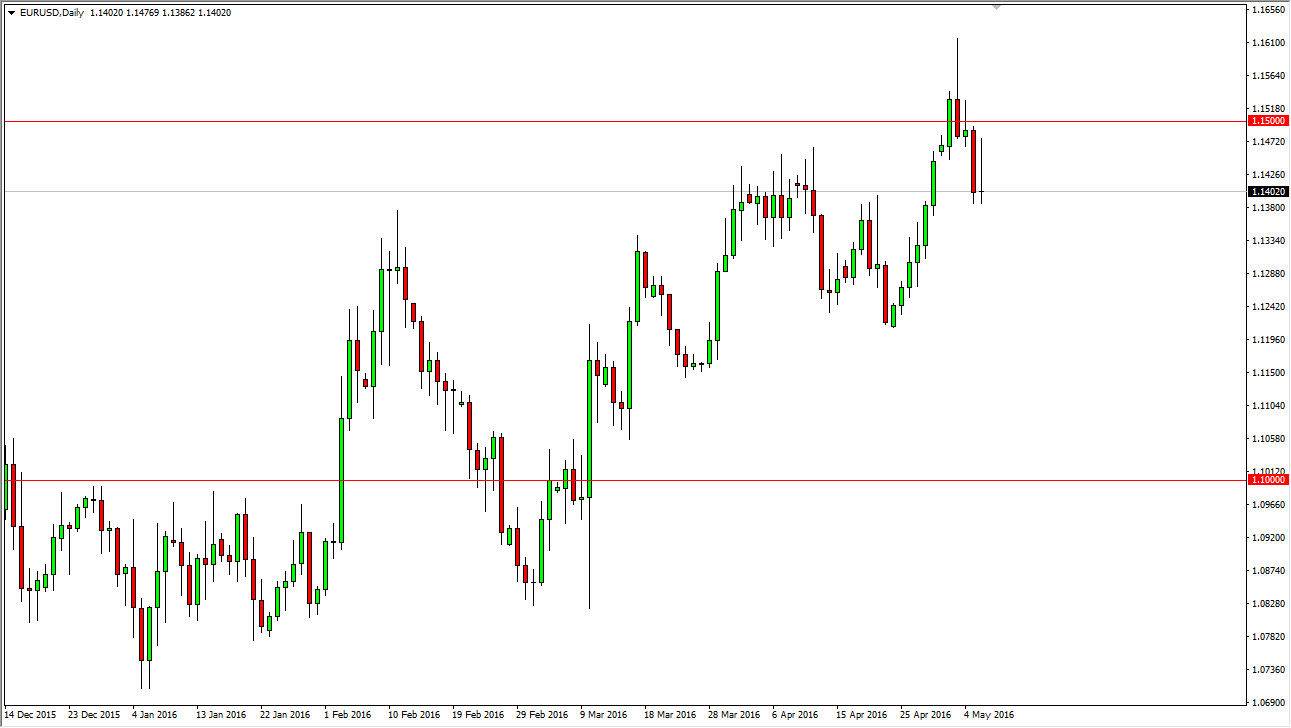

EUR/USD

The EUR/USD pair initially rallied during the day on Friday, but we found enough resistance just below the 1.15 level to turn the market back around and form a shooting star. The shooting star of course is a negative candle, and a break below that candle is traditionally a selling signal. I agree this time, although I do see quite a bit of support just below. With fact, I think that the market would probably turned back around to grind into the previous consolidation area, perhaps reaching the 1.12 level which had been supportive of the last time we saw. Ultimately, this market could start going lower than that, but at this point in time that’s about all I’m looking for.

On the other hand, if we can break above the top of the shooting star, and more poorly the 1.15 level, the market should continue to go higher at that point. No matter what happens though, I think you can count on quite a bit of volatility.

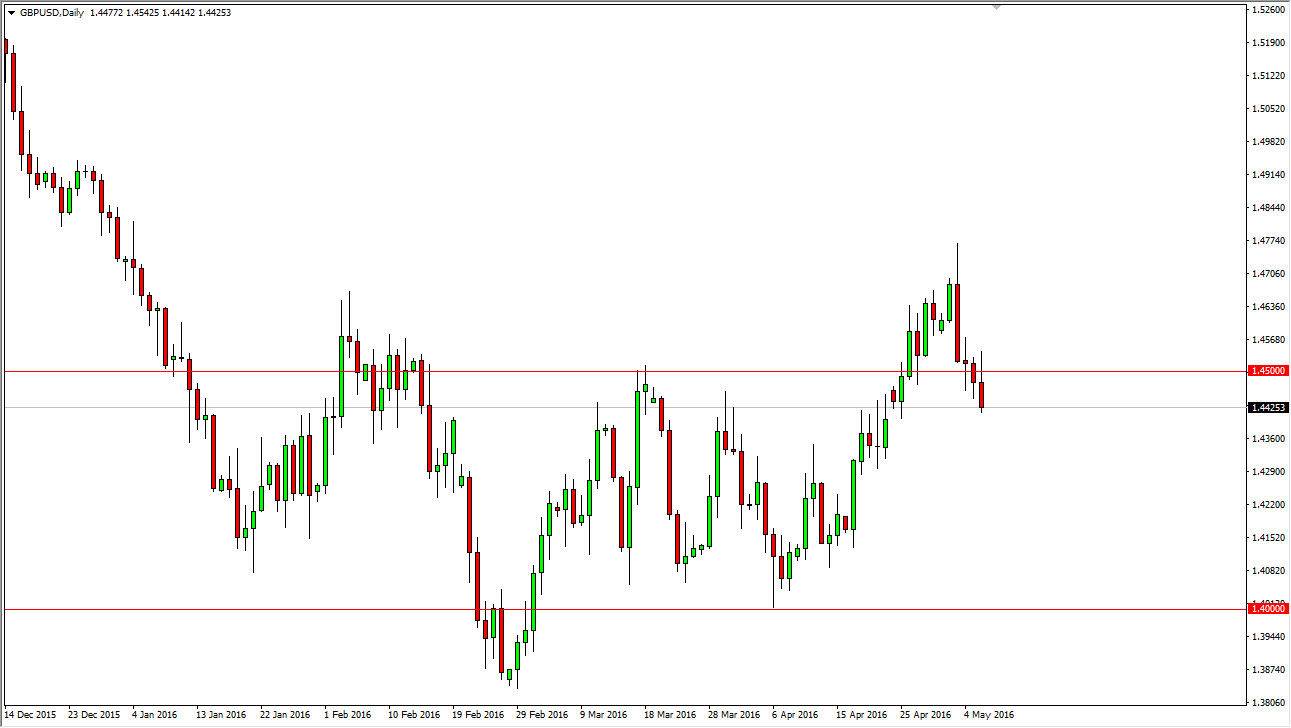

GBP/USD

The GBP/USD pair initially tried to rally during the day as well, and as a result it looks as if the sellers got involved above the 1.45 level, which has been resistance in the past. By doing so, we ended up pulling back to form a bit of a shooting star which of course is a negative candle, and could lead to further selling. A break down below the 1.44 level could send this market as low as 1.41, which was the bottom of the recent consolidation area, or at least the beginning of it.

On the other hand, if we can break above the top of the shooting star for the session on Friday, the market will more than likely try to reach towards the 1.48 handle. That being the case, the buyers would become emboldened going forward. At this point in time though, it does look a bit soft.