EUR/USD

The EUR/USD pair fell during the course of the session on Thursday, crashing into the 1.13 handle. Having said that the market looks as if it is going to try to drop from here, but quite frankly think there’s enough support below to turn this market around. After all, we had a very impulsive green candle form on Friday after the anemic jobs number, so having said that it looks as if the market will favor the Euro over the US dollar as it’s very unlikely that the Federal Reserve will be able to do a multitude of interest-rate hikes as we initially tried to suggest according to trader sentiment. With that being the case, I’m looking for supportive candle in order to start buying.

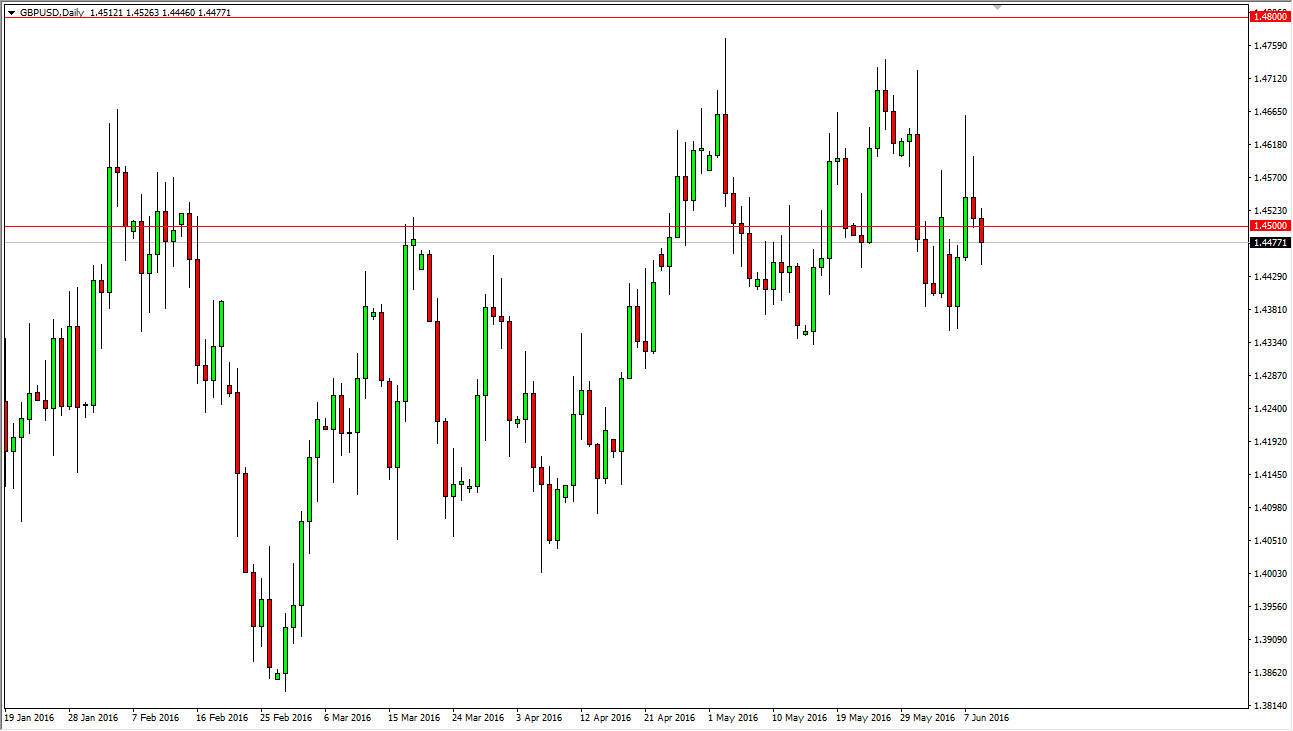

GBP/USD

The GBP/USD pair fell during the day on Thursday, breaking well below the 1.45 level, which had been supportive previously and the level that we formed a shooting star sitting on top of. That being the case, the market looks as if they could very well drop from here, but I expect a lot of bit of volatility. Quite frankly I do not like this particular pair due to the fact that we have to worry about the vote coming up later this month as far as whether or not the United Kingdom will decide to stay in the European Union. On the other side of the equation, we have to worry about whether or not the Federal Reserve can raise interest rates anytime soon. That being the case, we have the greenback falling overall at the same time, but this pair is going to be a little bit different because we have so many variables in the way of clarity, and that should continue to make this pair very choppy and difficult to deal with. With that, I’m on the sidelines for a little bit.