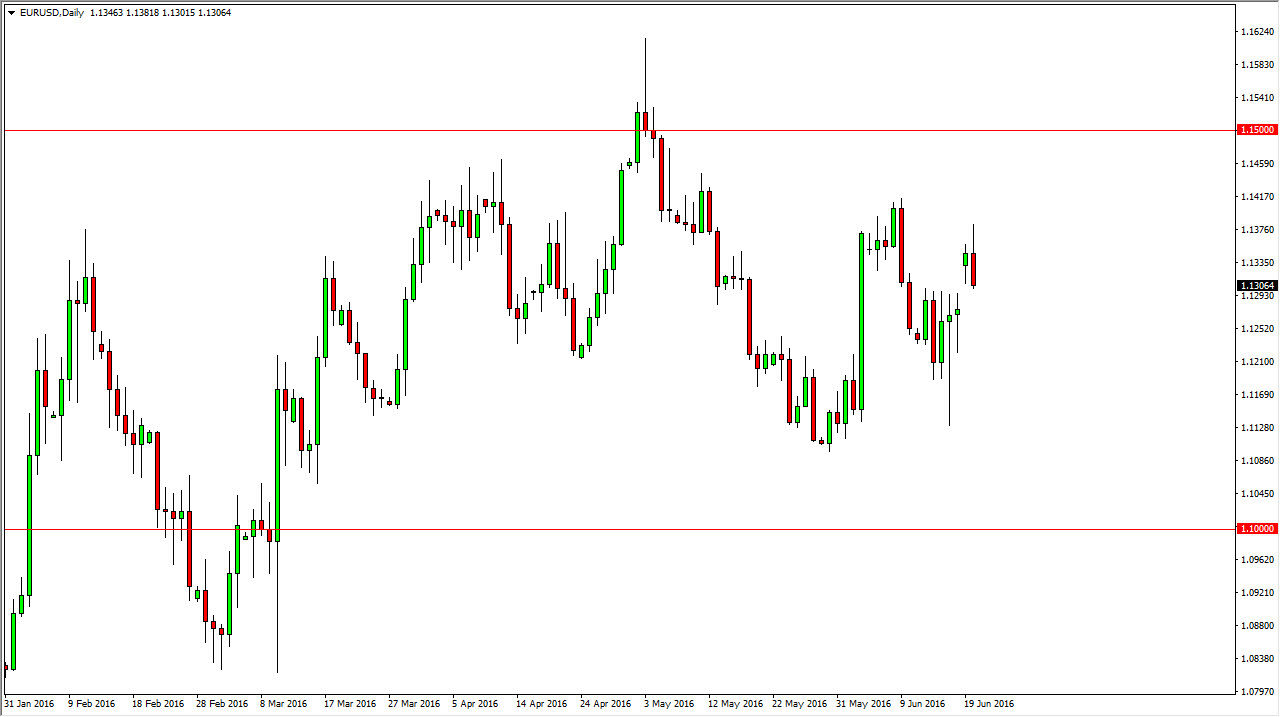

EUR/USD

The EUR/USD pair gapped higher at the open on Monday, as we got quite a bit of volatility due to the fact that the latest polls in the United Kingdom suggests that perhaps the British may be shifting towards the “remain” both. However, this is a market that should continue to be very volatile as the vote is still too close to determine. With this, the headlines over the next several sessions will continue to be market moving experiences, and as a result the Euro will of course get thrown around. With this, the markets going to be almost impossible to deal with and I believe that over the next couple of days we will continue to grind back and forth between the 1.12 level on the bottom, and the 1.14 level on the top.

GBP/USD

The GBP/USD pair initially gapped higher at the open on Monday and then skyrocketed. Ultimately, the market looks as if it is trying to reach towards the 1.48 level, which of course is rather resistive. With this, there will more than likely be sellers just above, as it’s difficult to imagine that this market is going to be able to break out before we get any real results. Headlines will continue to push this pair back and forth again and again, and as a result it’s difficult to imagine that we are ready to make a sustained move until we get some type of definitive answer to the question as whether or not the United Kingdom is going to leave the European Union.

Ultimately, there should be quite a bit of resistance above at the 1.48 level, so I’m waiting to see whether or not I get an exhaustive candle that I can sell for the short-term move. it’s likely that the market will try to fill the gap that formed, so therefore that’s just another reason to think that the knee-jerk reaction could turn right back around.