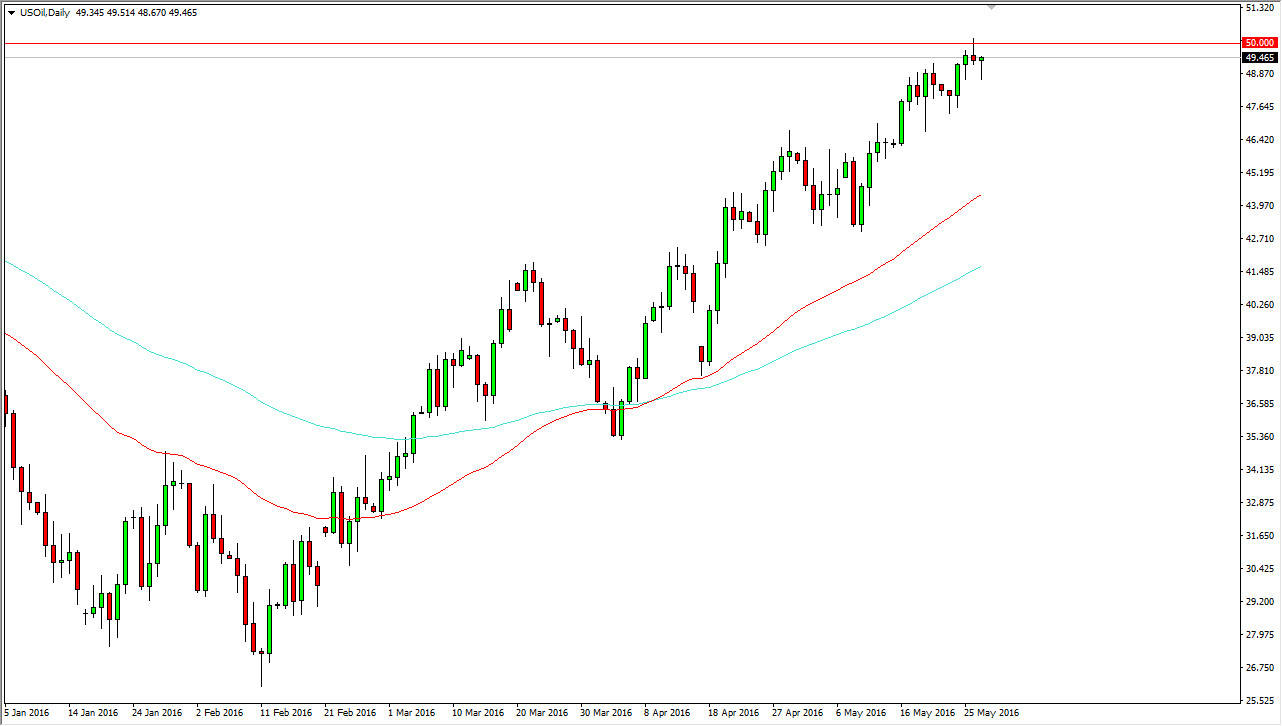

WTI Crude Oil

The WTI Crude Oil market initially fell during the day on Friday, but turned back around to form a hammer. That of course is a bullish sign and if we can break above the shooting star from the Thursday session, I feel that the market will be ready to go higher. After all, the $50 level is psychologically significant, and of course has been resistance not only on Thursday, but also during the month of October last year. I think we will eventually break out to the upside, but we could have to pull back from time to time as we build up enough momentum to finally go higher. Once we get above the $50 level, it’s likely that we will get a little bit more of a “buy-and-hold” type of attitude out of this market as clearing a psychologically important level like this will do good things for the psyche of buyers.

Natural Gas

Natural gas markets initially fell during the course of the day on Friday, but turned right back around and form a hammer as well. We are pressing the 200 day exponential moving average, and of course the $2.20 level above. I think if we can break above the $2.20 level, the market will then continue to grind its way higher, perhaps even as high as the $2.40 level. We could pullback in the moment though, as we may not have enough momentum to finally break out. On the other hand, if we break down below the bottom of the hammer from the session on Friday, that would be a very negative sign and we could very well drop back down to the $1.90 handle.

There is a lot of reasoning to thinking that the market is going to selloff before it’s all said and done, but if you have traded the markets for any real length of time, you know that they don’t necessarily do what they are “supposed to do” most of the time.