USD/JPY

The USD/JPY pair rose slightly during the course of the session on Monday, but did struggle towards the end of the day. Because of this, the market looks as if it is starting to struggle a bit, as the downward pressure is far too much. After all, a rally at this point in time will more than likely find plenty of people willing to jump on the bandwagon of selling this pair, as it should then try to reach towards the next psychologically significant number, the 105 level. I believe at this point in time that the 110 level above is essentially a “ceiling” in this market, and therefore exhaustive candles are exactly what I will use in order to start selling again. I have no interest in buying this pair, as the US dollar appears to be on its back foot at the moment.

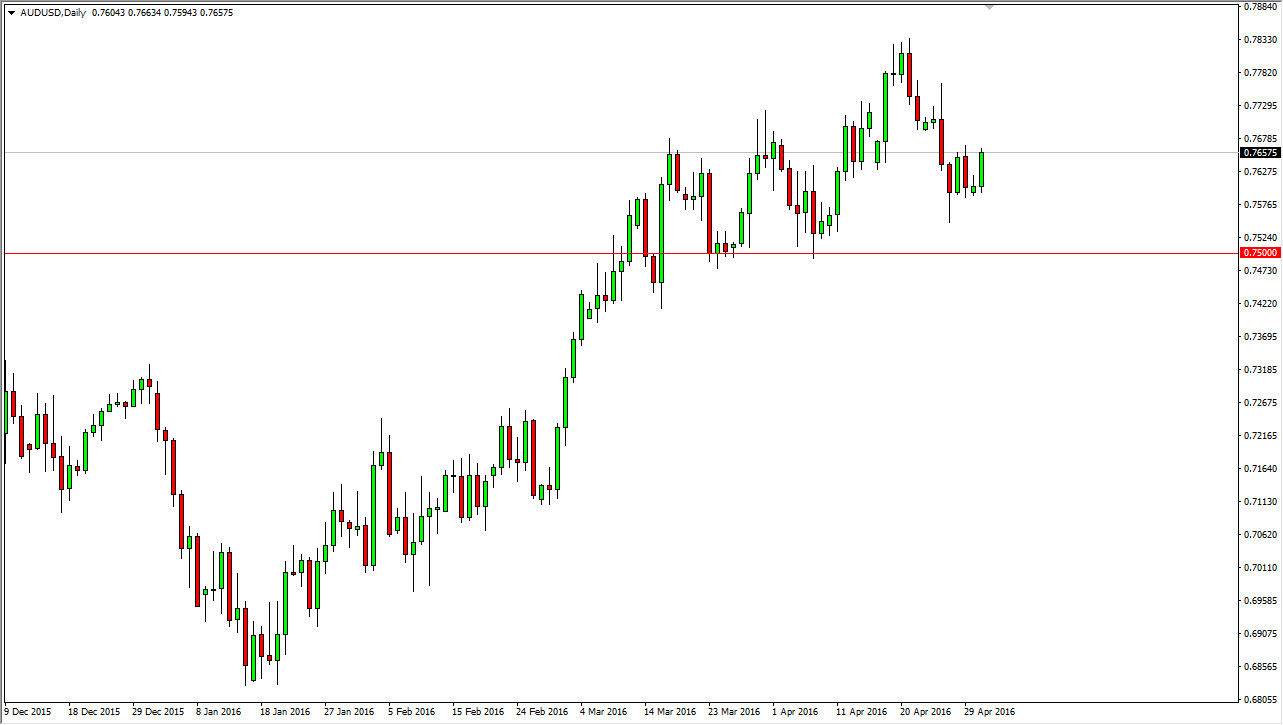

AUD/USD

The AUD/USD pair rose during the course of the day on Monday, as we continue to see buyers just below. The region of the 0.75 level is massively supportive as far as I can tell, and now should be supportive based upon the fact that it was such resistance before. Also, we’ve been in an uptrend for some time so it makes sense that we would continue to. I have no interest in shorting this market, and it appears that gold is ready to break out as well which could add further fuel to the fire of the Australian dollar going higher anyway.

On the other side of the equation, we have the US dollar which has been struggling as of late, and should continue to be another reason for this market to go higher. This pair should continue to grind towards the next logical level, the 0.80 level which I see as the longer-term target. It will be volatile though, so at this point in time expect pullbacks going forward.