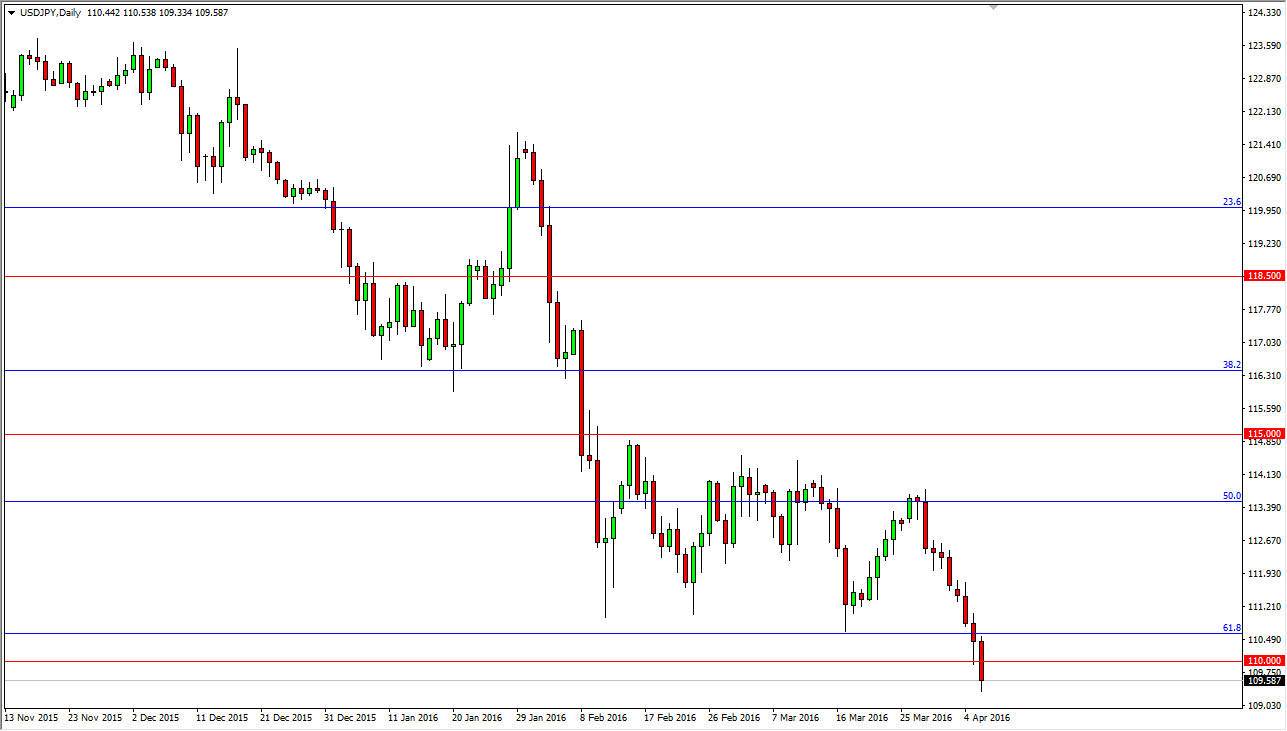

USD/JPY

The USD/JPY pair has now broken down below the 110 level, and that of course is a very bearish sign. This is an area that I thought would hold, and now that it hasn’t, I believe that a break down below the bottom of the range for the session is reason enough to start selling again, just as short-term rallies that show signs of exhaustion would be. At this point time, I don’t really have an interest in buying this pair, especially considering that the Federal Reserve seems to be very dovish. There seems to be a lot of concern in general right now, and that normally sends money looking for the Japanese yen. With this, I think we will continue to see selling again and again.

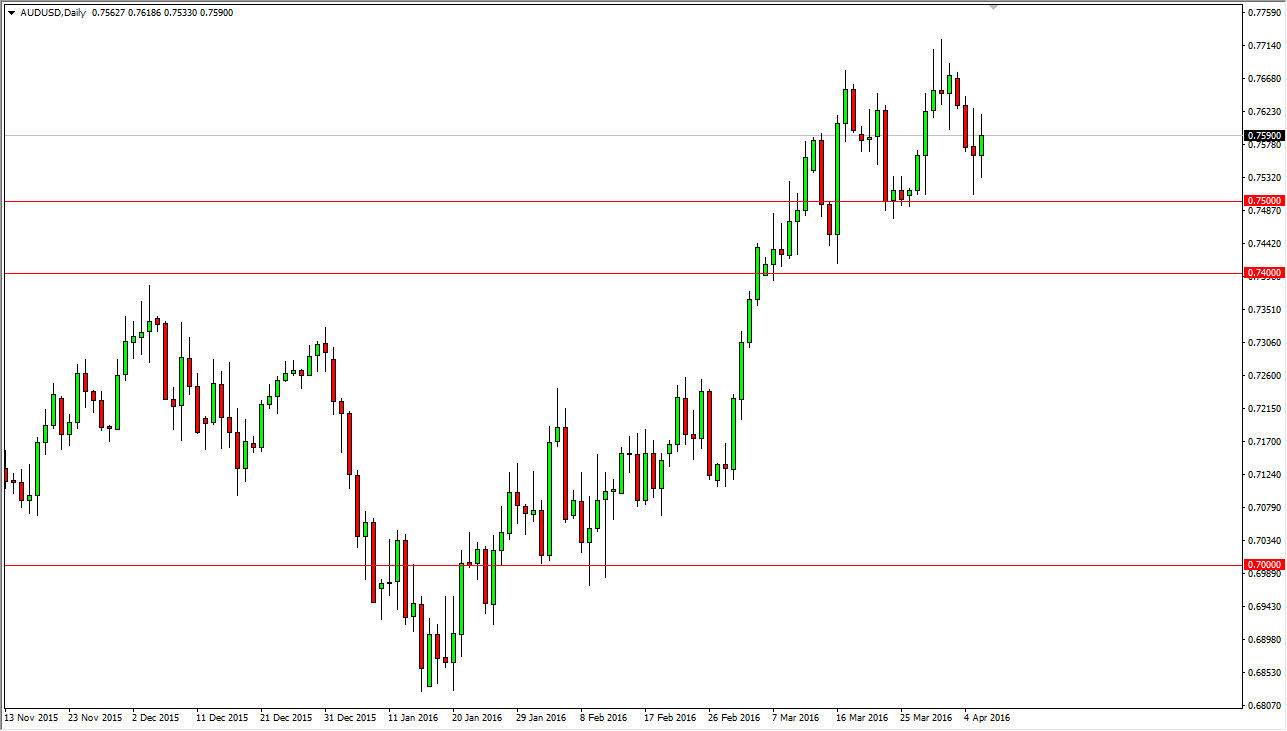

AUD/USD

Ironically, even though there’s been a little bit of a run to safety, the Australian dollar still does fairly well. Perhaps this is because of the fact that the gold markets will be somewhat supported by ultra-loose circle banks around the world, so at that point, I believe that a break above the top of the range during the day on Wednesday would be reason enough to start going long. The 0.75 level below continues offer quite a bit of support, and it extends all the way down to the 0.74 handle.

A supportive candle in that general region would be reason enough to go long in my opinion, because it would be right where you need to see buyers reenter the market. I believe that the market right now at least looks as if it is going to the 0.80 level, and with that being the case, I have no interest in selling, at least not until we get well below the 0.74 level below which would be a major breach of support. Also, we have to pay attention the gold markets and see whether or not they continue to support the Aussie.