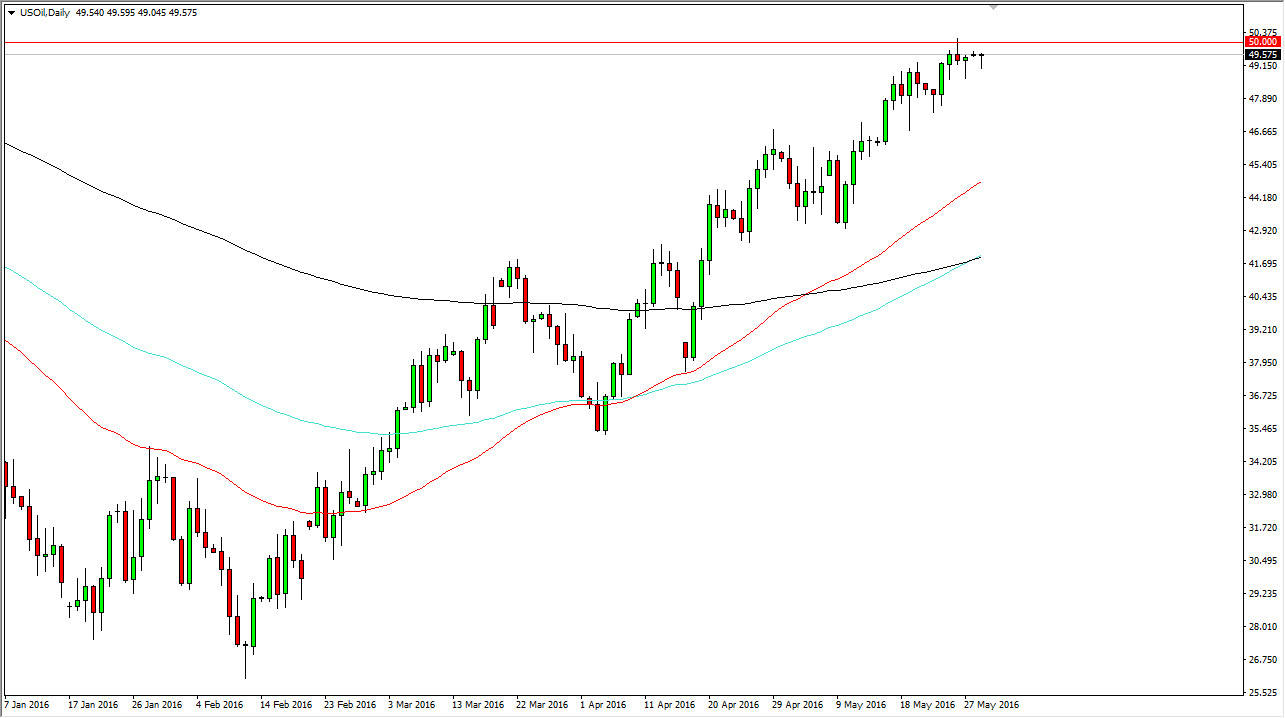

WTI Crude Oil

The WTI Crude Oil market was very quiet during the session on Monday as Americans celebrated Memorial Day. Having said that, the one thing that I do see on this chart is that we stubbornly sit still just below the $50 level. It is because of this that I think it’s only a matter time before we build up enough momentum to get above there. If we can break above the $50 level on a daily close, I feel that the market will be free to go much higher. Pullbacks at this point in time will more than likely have quite a bit of pressure applied to them as buyers will look at pullbacks as potential value.

At this point in time, I have no interest in selling this market, it simply seems far too strong and of course impulsive at this point in time. Also of interest is the fact that the 50 day exponential moving average has already crossed over the 200 day exponential moving average, and of course the 100 day exponential moving average is currently trying to do the same thing.

Natural Gas

Natural gas markets did very little during the session as well, simply because the Americans are by far the biggest traders of this commodity. We are sitting just below the $2.20 level, which is akin to the $50 level in the WTI Crude Oil market, and with that being the case it looks as if a break above there would very much move the market in an uptrend as we are currently bouncing around the 200 day exponential moving average. This of course is often used by longer-term traders, so with this being the case I am very interested in this market at the moment but I do not want to start buying into we break above the $2.20 level on a daily close. Until then, I would be very cautious here.