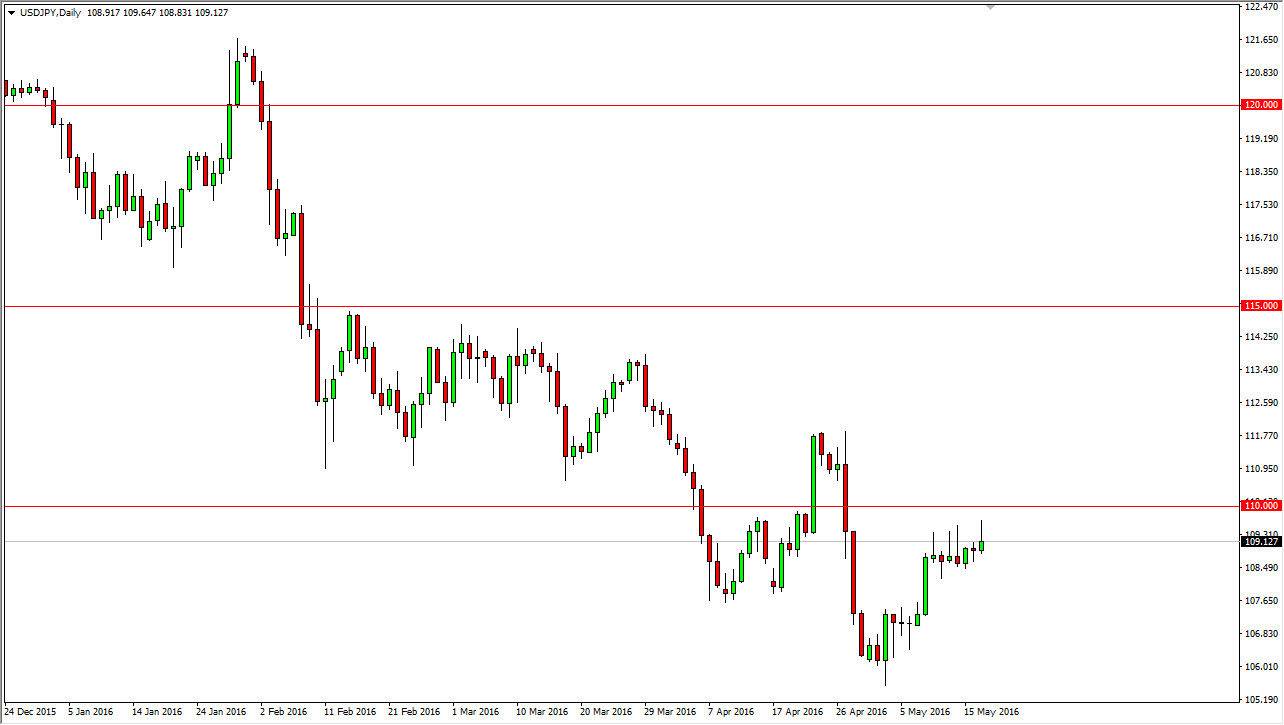

USD/JPY

The USD/JPY pair rallied initially during the day on Tuesday, but continues to see quite a bit of resistance all the way up to the 110 handle. In fact, at this point in time I think this is a market that you have to see a daily close above the aforementioned 110 level in order to start buying. Otherwise, you’re probably going to get chopped up in the ensuing volatility. However, if we can break down below the 108 level I feel that we will then go to the 106 level. We get the FOMC Meeting Minutes today, so it is likely that we will get some volatility but at this point in time I’d have to say that the resistance looks fairly strong.

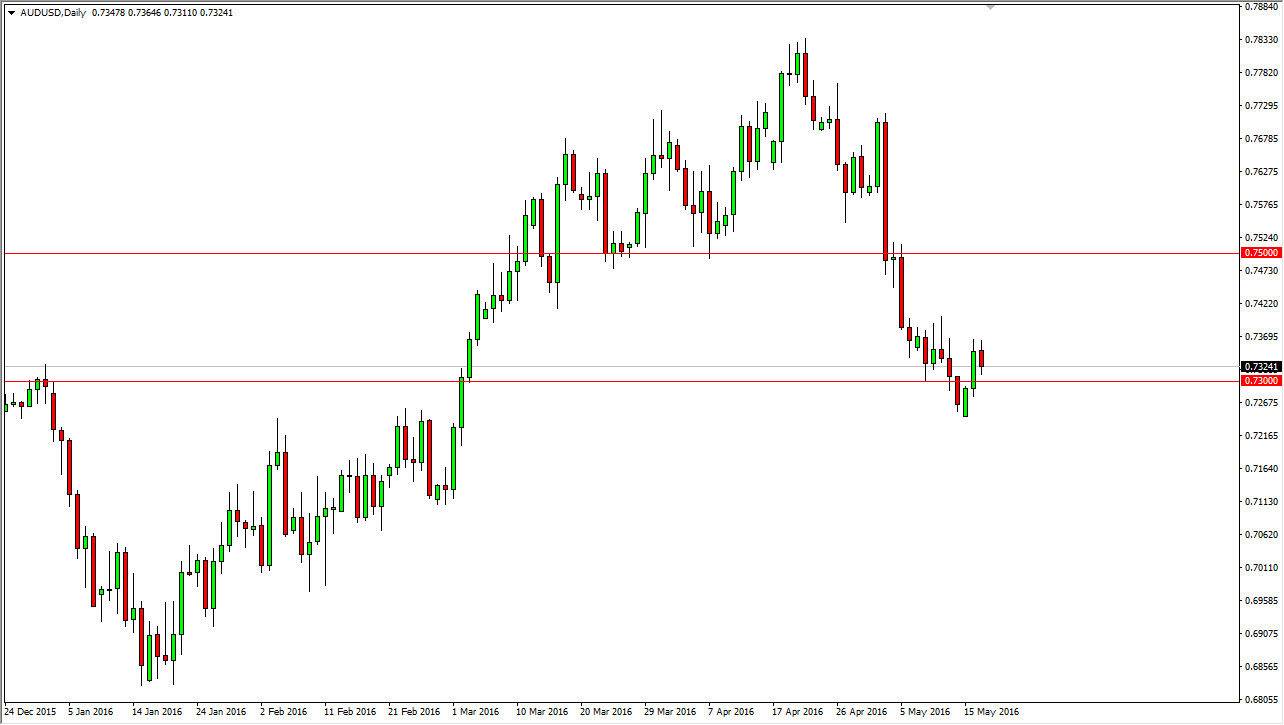

AUD/USD

The AUD/USD pair fell slightly during the course of the day on Tuesday as well, but remains above the 0.73 level for the moment. If we can stay above here, we have a chance for the Australian dollar to pick up steam against the US dollar, but I think there is a massive amount of noise between here and the 0.75 level. Quite frankly, we are going to need to see volatility due to the FOMC Meeting Minutes, or perhaps the gold markets rising in order to continue higher. If we did get above the 0.75 level though, I would be very impressed and would certainly be and more of a “buy-and-hold” mode. In the meantime, I do think we’re going to try to rally, but it’s going to be very difficult and needless to say very dangerous.

If we do break down below the 0.73 level, we will probably try to grind down to the 0.71 handle although there is a lot of noise below, which means it will be very difficult as well. Quite frankly, the currency markets look very choppy at the moment and difficult to navigate.