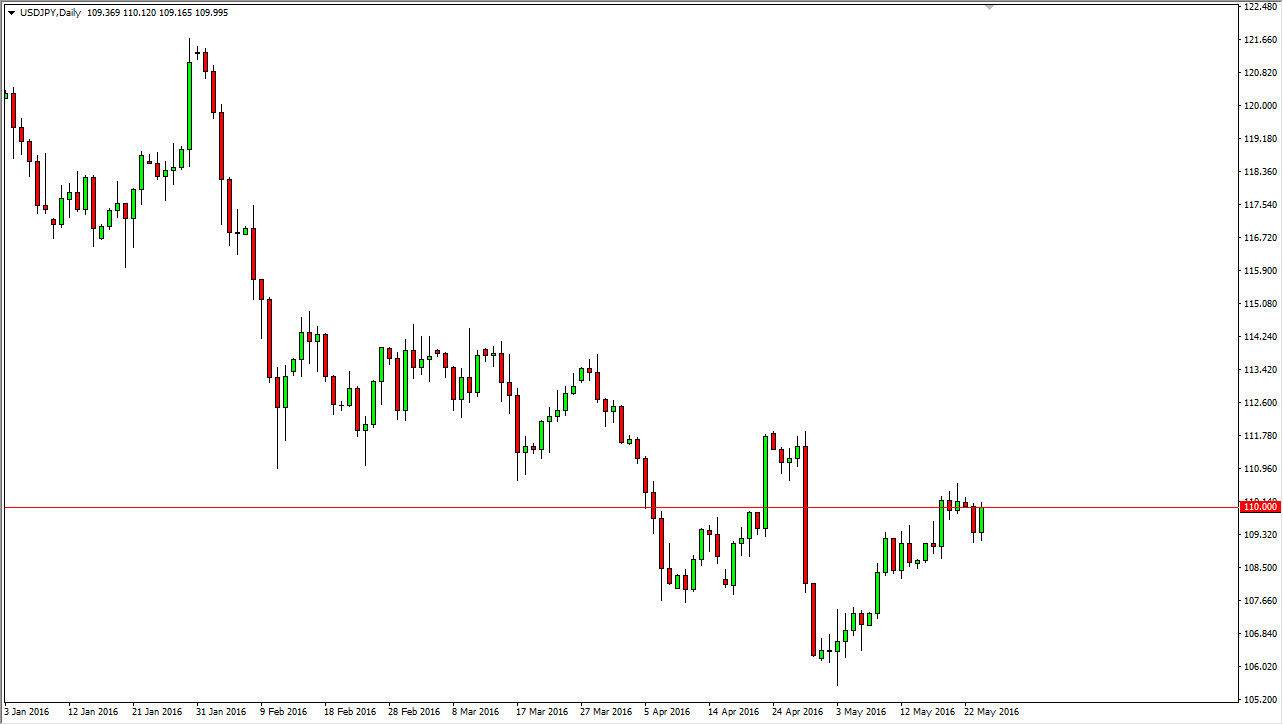

USD/JPY

The USD/JPY pair initially tried to fall during the course of the day on Tuesday, but turned around to crash into the vital 110 level. This is an area that I have been watching for some time now, and I believe it will continue to offer resistance. However, there is a shooting star from the Friday session that I believe will be the biggest indicator as to whether or not we can go higher. Simply put, if we can break above that shooting star would be very interested in going long and aiming for at least the 112 level. If we can get above there, we could go towards the 115 level, but there will be quite a bit of volatility to that area.

Risk appetite

Keep in mind that the USD/JPY pair is highly sensitive to risk appetite, and as a result it’s likely that the stock markets will have to be paid attention to as they are a great indicator of whether or not there is any type of risk appetite or tolerance out there. With this, the market will probably follow the S&P 500 as it typically does. If we can rally in the S&P 500, it should signal that the market is ready to break above the top of the shooting star that I mentioned previously.

I have no interest whatsoever in selling this market, simply because I see quite a bit of support near the 108 level. If we get down below there, I would have to rethink everything but it would also have to be in congruence with a general selloff in the stock markets and of course the breakdown mentioned. The commodity markets could also be looked at as well, as they tend to be highly influenced by risk appetite in general. So pay attention to the commodities markets and stock markets, as they should give us an idea of where this pair goes.