Gold markets absolutely skyrocketed during the course of the session on Friday, as it was announced that the United Kingdom was leaving the European Union. This of course sends quite a bit of fear into the financial markets, and people are starting to buy gold more or less as a bit of “hard currency” instead of trying to deal with the Pound or the Euro. In other words, money is running away from Europe in general.

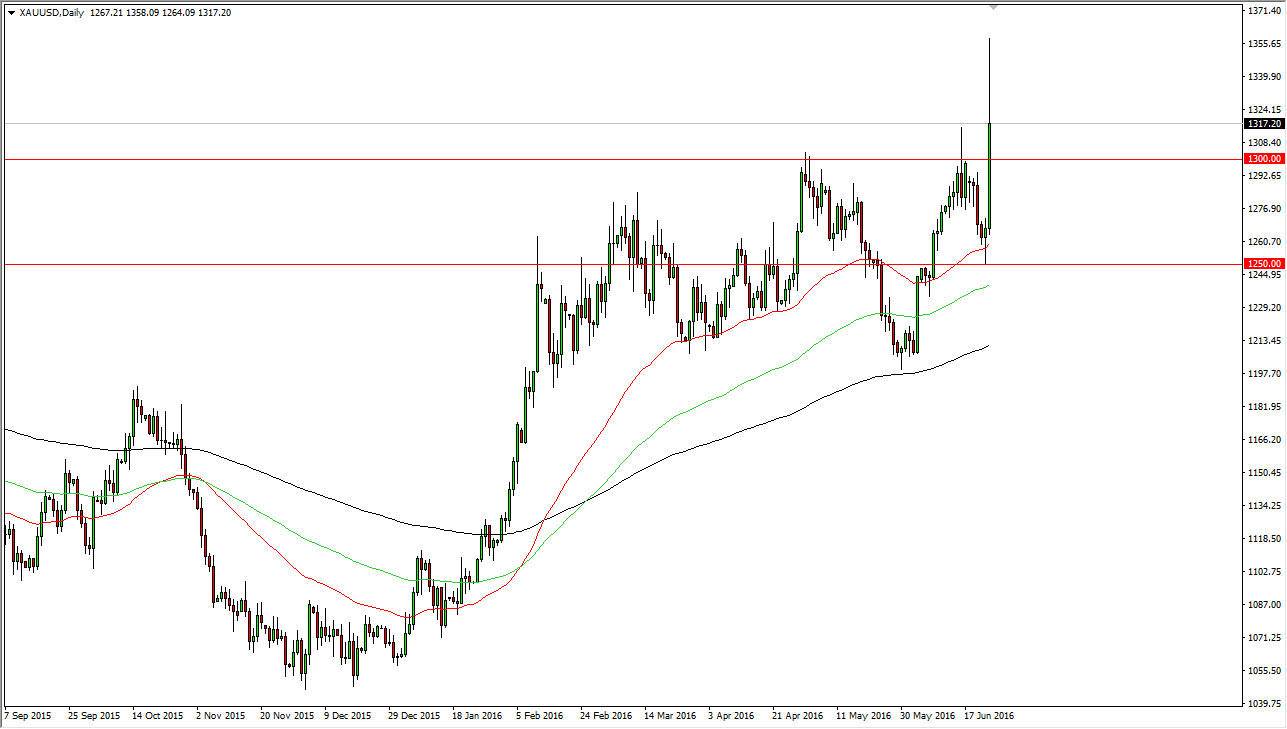

On this chart, you can see the 50 day exponential moving average colored in red, the 100 day exponential moving average color in green, and then finally the 200 day exponential moving average and black. We have a nice spread on these moving averages, and therefore we have a nice trend to the upside. It should also be noticed that the Thursday candle was a massive hammer that had formed on the $1250 level.

$1300 broken

The $1300 level was sliced through during the course of the session on Friday, and even though we gave back quite a bit of bullish pressure, the reality is that we may have just blown out quite a bit of the stop loss orders that would have undoubtedly been congregated around that large, round, psychologically significant number. At this point in time, I am currently looking for short-term pullbacks and show signs of support that I can start buying. This will be especially true near the $1300 level, which has been so significant in the past. I believe that people will continue to try to stay away from flat currencies at the moment as the uncertainty around the world should continue to be a catalyst for people to try to find assets that can offer value over the longer term.

On top of that, we have been in a longer-term uptrend for some time, so this has only thrown “fuel on the fire” as the market now has a nice boost to go higher for the next leg up.