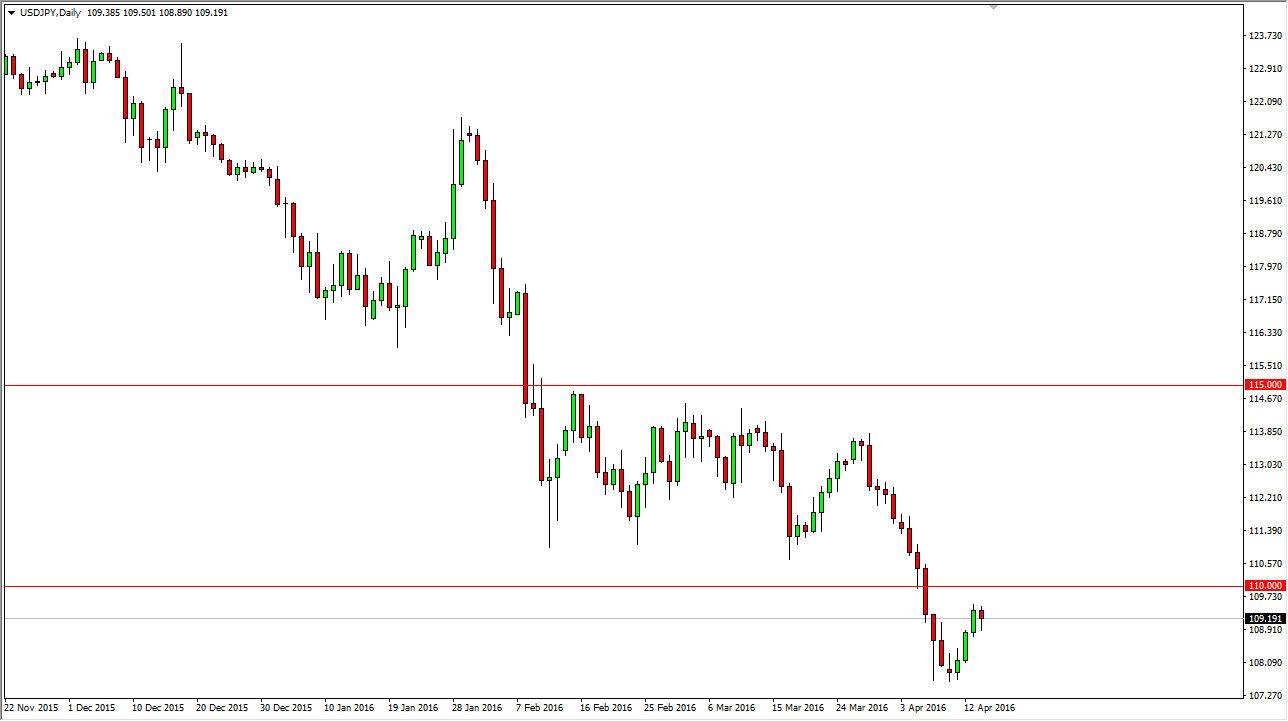

USD/JPY

The USD/JPY pair initially fell during the course of the session on Thursday, but turned right back around to form a hammer. The hammer of course is a fairly bullish sign, but at the end of the day it’s difficult to imagine that the market is going to take off to the upside without a serious fight. After all, the 110 level above is previous support, so it should now be massively resistive. This area is also a large, round, psychologically significant handle of course, so that of course will bring in quite a bit of buying and selling interest anyway. This is an area that the market will more than likely be interested in. The market has a significant amount of resistance all the way to the 111 level, and it’s not until we get above there that I have interest in buying. I think that an exhaustive candle would be a nice selling opportunity as we are most certainly in a downtrend.

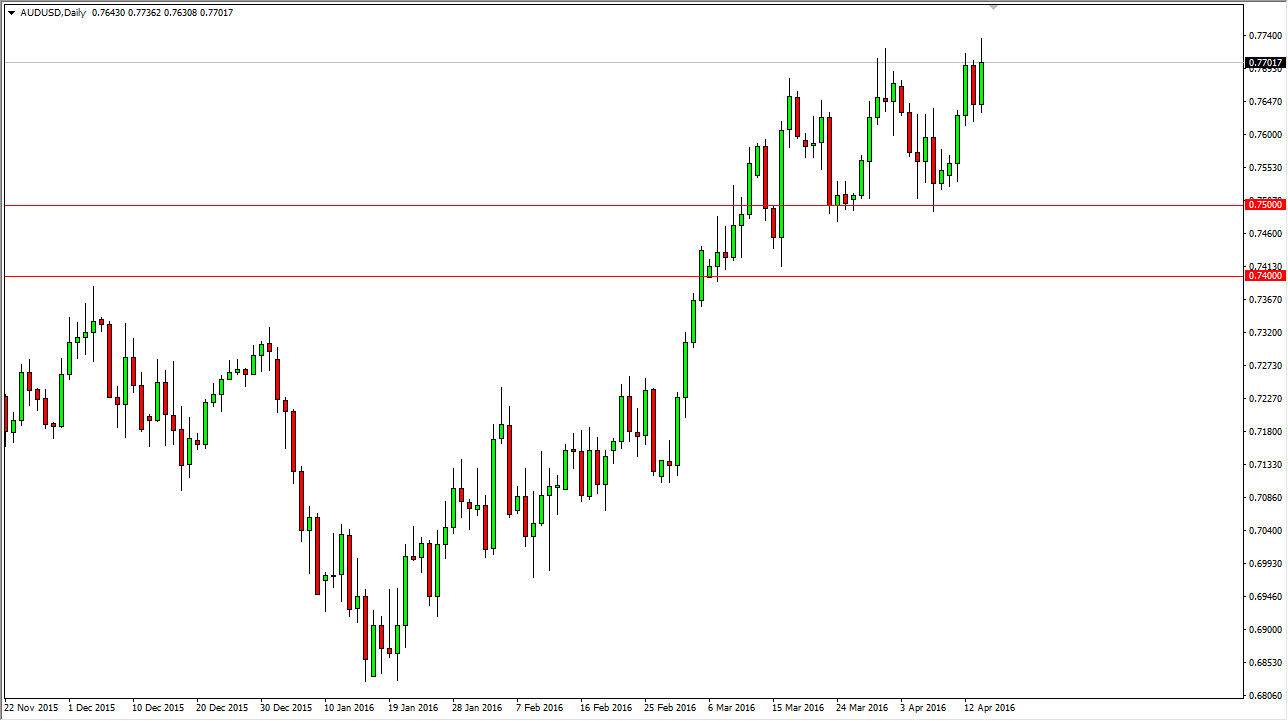

AUD/USD

The AUD/USD pair tried to break out to the upside during the course of the day on Thursday but continued to struggle a bit. That’s not a huge surprise, because of course there is the top of the consolidation area at the psychologically significant 0.77 level, which keeps the market somewhat in check. Pullbacks at this point in time should be buying opportunities though, and that’s exactly how I'm going to look at any pullback. On the other hand, if we break above the top of the range for the session on Thursday, that’s good enough reason for me to start buying as well.

Keep in mind that the gold markets can influence the Australian dollar as well, and even though they fell during the course of the day on Thursday, keep in mind that if it turned back around that would be reason enough to start buying the Australian dollar under most circumstances.