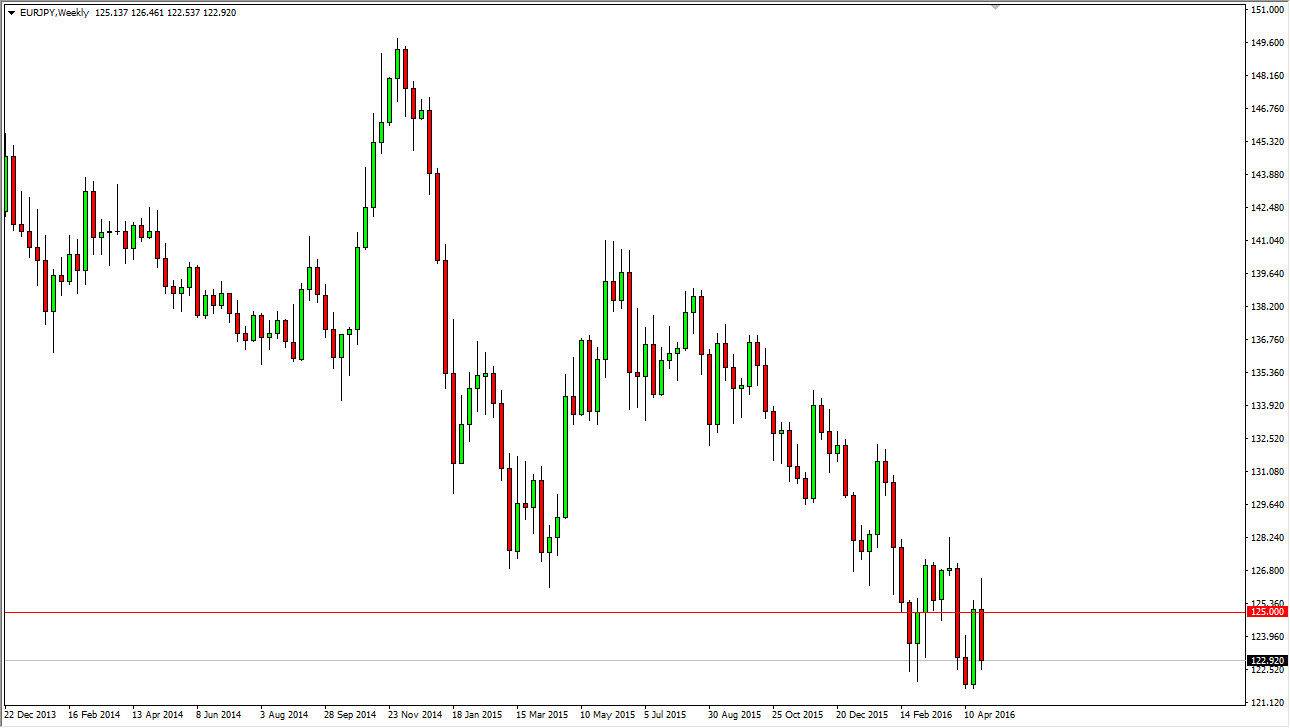

The EUR/JPY pair tried to rally during the course of the month a couple of times in April, but with this being the case it looks as if the downtrend is a very much in effect still, but I think that we may see a bit of consolidation at this point. Yes, we have sold off rather drastically but I think that the 120 level below should be massively supportive. The 125 level has obviously been resistive, and as a result it looks as if the market will continue to bounce around back and forth, as there is a lot of uncertainty in the world right now. Keep in mind that the EUR/JPY pair tends to be very sensitive to risk appetite, and although stock markets look as if the buyers are starting to return, the reality is that the trading public is most certainly very unsure of what’s going to happen next.

Longer-term trend

Because of the longer-term trend been so negative, I think it is easier to sell exhaustive candles on short-term charts. I believe that this market should continue to see sellers enter every time we try to rally as we should find exhaustive candles in that general vicinity. This is a market that doesn’t look like it’s able to be bought until we get above the 127 handle, which is a long way away. At this point I think that it is easier to simply sell those short-term rallies as we may have to play small positions over short time periods in order to make money.

If we can break below the 120 level, that means that most risk appetite around the world would probably disappear. This would not only be bad for this particular market, but probably manifests itself in negative stock markets as well, and perhaps even commodities. At this point in time, it’s just a market that is choppy and sideways, but it does look like the negativity is starting to pick up.