Gold prices ended Tuesday's session down $4.92, to settle at $1291.29 an ounce as the market's inability to pass through the $1300 level triggered some profit taking. Comments from San Francisco Fed President John Williams and Atlanta Fed President Dennis Lockhart added to pressure on gold. Lockhart said, "Two rate hikes are certainly possible. We have enough (Fed policy) meetings remaining but it depends entirely on how the economy evolves." "I do expect us to be raising rates gradually over the next couple of years due to the strength of the labor market and where I see inflation going," Williams said.

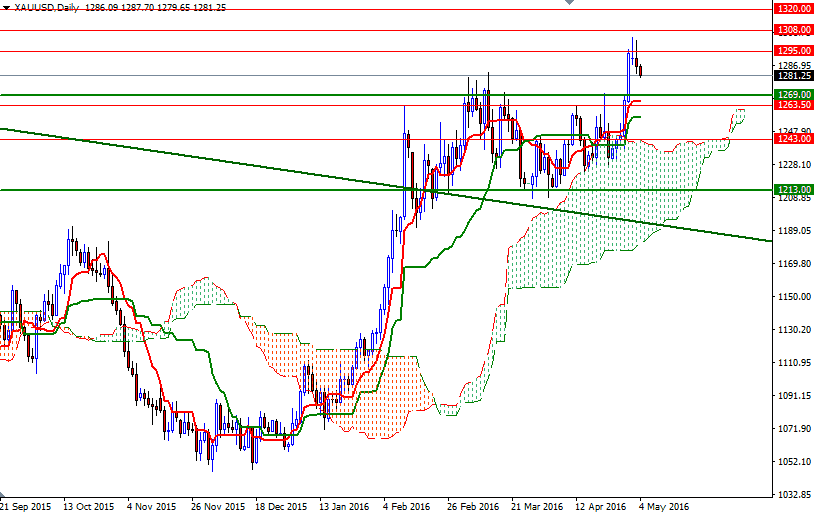

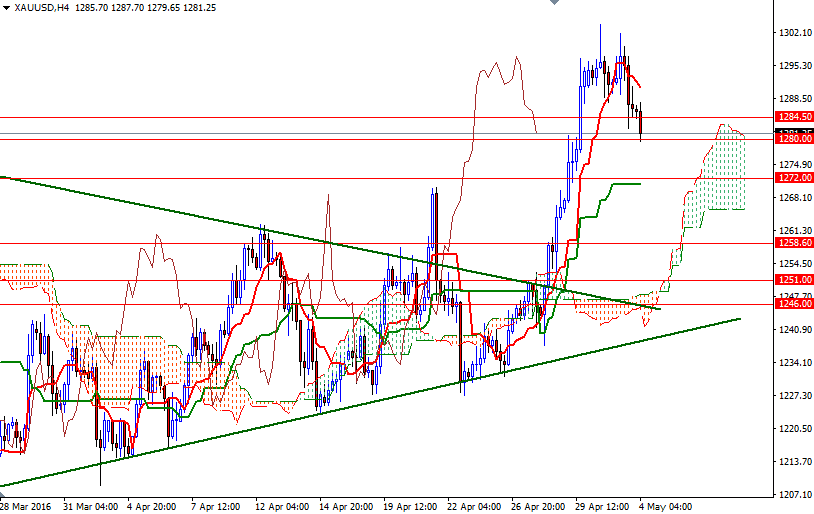

Gold prices edged down in Asian trade, moving away from a 15-month high struck earlier this week. As I warned in my previous analysis, there was a significant barrier ahead. Despite the positive medium-term outlook, short-term charts show signs of exhaustion - the XAU/USD pair trading below the Ichimoku clouds on the 1-hour and 30-minute charts and Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are negatively aligned.

If the 1280/78 support is broken, then the market may continue to retreat towards the 4-hourly clouds. In that case, the 1272 and 1269 levels will be the next possible targets. A daily close below 1269 would imply that the market is ready to test the support at 1263.50. If the 1280/78 support remains intact, we could see a renewed push up to the 1287/4.50 area. There is another crucial resistance level not far above at 1290. The bulls have to push prices back above 1290 so that they can make a fresh assault on the 1297/5 area.