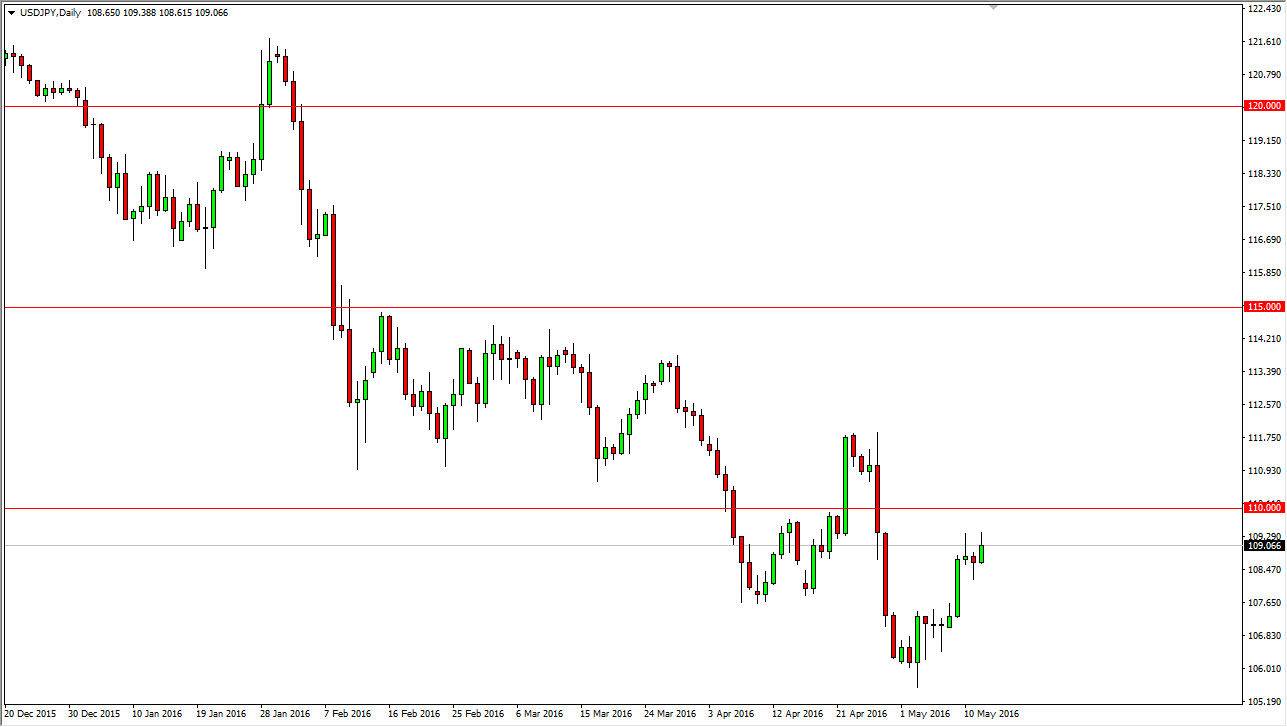

USD/JPY

The USD/JPY pair rose slightly during the course of the day on Thursday as we continue to try to grind our way towards the 110 handle. The 110 handle of course is a massive resistance barrier, and as a result it’s likely that we will continue to fight back and forth. An exhaustive candle in this area should be a reason to start selling, and with that being the case the market could very well drop back down towards the 106 level. There is quite a bit of noise in this general vicinity, and as a result it’s likely that the volatility will keep a lot of you out of the market. At this point in time though, it’s likely that we will see sellers enter the market again and again. However, if we break above the 110 level, we could reach as high as the 112 level. Remember, this pair continues typically to follow risk appetite, so having said that we will have to pay attention the stock markets as well.

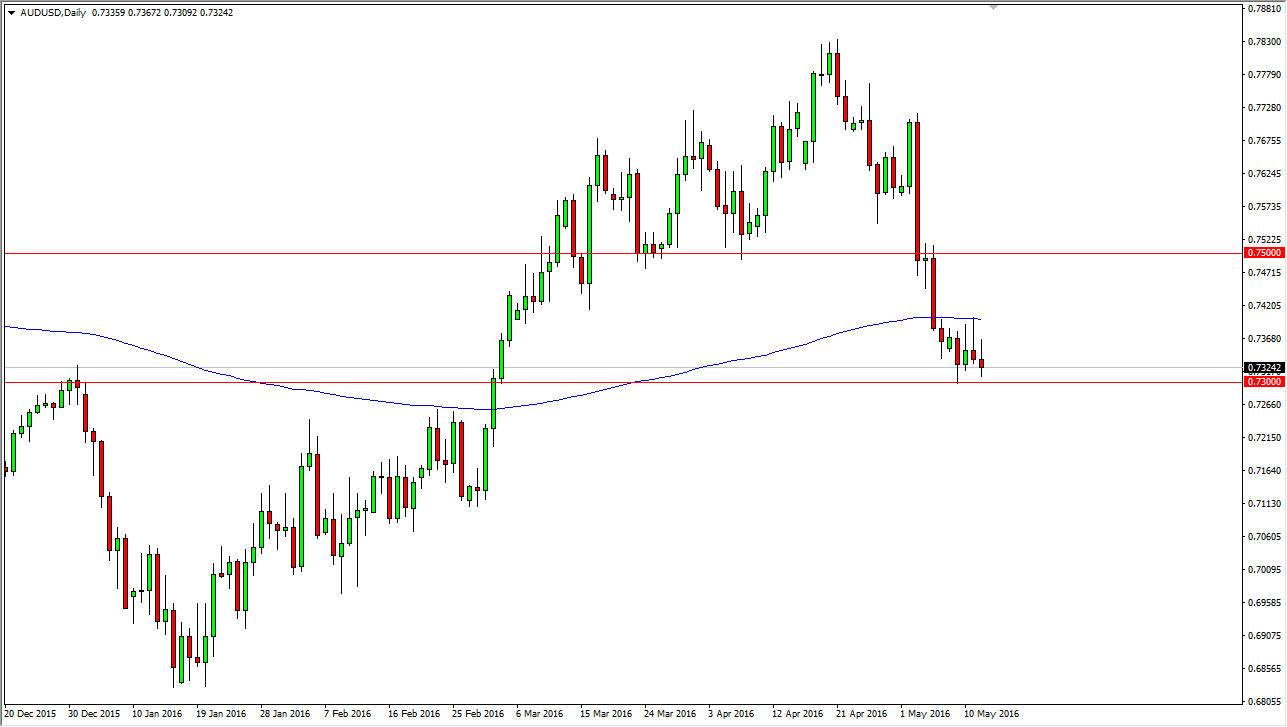

AUD/USD

The AUD/USD pair initially tried to rally during the day on Thursday but turned right back around to form a shooting star. The shooting star mirrors the shooting stars that also formed for the Wednesday and Tuesday session, meaning that we are starting to see a significant amount of bearish pressure in this market. Granted, the 0.73 level below is supportive, but at this point time if we can break down below there on a daily close I am more than willing to start selling the Australian dollar as it should continue to fall. Keep in mind that the gold markets also can have an influence on this particular currency pair, so pay attention to those as well although they don’t necessarily have to move perfectly in unison. The 200 day exponential moving averages just above the current trading range, so I have to believe that longer-term traders are starting to look at shorting this market. Ultimately though, if we can break above the top of the 200 day exponential moving average, I’d be willing to start buying and aiming for the 0.75 handle above.