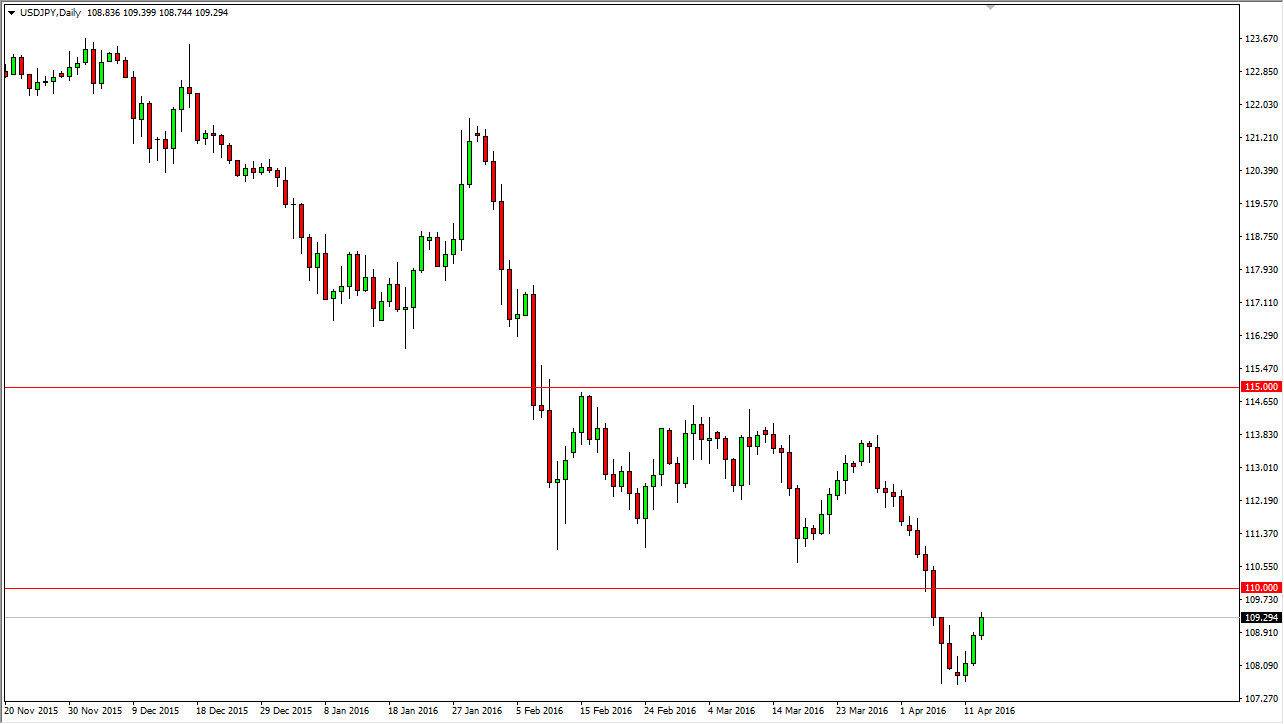

USD/JPY

The USD/JPY pair rose again during the day on Wednesday, as it looks like the market is heading towards the 110 level. I believe that short-term traders will continue to push this market to the upside, but I believe that there is a significant amount of resistance near the 110 level. I also believe that the resistance near the 110 level extends all the way to the 111 handle, so having said that it is probably only a matter of time before the sellers return. With that being said, I am a bit hesitant to start buying, but I do recognize that if you are an extraordinarily short-term trader, you may take advantage of this move.

Given enough time, I believe that an exhaustive candle will present itself somewhere between the 110 level, and of course the 111 level. That resistive candle is reason enough for me to start selling the USD/JPY pair yet again. Ultimately, it is not until we break above the 111 level until I believe it’s safe to start buying again.

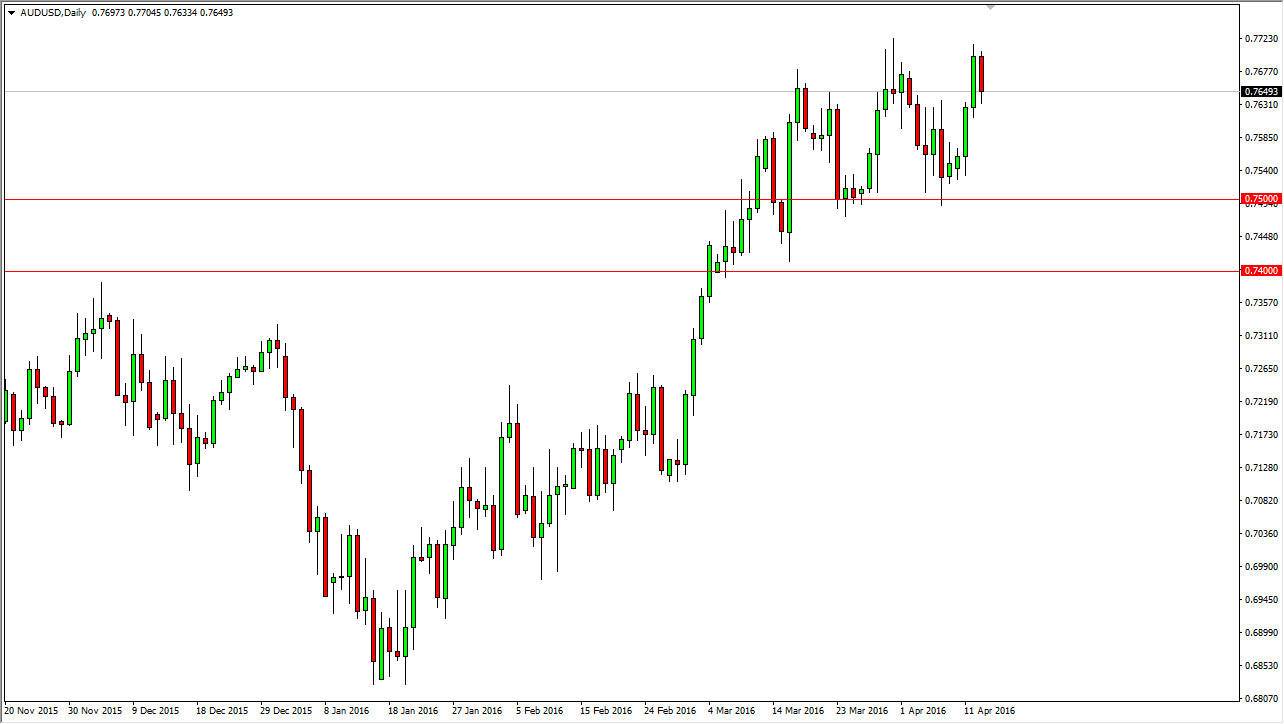

AUD/USD

The AUD/USD pair fell during the course of the session on Wednesday, but remains well within the overall consolidation that has a lower level of 0.75, and an upper level of the 0.77 region. The support is strong enough that it extends from the 0.75 level to the 0.74 level, and I believe that the area is essentially the “floor” of this market. Ultimately, I believe that this pair goes to the 0.80 level, which of course is a large, round, psychologically significant number. That area should cause quite a bit of resistance, but if we can break above there it is a larger and longer uptrend just waiting to happen. That area has been massively important over the longer term, and with that being the case I am watching and with quite a bit of interest. In the meantime, I do think we reach that area sooner or later.