USD/CHF Signal Update

Last Thursday’s signals were not triggered.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be entered between 8am and 5pm London time today.

Long Trade 1

Long entry after bullish price action on the H1 time frame following the next touch of 0.9500.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry after bearish price action on the H1 time frame following the next touch of 0.9580.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

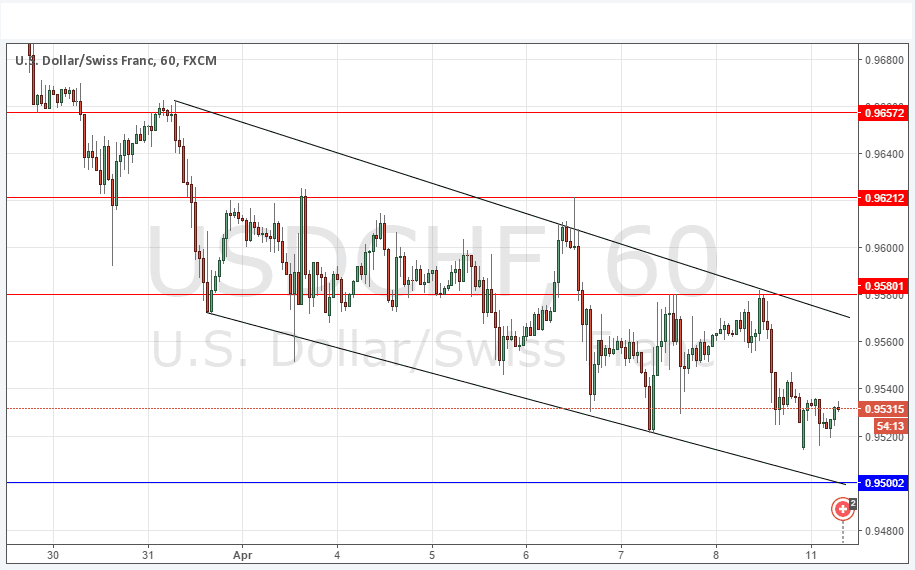

USD/CHF Analysis

The chart below shows that this pair is well established within a fairly symmetrical bearish channel, with both the current upper and lower edges looking confluent with key horizontal levels. A short off 0.9580 would be going with the trend, but the lower lever at 0.9500 is a key psychological level that could provide a strong bullish bounce and possible be key within a major reversal. All will depend upon sentiment regarding the U.S. dollar over the coming days.

Regarding the USD, there will be an announcement by the Federal Reserve at some time today concerning discount rates. There is nothing due concerning the CHF.