USD/JPY Trade Idea

When you are looking for a trade, and you are prepared to use your own judgment instead of following a mechanical system, what you need to look for are high-probability trade set-ups well before they actually happen. You have to anticipate a strong opportunity, and wait for it to play out with patience. Ideally, you want to see a few strong factors all come into play at the same time: what traders call “confluence”. At the time of writing – just before New York opens on 9th May 2016 – I see a potential short trade set-up on USD/JPY at or around the price of 108.72. There are several reasons why this looks like it might be a really strong opportunity.

Right now, the USD is driving the market. It is strong against almost every other currency, and later it might weaken everywhere as it is clearly in focus.

The USD/JPY is the strongest mover of today, so of all USD pairs, it is the most in focus, and so a reversal could be dramatic.

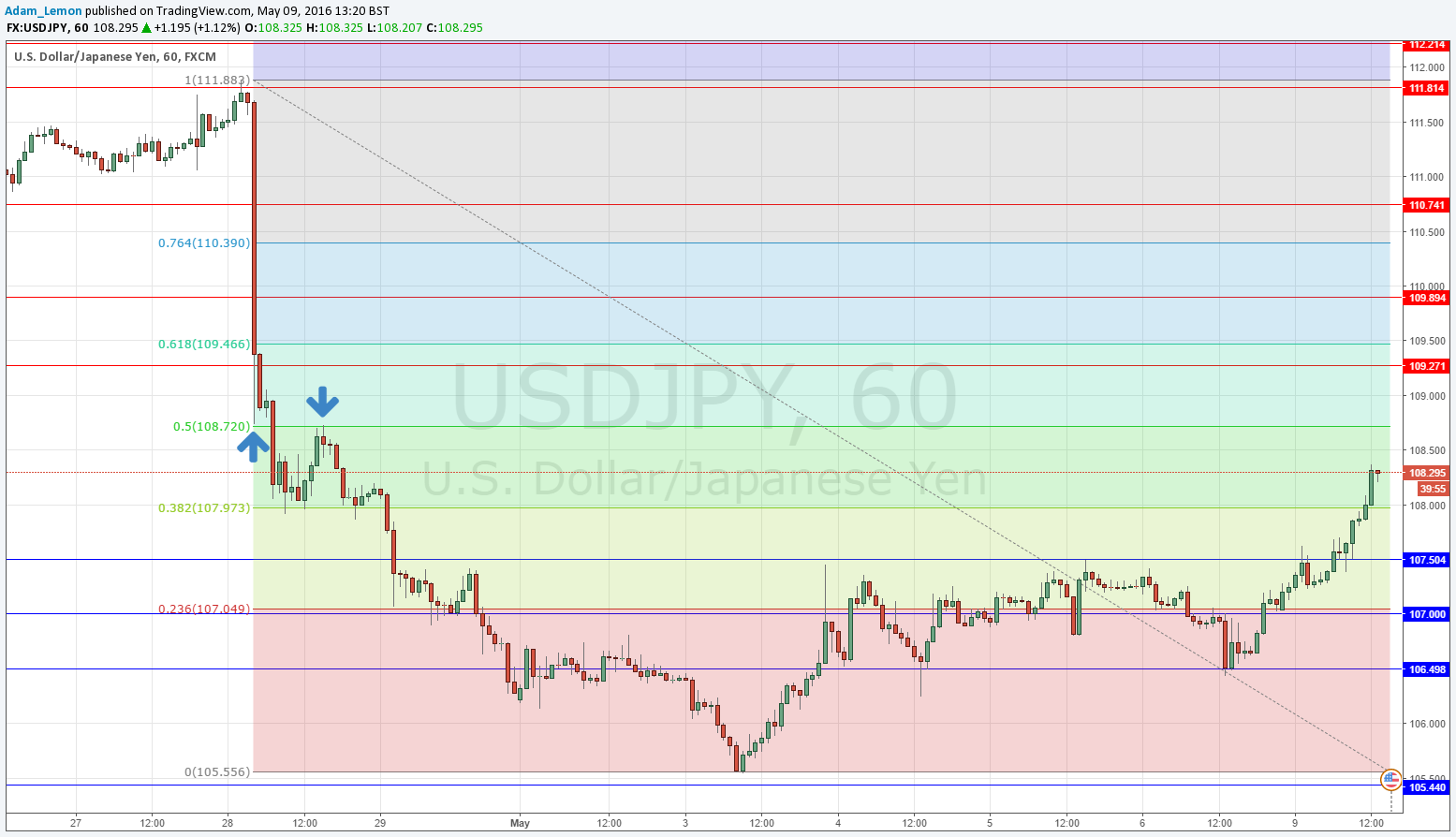

The USD/JPY pair made a very strong and fast downwards move at the end of April, falling from 111.88 to 105.56 in barely more than 3 days. There has been a retracement (pullback) of this move happening over the past several days. Fibonacci retracement levels can be used as a tool to measure likely turning points, i.e. where the pullback might end. The best Fibonacci level of all is 50%, and this is shown in the chart below as lying at 108.72, represented by the dark green line.

If we look at the left side of the chart, we can see that this level, before it became a 50% Fibonacci retracement, acted as firstly support (marked by the up arrow), then after breaking down it acted as resistance (marked by the down arrow). Levels which act as both support and resistance are often especially strong support and resistance levels.

Time of day is also a factor. If the price level of 108.72 is reached in the coming hours, it will happen during the peak market volume for this pair, which occurs during the New York and Tokyo trading sessions.

For these reasons, I will wait patiently for the price to reach 108.72. It may not happen in the near future. The quicker it happens, the more significant it will be, and the higher probability any short trade taken will have of resulting in a winning trade.

If the price does reach 108.72, it is safer to wait and see if the price turns bearish by watching the price action that occurs there, than it would be to just enter a short trade as soon as the price reached 108.72.