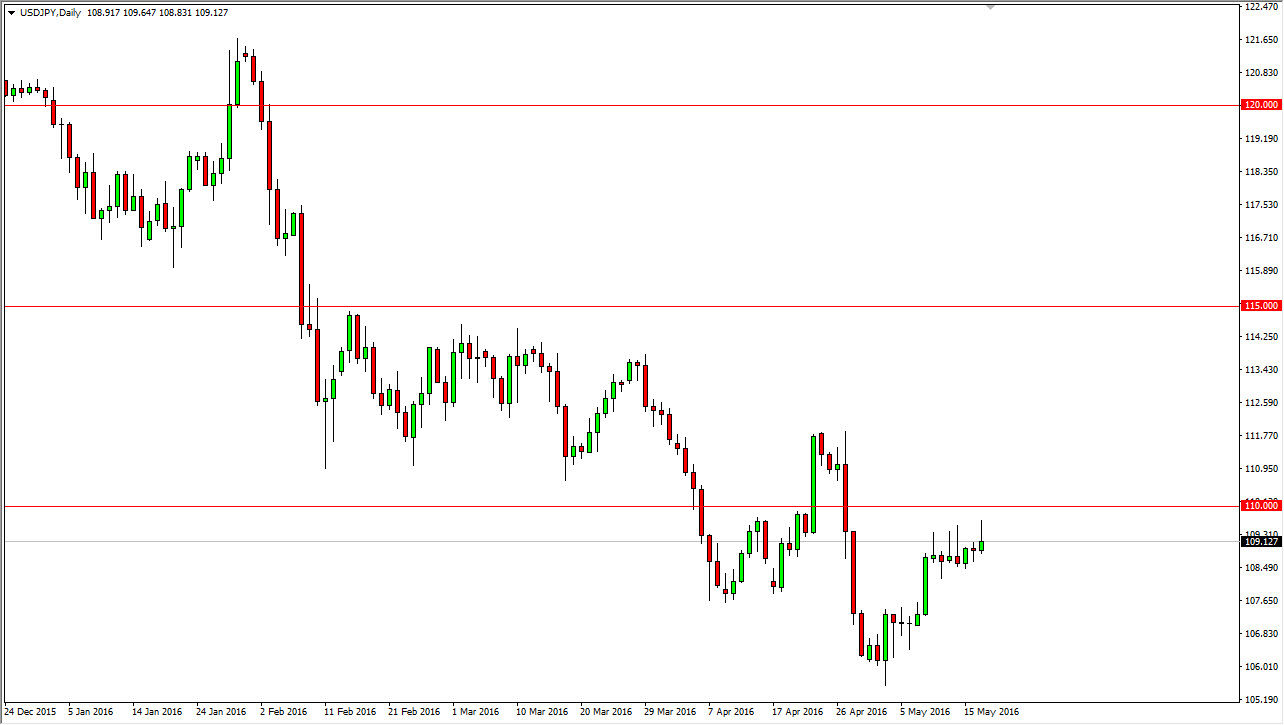

USD/JPY

The US dollar took off to the upside against the Japanese yen during the session on Wednesday, clearing the 110 level. For myself, this is a very strong sign and I believe that the market is going to continue to go higher from here. I anticipate that the market is going to see a move to the 112 level, which is where we sold off rather drastically a few weeks ago. I also think that there is a significant amount of support below, somewhere near the 109 handle, so it’s likely that the buyers will be involved in this market on pullbacks and show signs of support. Because of that, I believe that it’s only a matter of time before we not only reach the 112 level, but perhaps even try to take off above there.

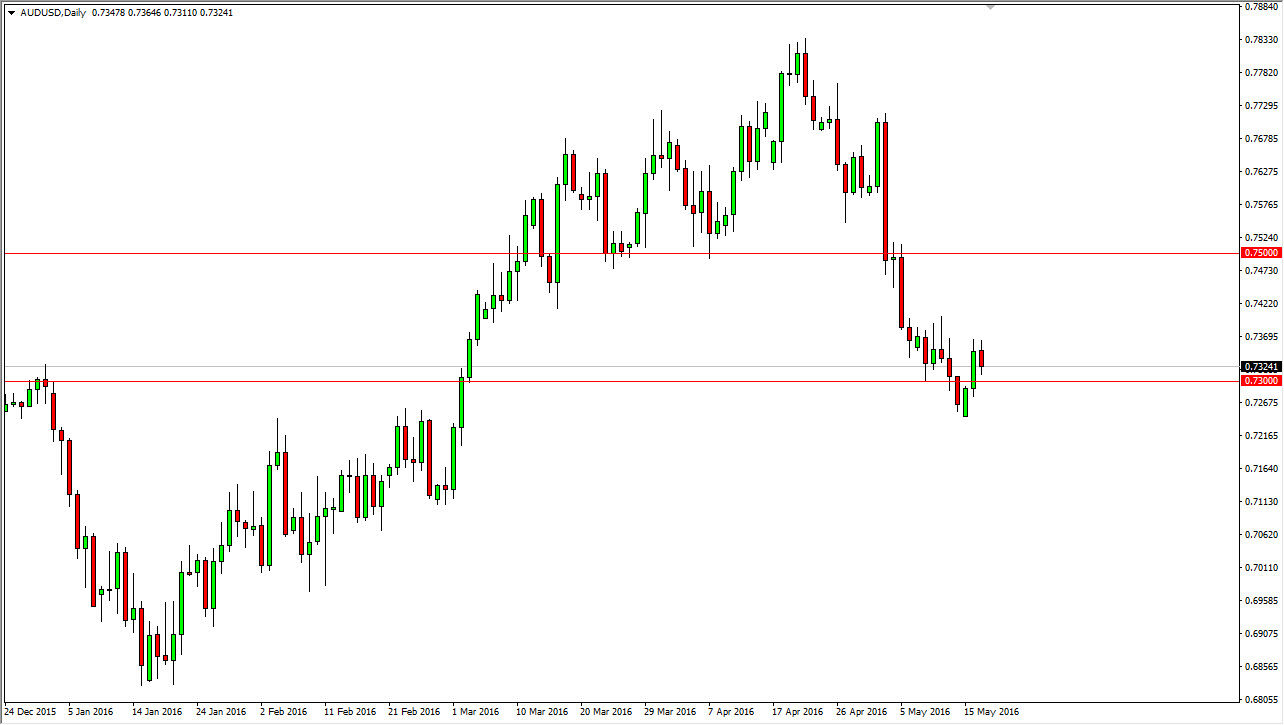

AUD/USD

The Australian dollar fell during the day on Wednesday, breaking below the bottom of the shooting star from the Tuesday session. We are well below the 200 day exponential moving average now, and it appears that we are trying to grind our way down to the 0.70 level. There is a lot of noise just below though, so I don’t look at this as an easy trade, but certainly one that goes with the overall theme of a shrinking Australian dollar, as the Reserve Bank of Australia cut interest rates in a bit of a surprise move a couple of weeks ago.

Rallies at this point in time will more than likely struggle at either the 0.73 handle, or perhaps the 200 day exponential moving average. With that being the case, I do think that the downward side as the best way to play this pair, but keep in mind that the volatility will probably make it a series of short-term selling opportunities more than a longer-term trade that you can hang onto.