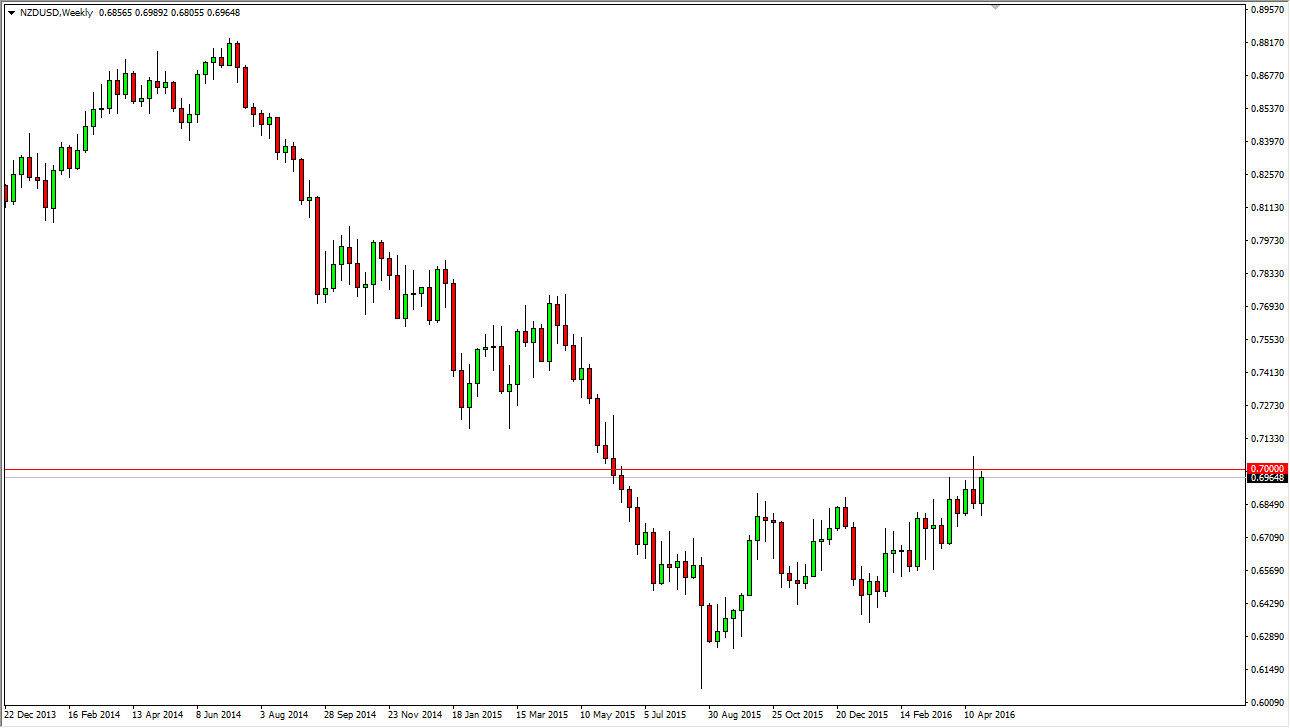

The NZD/USD pair had a slightly positive month for April, but it appears that the market is struggling at the 0.70 level. I do think that we will eventually break out above there, and if we can clear above the top of the shooting star from the third week of April, the market should continue to go much higher given enough time. That’s not to say that we can’t pullback, but at this point in time I think we will see quite a bit of support all the way down to the 0.69 handle, which is where buyers would return. Yes, we could break down below there, and I think that would be slightly negative but in the end it appears that the longer-term market should continue to favor the upside.

Commodities

Please do not forget the commodities can drive this market, and that in general the New Zealand dollar is a reflection of the overall attitude of those markets. It’s not driven by any one particular commodity like the Australian dollar can be, it’s more or less an amalgamation of everything that’s going on in the futures bets. With this being the case, I think that perhaps commodities could have a good couple of weeks, and the New Zealand dollar will benefit as a result. Selling isn’t even a thought until we break down below the 0.68 handle, which could send this market down to the 0.65 handle given enough time. I think it would be a choppy move, because there so much in the way of noise below but given enough time it’s likely that the buyers will return regardless.

If we do break out to the upside I believe that we will then track the 0.75 handle given enough time. I think that level will obviously offer quite a bit of resistance, but once we break above the 0.70 level, I feel that this market will continue to offer buying opportunities.