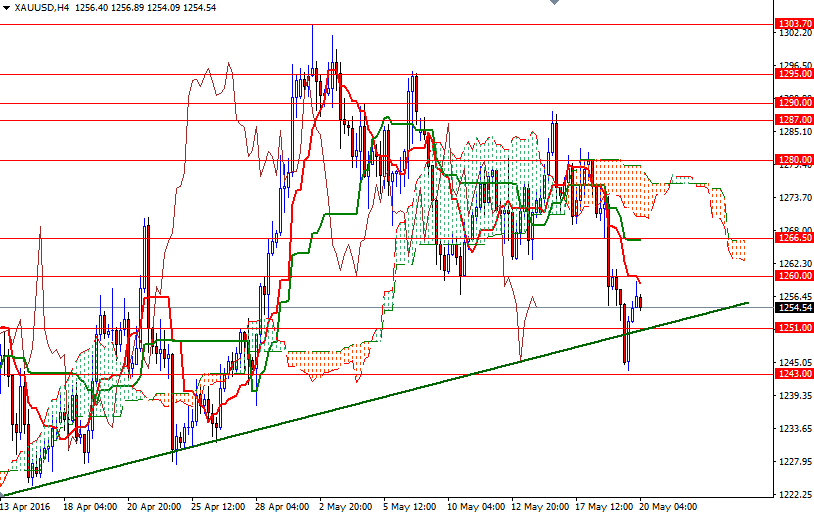

Gold prices extended losses on Thursday as a strong U.S. dollar abated investor appetite for the precious metal. The market has been under pressure since the minutes of the Federal Reserve’s last policy meeting stoked worries that the central bank could raise interest rates as soon as June. The XAU/USD pair fell as low as $1243.79 an ounce after the support in the $1258/6 zone was broken.

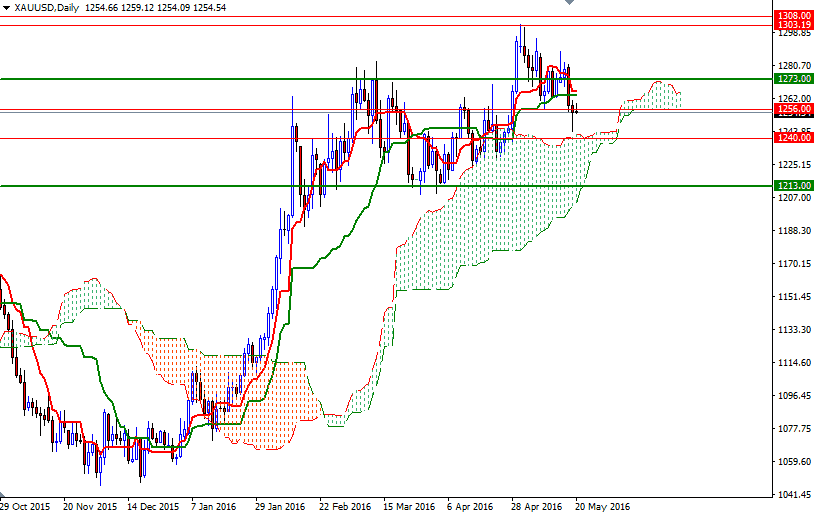

As I pointed out in my previous analysis, the short-term technical outlook has shifted to the downside. The recent downswing may remain intact as long as the market trades below the Ichimoku cloud on the 4-hour time frame. However, I advise a bit of caution at this point because the daily cloud stands not too far from the current levels. Technically, Ichimoku clouds not only identify the trend but also define support and resistance zones. The thickness of the cloud is relevant, as it is more difficult for prices to break through a thick cloud than a thin cloud.

From an intra-day perspective, the key levels to watch will be 1260 and 1251/0. I think the bulls will have to push the market convincingly beyond the 1260 level so that they can make an assault on 1266.50-1264 where the daily Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines converge. If this resistance is broken, the market will be aiming for 1273. Breaking below the 1251/0 area, on the other hand, could encourage sellers and pave the way for a retest of 1243/0. Closing below 1240 would be negative and could take us back to the 1231/28 region.