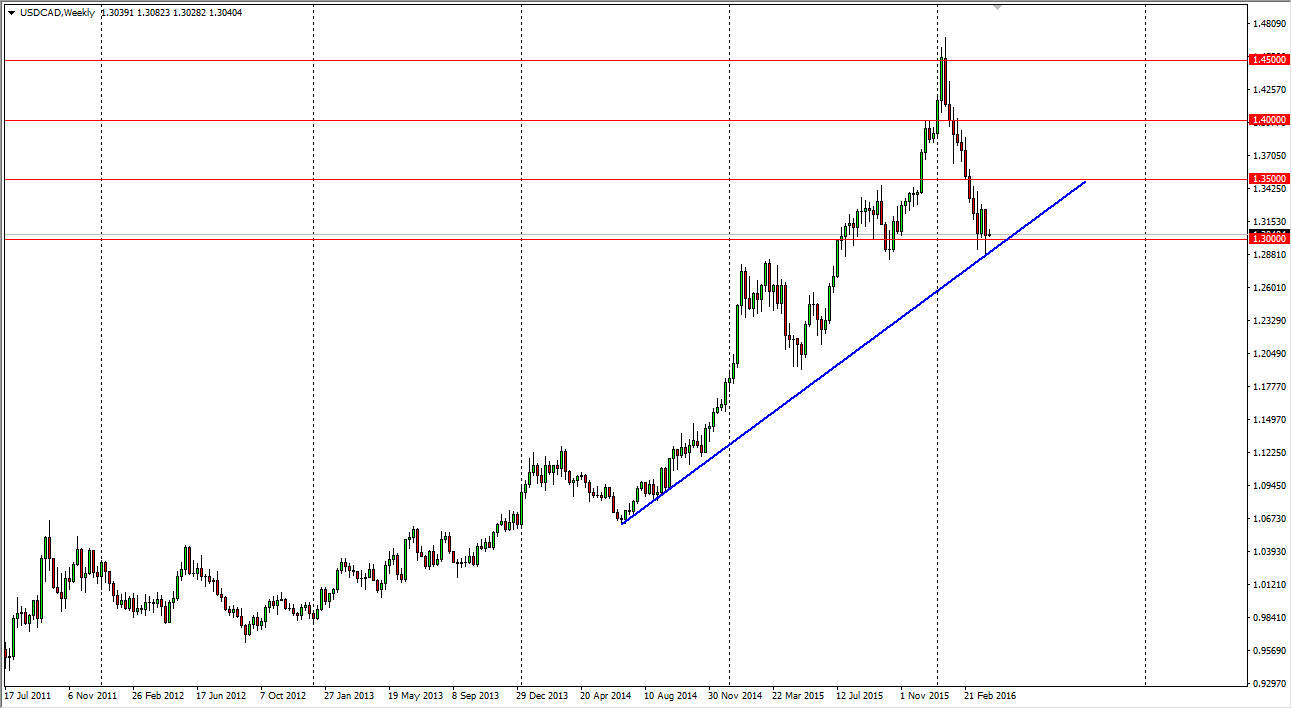

The USD/CAD pair has had a very rough year for the first three months. However, we are currently testing a major trend line that has been reliable for the accelerated uptrend. On top of that, we are approaching the 1.30 handle at the time of writing, which of course is a large, round, psychologically significant number. With this in mind, we could very well find that April is the month that determines the next move in this particular market.

At this point in time, I have to assume that the uptrend line is going to hold. However, if we break down below the 1.29 handle, I feel that the market will start to fall apart. Obviously, there are a lot of different factors affecting currencies at the moment, none the least of which is the “pseudo-currency war” that is currently being waged by several super banks around the world.

Oil

You can never forget the impact that oil has on the Canadian dollar, and that might actually be what makes up the market’s mind going forward. As oil falls, typically this pair goes higher, so we are essentially going to have to see the WTI Crude Oil market starts struggling again. At the moment, it is consolidating, but I feel that the overhead pressure is probably going to be a bit much. With this being said I feel that this market will probably follow the trend line higher.

So far, it looks as if the 1.45 level was simply an overextension of the market, and now we have pulled back, something that could be an attempt to try to find more momentum. Yes, it’s very brutal in the sense that we fell so far and so quick, but when you look at the overall uptrend, it still is well within the tolerance of a simple pullback. Because of this, I believe that it’s not too late to save the uptrend.