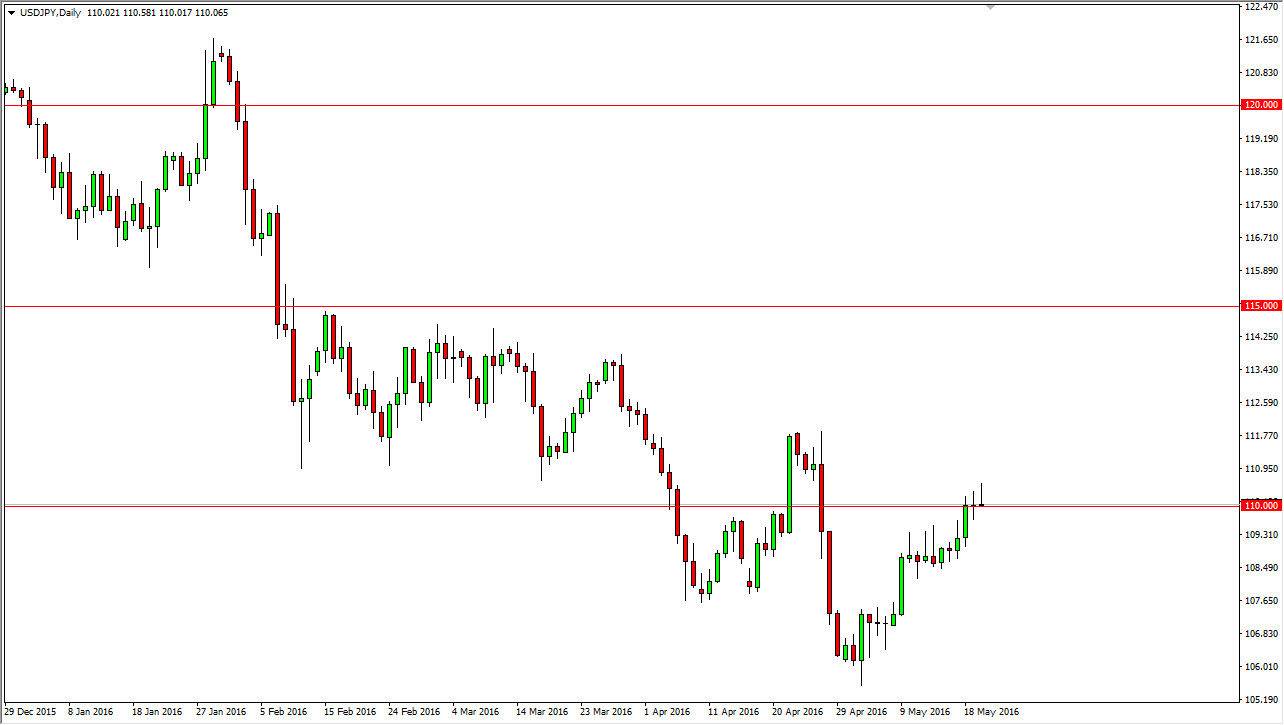

USD/JPY

The USD/JPY pair initially tried to rally during the day on Friday but turned right back around above the 110 level. There is a significant amount of resistance just above there, so it makes sense we would form a massive shooting star. A break down below the bottom of the shooting star would be a negative sign, but I also think that there is a significant amount of support at the 109 level to keep this market going higher. If we can break above the top of the shooting star though, that would be a bullish sign and should send this market towards the 112 level. Ultimately, you have to keep in mind that this pair tends to react to risk appetite around the world, and as a result you will have to watch stock markets and commodity markets in general to see how the trading world views risk.

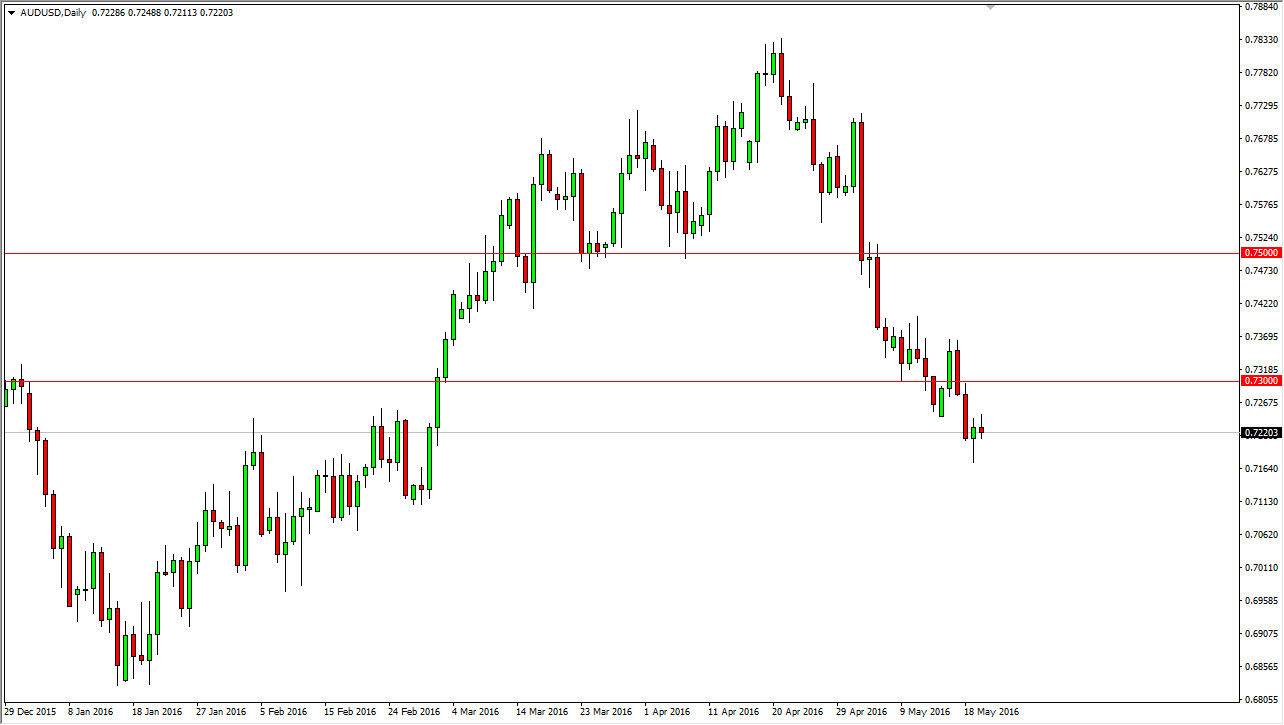

AUD/USD

The AUD/USD pair went back and forth during the course of the session on Friday, showing that there is a bit of resilience, as we broke above the top of the hammer, but there is a significant amount of resistance just above in this market. The 0.73 level above offers quite a bit of resistance due to the fact that it was support recently, but we also have the 200 day exponential moving average recent consolidation area, so this point in time I think that any rally in this market would be a reason to start selling. Simply waiting for exhaustion would be the best way to trade any rally in my estimation as the Australian dollar has recently suffered a surprise interest-rate cut by the Reserve Bank of Australia. Ultimately, this market could drop down even further but there is a significant amount of support just below that makes a bounce in this area likely, but should just simply be an attempt to build up enough momentum to break down.