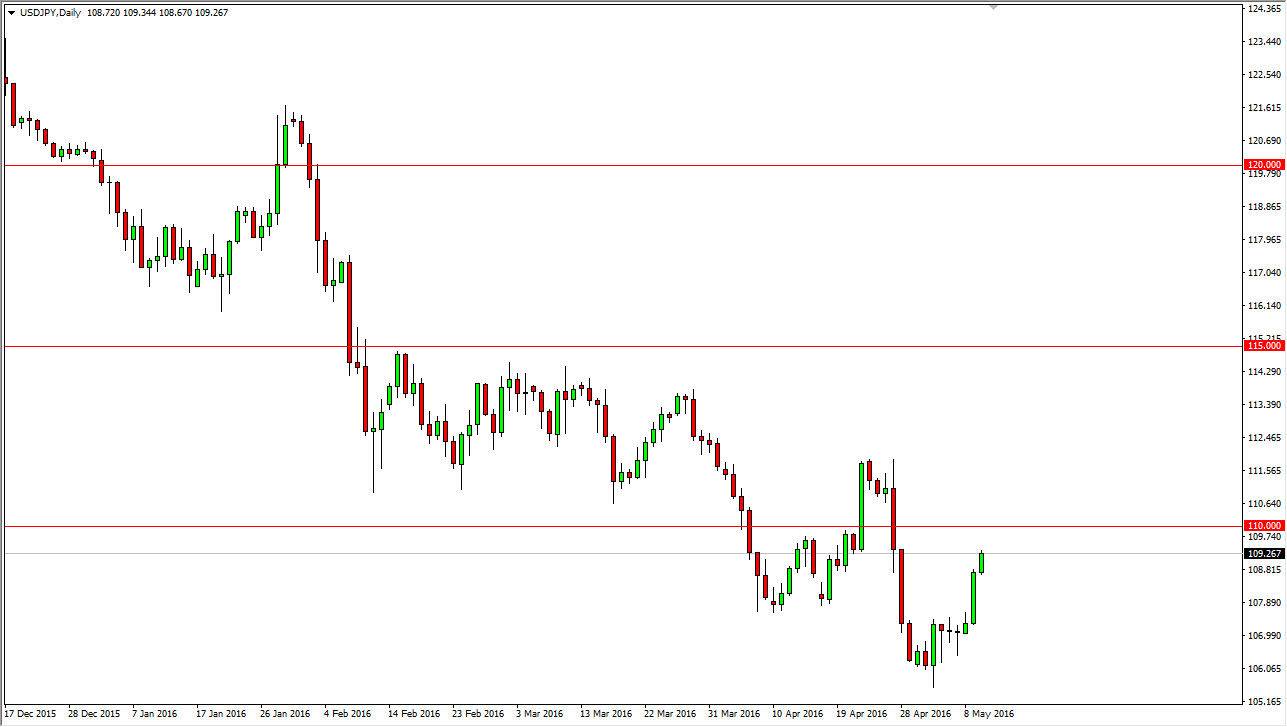

USD/JPY

The USD/JPY pair rose during the course of the day on Tuesday, as we continued to see buyers jump into this marketplace. I now think that we are going to test the 110 level for resistance, as it is obvious the buyers have returned. The real question then becomes whether or not we can break above that level significantly, which remains to be seen of course.

Keep in mind that this pair tends to be very sensitive to risk appetite, so if we see the stock markets around the world starting to rally, this pair will probably go higher as well. Remember, the Japanese yen is considered to be one of the biggest safety currencies in the world, so that’s why the yen related pairs tend to be so significantly influenced by risk appetite. If we can break above the 110 level, I think the next stop will be somewhere near the 111.50 handle.

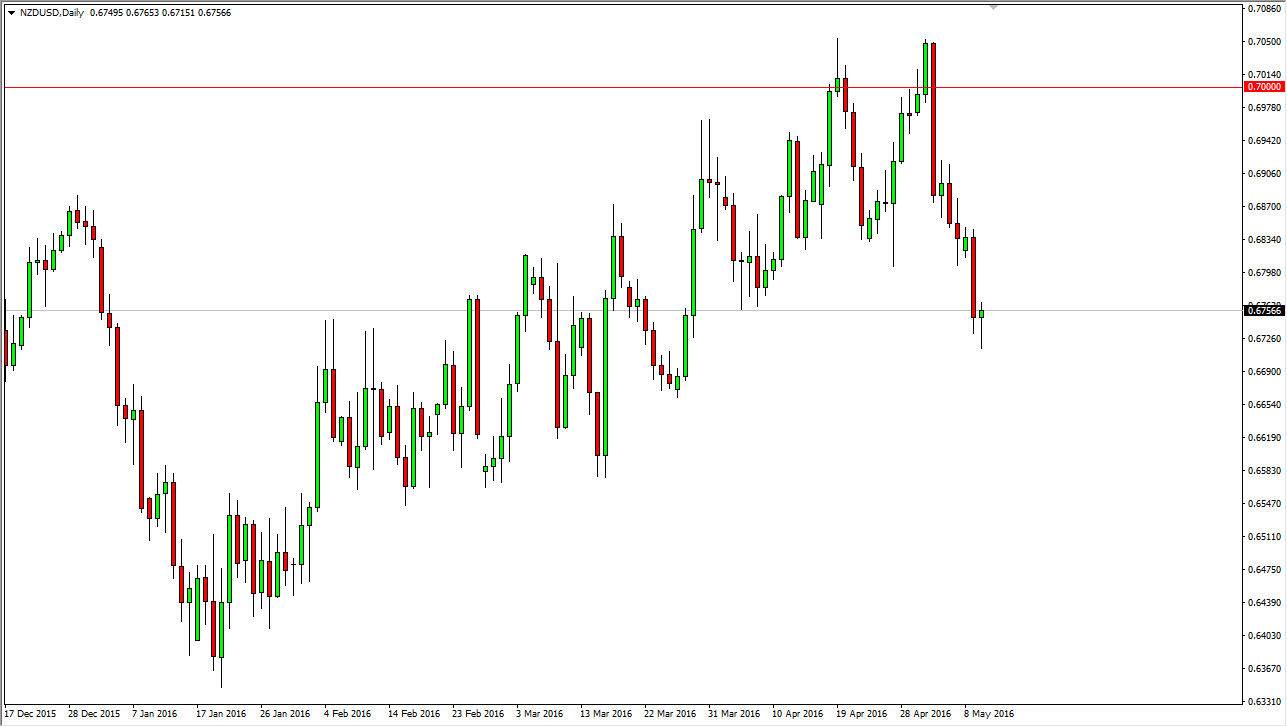

NZD/USD

The NZD/USD pair initially fell during the day on Tuesday, breaking down towards the 0.67 handle. However, we turned back around to form a bit of a hammer, and that is one of my most favored by signals. If we can get above the top of the range for the day on Tuesday, we could very well find yourselves reaching towards the 0.6850 level.

This isn’t to say that the move higher is going to be easy, just that it very well could happen. On the other hand though, if we break down below the bottom of the hammer that is a very negative sign, and could send this market looking for 0.66 over the next several sessions. Regardless of what happens, I think it’s fair to say that there will be quite a bit of volatility in this market, and you have to keep in mind that the New Zealand dollar is highly sensitive to commodity markets. On the whole, if they go higher, so does this pair and of course vice versa.