USD/JPY

USD/JPY pair initially fell during the course of the session on Tuesday, but turned back around to form a positive candle. That being the case, the market looks as if it is going to try to grind higher, perhaps reaching towards the 114 handle where we had seen a significant amount of resistance. The area extends from 114 level to the 115 level. Ultimately, we should see quite a bit of volatility in the way up, but it does appear that the market is trying to build a bullish case. I also believe that there is a significant amount of support just below, especially near the 110 handle. With this, it is likely that any dip will attract quite a bit of attention as well.

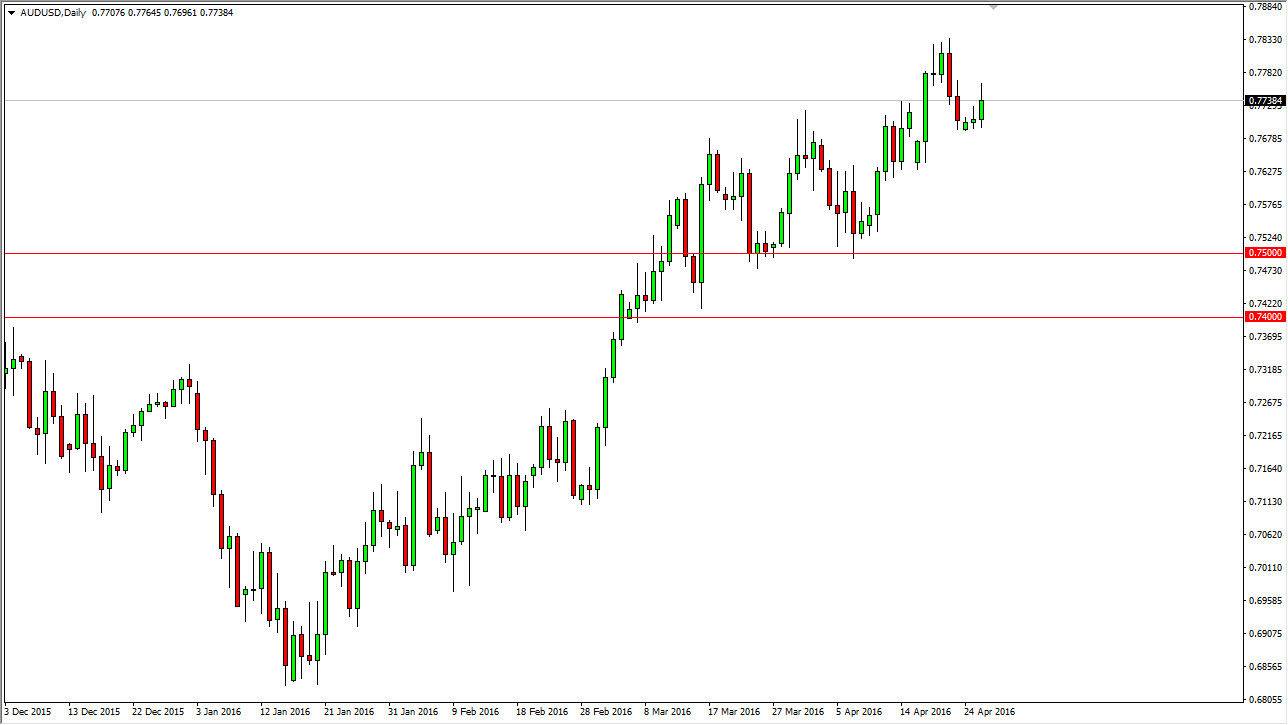

AUD/USD

The AUD/USD pair rose during the course of the day on Tuesday, as we tested the 0.7750 level. Ultimately, this market should continue to grind higher, but recognize that there is quite a bit in the way of volatility. I feel that the market has quite a bit of support below, extending all the way down to the 0.75 level. The 0.75 level begins a significant amount of support all the way down to the 0.74 handle, as the region has been so reliable so far. Because of this, it is likely that the market will find buyers below, possibly even before we get there.

Gold markets are showing signs of trying to perk up, and with the FOMC Statement coming out today, we could get quite a bit of volatility based upon interest-rate expectations out of America. That almost always moves the gold markets, and that of course could be a bit of a “knock on effect” waiting to happen in this market as that alone could be the catalyst for the Australian dollar rising, and the US dollar falling in congruence.