USD/CHF Signal Update

Yesterday’s signals were not triggered as the price did not reach 0.9700 until after London closed.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be taken before 5pm London time today only.

Long Trades

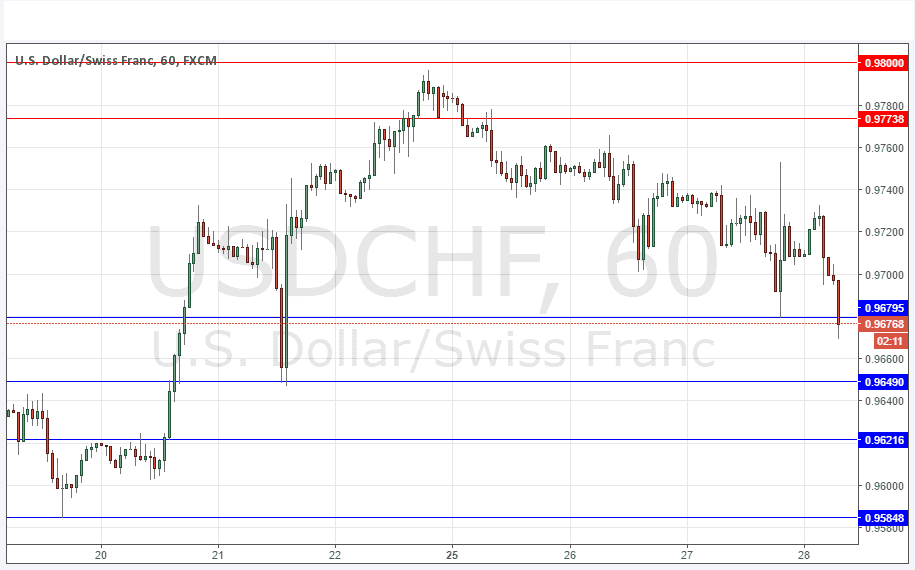

* Go long after bullish price action on the H1 time frame following the next touch of 0.9649 or 0.9622.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trades

* Go short after bearish price action on the H1 time frame following the next entry into the zone between 0.9800 and 0.9814 or a touch of 0.9774.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

The FOMC Statement has weakened the U.S. Dollar, but in spite of the fairly long-term bearish trend the CHF is not particularly strong, so although movement is prevailing downwards it is not very strong. If the USD recovers later, this pair could see a bounce from one of the supportive levels below. Unfortunately it is a long way above until there are any good flipped resistance levels.

At the time of writing it looks as if the support at 0.9680 is being broken to the downside, but it might hold, so we may even have seen the low of the day already.

Regarding the USD, there will be releases of Advance GDP and Unemployment Claims data at 1:30pm London time. There is nothing due concerning the CHF.