USD/CAD Signal Update

Yesterday’s signals were not triggered as the anticipated support at 1.2592 was not respected when the price reached it.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades may only be taken before 5pm New York time today.

Long Trades

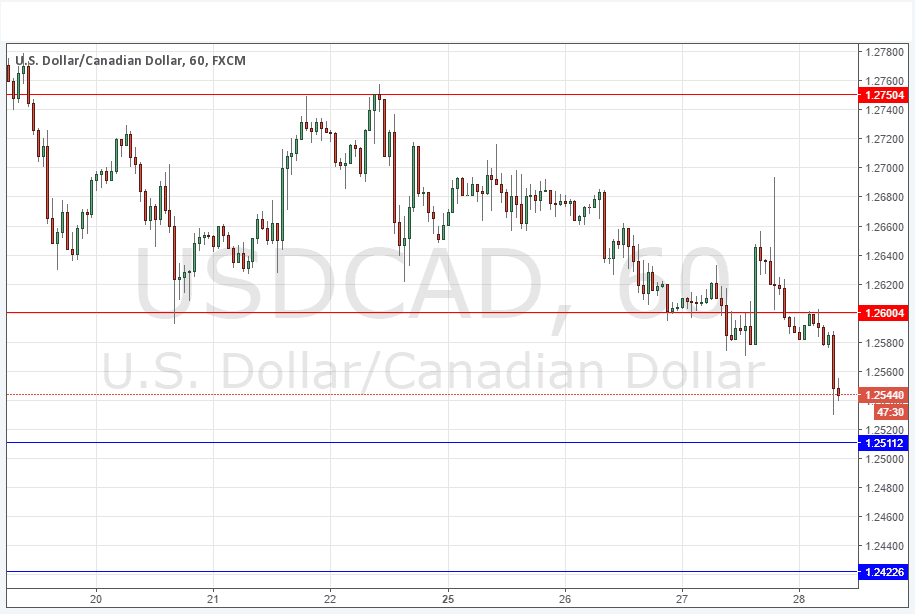

* Long entry after bullish price action on the H1 time frame following the next touch of 1.2511 or 1.2423.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

* Short entry after bearish price action on the H1 time frame following the next touch of 1.2750.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CAD Analysis

This pair has continued to move in line with its strong and very well-established long-term trend, and yesterday’s FOMC release pushed sentiment firmly against the USD and enabled the price here to get properly established under 1.2600. Note how the previous support at 1.2592 has now flipped to become resistance with selling at retests of 1.2600 from below. All signs continue to be bearish for this pair, and trend traders with well-established short positions can sit tight and be happy. Everyone else can look to sell at another failed attempt to move above 1.2600.

Regarding the USD, there will be releases of Advance GDP and Unemployment Claims data at 1:30pm London time. There is nothing due concerning the CAD.