USD/JPY

The USD/JPY pair rose during the course of the day on Monday, after initially gapping lower. Because of this, the market tested the 109 level, an area that I think should be resistive. We pulled back slightly, so I believe that short-term traders may be able to find selling opportunities based upon the resistance. It will be interesting to see whether or not we can find enough selling pressure break down, but at this point in time I believe that the resistance isn’t only found at the 109 level, but probably extends all the way to the 110 handle at the very least. With that being the case, I don’t really have any interest in buying this market yet, and believe that sooner or later we are going to see sellers reenter this market and take control yet again.

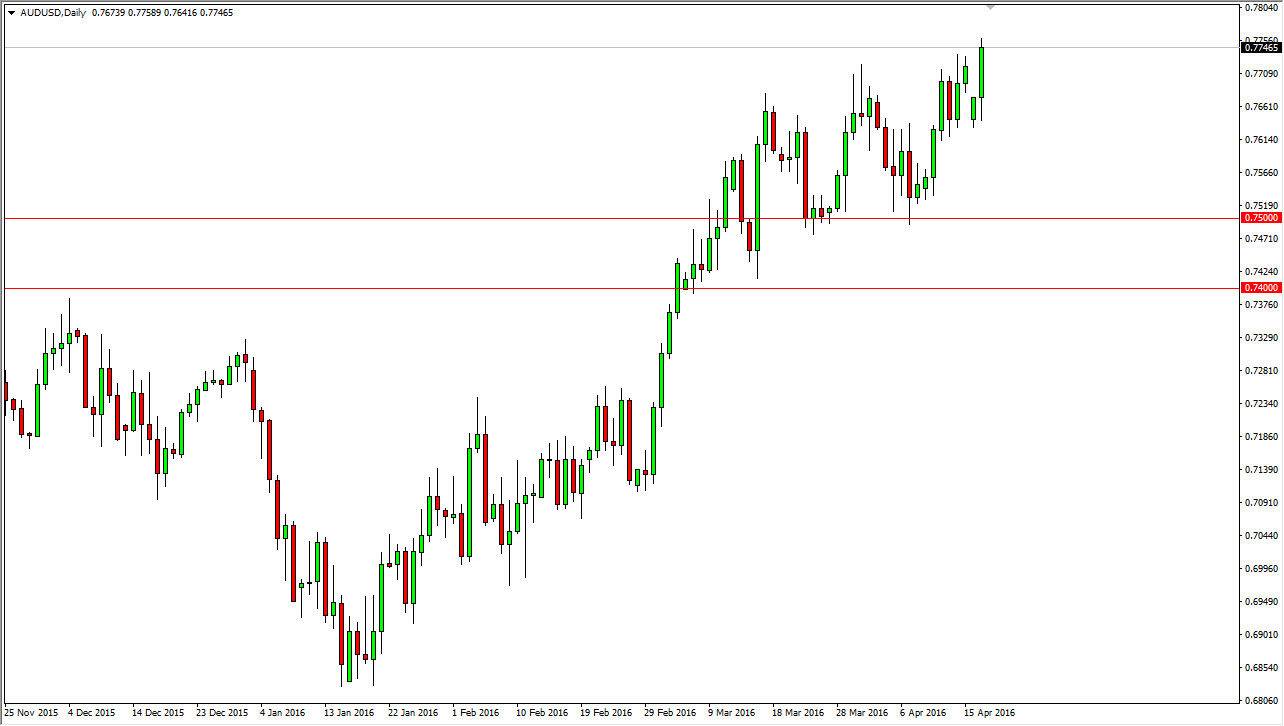

AUD/USD

The AUD/USD pair initially fell during the day on Monday, as we gapped lower at the open. However, we turned right back around to break out to the upside and form a very bullish candle that not only broke out above the gap, but we also broke out to a fresh, new high. That being the case, the market looks as if it is going to continue to go much higher, and perhaps continue to grind towards the 0.80 level, the area that I have been targeting for some time now. That being the case, I believe the pullbacks will continue buying opportunities, and a supportive candle should continue to push buyers back into the market in general. Keep in mind that gold markets can have a positive influence as well, assuming they go higher. I believe there is plenty of bullish pressure in the gold market on the longer-term charts, and therefore it is probably only a matter of time before we go higher. I believe that the 0.75 level is essentially the “floor” in this market right now.