Gold prices ended Monday nearly unchanged as investors took a cautious stance ahead of the April U.S. employment report and other key economic numbers which could impact the Fed's monetary policy. Although the bullishness continued, the market found some resistance at around the $1303.50 level - just below the 2015 high recorded in January. The market rallied last week as a lower dollar and falling stock prices around the world prompted investors to seek refuge in gold.

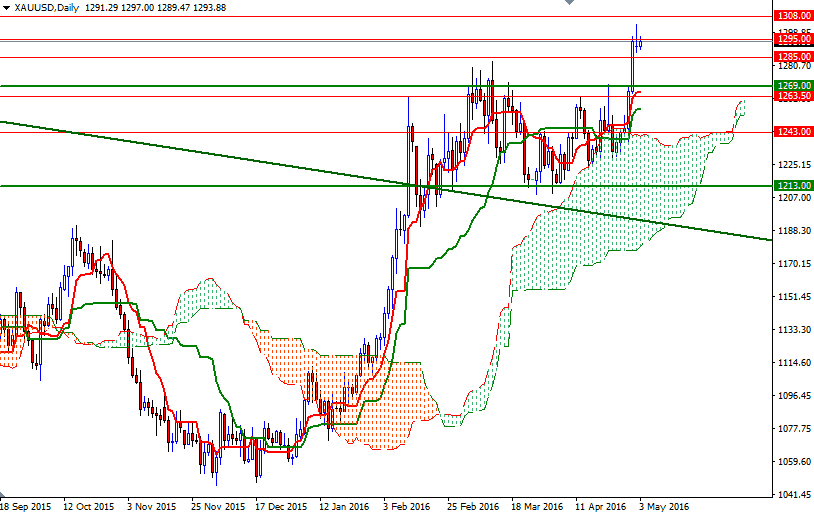

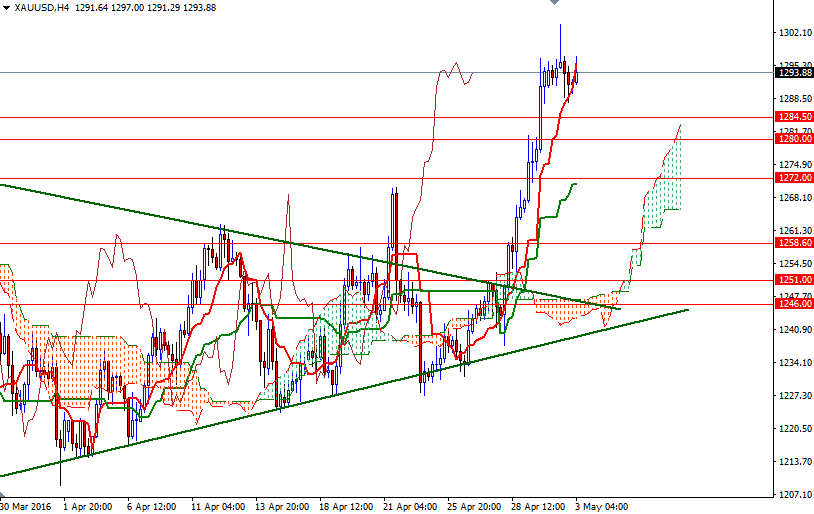

Currently the XAU/USD pair is trading above the Ichimoku clouds on the weekly, daily and 4-hour time frames, indicating that the market will have a tendency climb higher. Keep in mind that the Ichimoku clouds define an area of support or resistance depending on their location and in our case they indicate that the path of least resistance is to the upside. However, there is a significant barrier right on top of us so, the market may remain range-bound for the next few days.

The initial resistance stands in the 1297/5 region. The bulls will have to pass through this area in order to challenge the bears at the 1308 battle field. Anchoring somewhere beyond that could puts us back on track with such a scenario eying subsequent targets at 1312 and 1320. On the other hand, if the bears increase the downward pressure and we drop through 1287.50, then the 1284.50 and 1280/78 levels will probably be the next stops. Closing below 1278 could see a retracement towards the 1272 level.