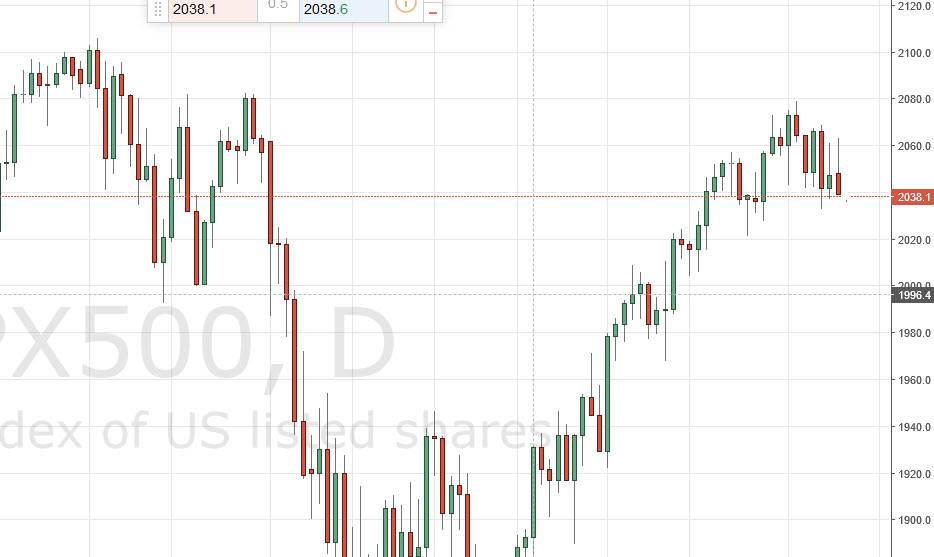

S&P 500

The S&P 500 initially tried to rally during the course of the day on Monday, but found the 2060 level to be far too resistive to continue. By doing so, we ended up forming a massive shooting star, which of course is a fairly negative sign. If we can break down below the bottom of the range, it’s very likely that the market will try to reach down towards the 2020 handle, perhaps as low as the 2000 level eventually. The 2000 level is a massive floor in this market though, so having said that it’s very likely that the pullbacks going forward should find plenty of buyers. Ultimately, I am waiting for supportive candle in order to start going long, or a break above the top of the shooting star for the Monday session.

NASDAQ 100

The NASDAQ 100 initially tried to rally during the course of the day on Monday as well, but also turned back around at the 4520 level to form a shooting star. By doing so, it shows that we do continue to struggle at the moment, as the struggles continue to play the market, there are a lot of concerns when it comes to global markets. Ultimately though, I believe that there is a massive amount of support somewhere near the 4400 level, so any supportive candle in that area is reason enough for me to go long.

On top of that, we could break above the 4520 level, which would be a very bullish sign. At that point, I would anticipate that the market would continue to try to grind higher, perhaps pulling back from time to time in order to offer value as it will take quite a bit of work to break to the top of the large consolidation area which extends all the way to the 4225 level above.