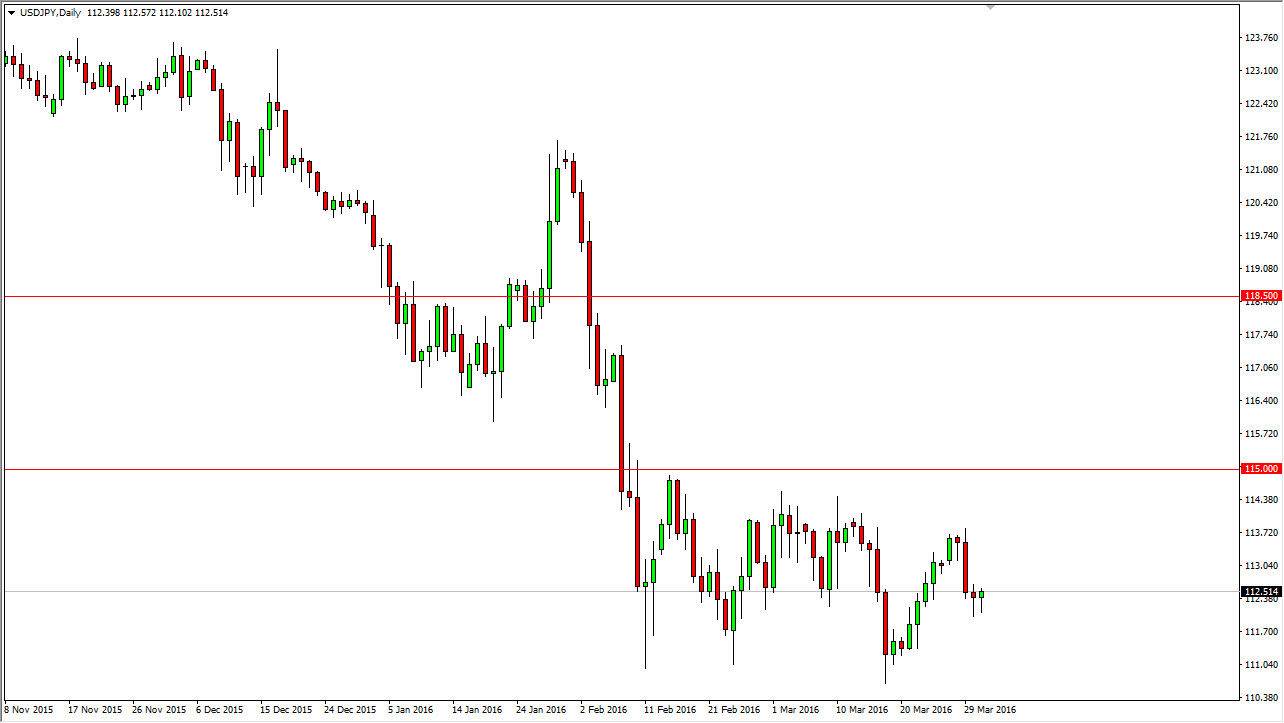

USD/JPY

The USD/JPY pair initially fell during the course of the session on Thursday, but found enough support to turn things around and form a hammer. This was preceded by a hammer on Wednesday as well, so it’s very likely that we will get a bit of a bounce at this point. Ultimately, the Nonfarm Payroll Numbers come out today, and that of course is a major driver of volatility in this market. Given enough time, the market will reach towards the 114 level, and then perhaps even above there. The resistance extends all the way to the 115 level as well, so it’s not until we break above there that I feel this market can go higher for the longer term.

I don’t have any interest in selling this market, simply because of all of the support that we have seen recently near the 112 handle. Ultimately, this is a market that seems to be fairly content in this general vicinity.

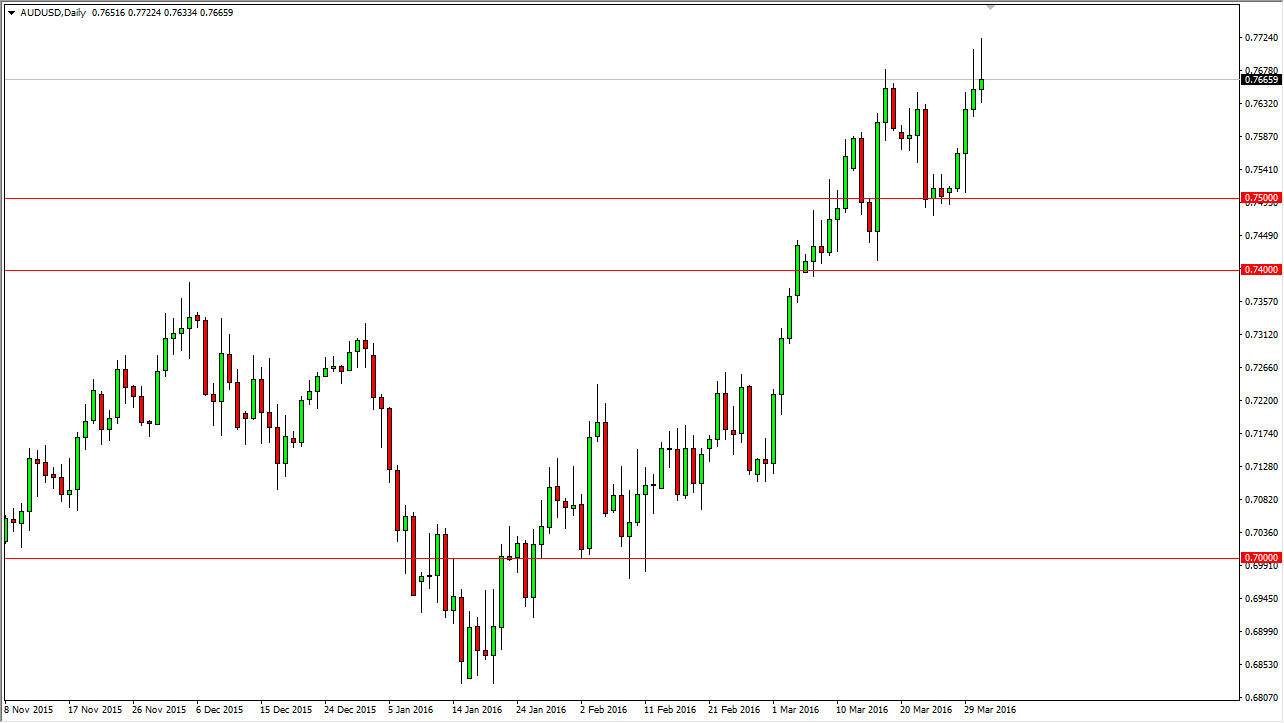

AUD/USD

The AUD/USD pair initially rallied during the course of the session on Thursday, but turned back around to form a massive shooting star. The shooting star of course is a very negative sign, and as a result it looks as if the market will probably pull back. The 0.75 level below is the beginning of major support though, which extends all the way down to the 0.74 level below, so at this point in time I believe that sooner or later the buyers get involved in this marketplace to the upside.

Given enough time, we could also break above the top of the shooting star, which would be a very positive sign, which should send this market looking for the 0.80 level, which has been vital when it comes to the longer-term charts when it comes to the Australian dollar. Also, you have to keep in mind that the gold markets can drive this market as well.