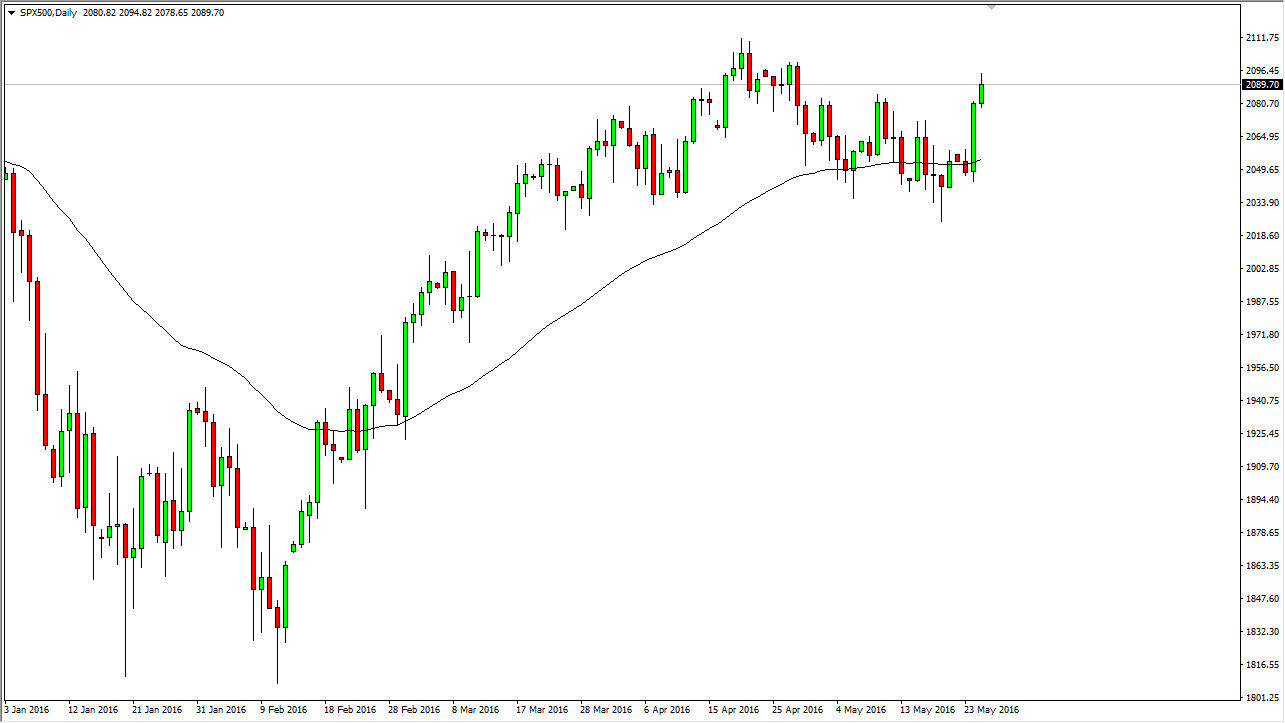

S&P 500

The S&P 500 had a positive session during the day on Wednesday as we continue to see the buyers take over. We have broken above the 2080 level which of course was resistance, but we could not break above the 2100 level. That’s not a huge surprise though because quite frankly it was so resistive in the past. I think that it’s going to take at least one more attempt to get above that level, so I look at pullbacks as potential “value plays” as it would make the S&P 500 cheap. I think there is more than enough dynamic support below on the 50 day exponential moving average plodded, and of course the fact that the 2050 level was so supportive previously. Ultimately, this is a buy only market as far as I can see and I believe that pullbacks that show signs of support will be used as value.

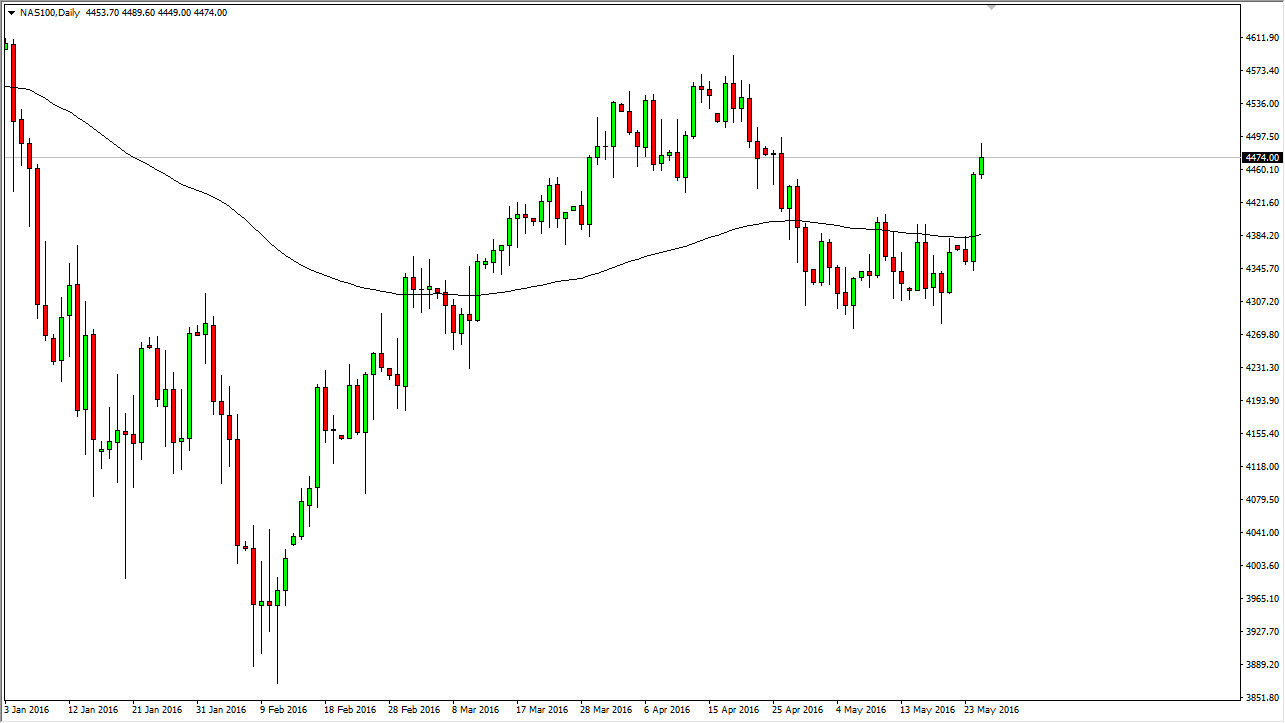

NASDAQ 100

The NASDAQ 100 rose as well, although it had shown quite a bit of bullishness the previous session. Because of this, we started to run out of a little bit of momentum as we approached a fairly noisy area. I think that a pullback is likely, but quite frankly I also think that it’s very healthy. On this chart, I have the 100 day exponential moving average plodded, and you can see that it was previously dynamic resistance they got broken above. With this being the case, it’s very likely that if we fall all the way back down to their there will be support. With the impulsive candle from the Tuesday session I think that’s going to be the case the matter whether or not the exponential moving average is there quite frankly.

I believe that the NASDAQ 100 will more than likely break out to the upside given enough time, so when it pulls back you have to be looking for supportive candles on short-term charts in order to start buying in my estimation.