USD/JPY

The USD/JPY pair fell during the course of the day on Wednesday, breaking the bottom of the shooting star that formed on Tuesday. This is without a doubt one of my favorite sell signals, breaking the bottom of a shooting star. I believe that the market is going to continue to grind lower, I’m not necessarily looking for some type of break down. The US dollar of course has struggled in general of the last several sessions, and it very well could continue to do so based upon this chart. The market will more than likely reach to the 106 level next, and then possibly even lower than that. I have no interest in buying until we break above the 110 level, something that doesn’t look very likely to happen at this point in time, as all signs are bearish.

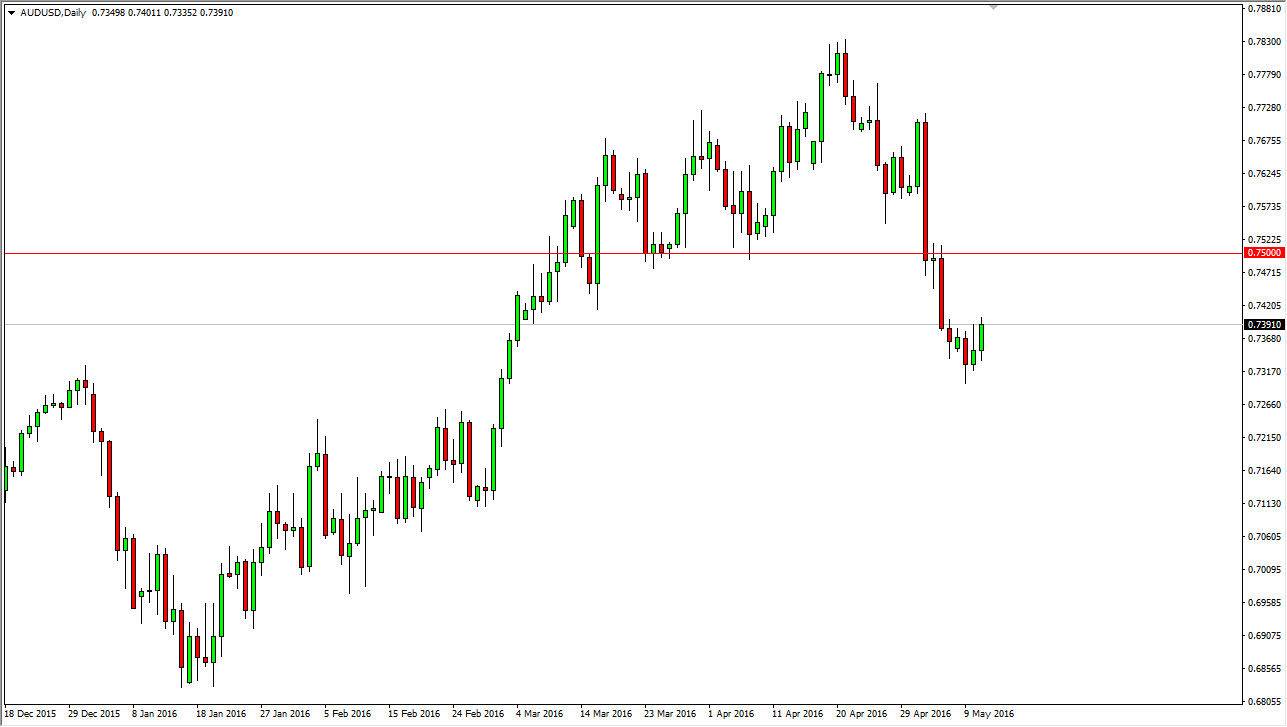

AUD/USD

The AUD/USD pair broke higher and above the top of the shooting star from Tuesday during the Wednesday session, and it looks like we could try to grind our way higher, perhaps reaching as high as the 0.75 level. It is at that level that I would anticipate quite a bit of bearish pressure, so I’m not necessarily sold on buying this market right now. I think you are probably best left on the sidelines and not worrying about the Australian dollar right now. If we broke above the 0.75 handle, then it becomes a completely different scenario. But until then I think there is still quite a bit of bearish pressure above that could jump right back into the marketplace and pushed the Aussie lower. With that being the case, I certainly don’t have any interest in risking any money in a currency market that could be quite volatile.

Keep an eye on the gold markets, they of course have their own influence on the Australian dollar, but at this point in time I think this is simply a reaction to the Reserve Bank of Australia cutting interest rates last week.