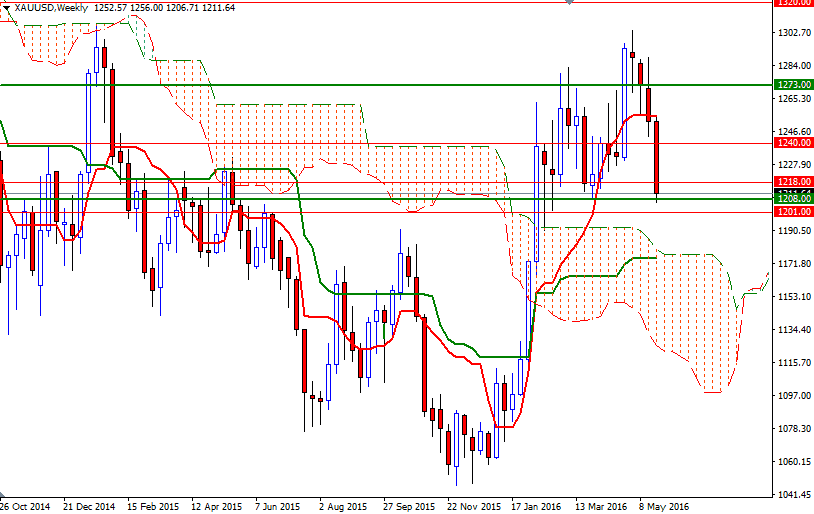

Gold prices settled at $1211.64 an ounce on Friday, suffering a loss of 3.26% on the week and 6.16% over the month. The XAU/USD pair, which hit the highest level since January 2015 at the beginning of the month, came under pressure from a rising dollar and speculation that the U.S. Federal Reserve may lift interest rates at its June 14-15 meeting. Comments from several Fed officials, including Chair Janet Yellen, in recent weeks caused investors to unwind bullish bets in gold. Friday's data from the Commodity Futures Trading Commission (CFTC) show that speculative investors reduced their net-long position in gold to 206632 contracts, from 266288 a week earlier.

Fed policy makers will have more information about the strength of the economy, including another monthly unemployment report, before they make a decision. Although the prospect of a rate increase in the near future will continue to weigh on gold, what happens after that will depend on how Fed Chair Yellen describes the expected path of policy tightening. If she emphasizes that the central bank will take its time in raising rates further, it could be supportive for gold - or at least trigger a relief rally.

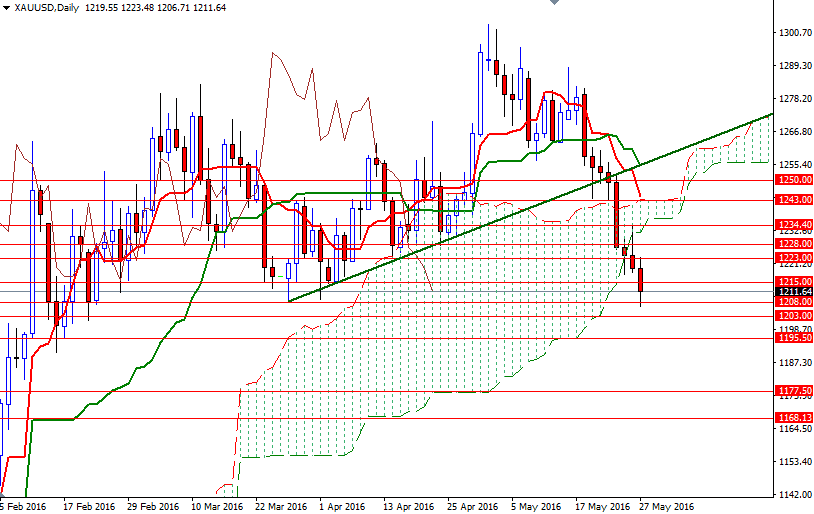

Over the last two weeks, I have been repeating that the current downswing might remain intact as long as the market traded below the Ichimoku cloud on the 4-hour time frame. Last week’s drop in gold prices not only invalidated a short-term bullish trend line but also dragged prices below the daily Ichimoku cloud, and the market’s inability to climb above the 1226/3 area resulted in a test of the 1213/08 region. If this support -which held the market in the past- is broken, then look for further downside with 1203/1 and 1195.50 as targets. A sustained break below 1195.50 would make me think that XAU/USD will have a tendency to test the 1177/0 zone. On the other hand, if the bulls manage to retain the market above the 1208 level, expect a bounce towards 1226/3. The market has to overcome this barrier in order to make a trip back up to the 1250/43. On its way up, resistance may be found at 1236.80-1234.40