USD/JPY

The USD/JPY pair fell during the bulk of the session on Tuesday, testing the 110 level. We found enough support there to turn things around though, and as a result we formed a bit of a hammer. This is interesting to see at this level as it is a large, round, psychologically significant number, and exactly where you would expect the buyers to return. However, today is FOMC Meeting Minutes Wednesday, so there is the possibility of extended volatility based upon that.

I believe that the easiest way to trade this market is on a break above the top of the hammer for the session on Wednesday, it’s a buying opportunity. On the other hand, if we break down below the 110 level, and could very well be a selling opportunity. I would also wait until we get a daily close to confirm that particular trade.

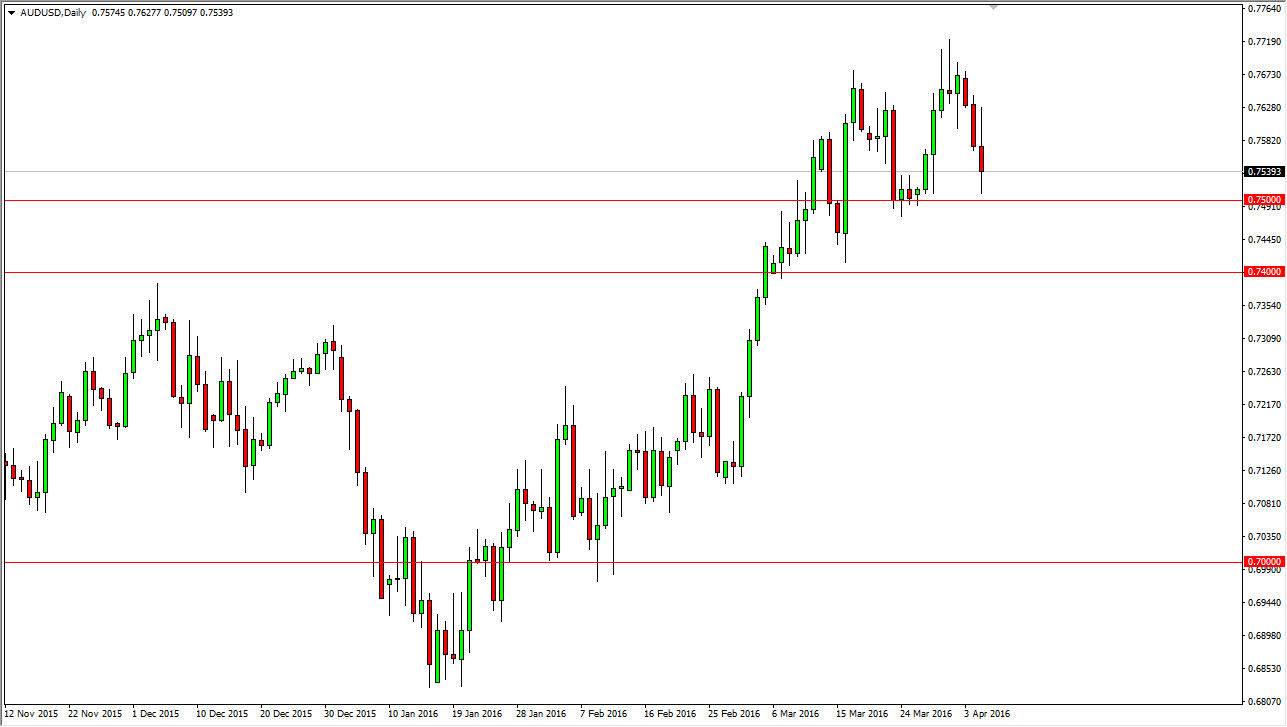

AUD/USD

The AUD/USD pair initially rallied during the course of the session on Tuesday, but turned right back around form a fairly negative candle before bouncing off of the 0.75 support level. Looking at the chart, I see quite a bit of support all the way down to the 0.74 handle anyway, so it’s not surprising to see that the market could break down for a significant move. I believe that as soon as we get a supportive candle, it’s an opportunity to start going long in a market that’s very bullish to begin with. If we can break above the top of the range for the day, that would be very bullish, as we should then go to the 0.77 handle, and eventually the 0.80 level which is my longer-term target.

Pay attention to gold, it can often influence with the Australian dollar does, but I should note that gold looks as if it is trying to pick up a little bit of steam now, and needless to say the Federal Reserve with its announcement today could very well accelerate the upside and gold if they are overly dovish.