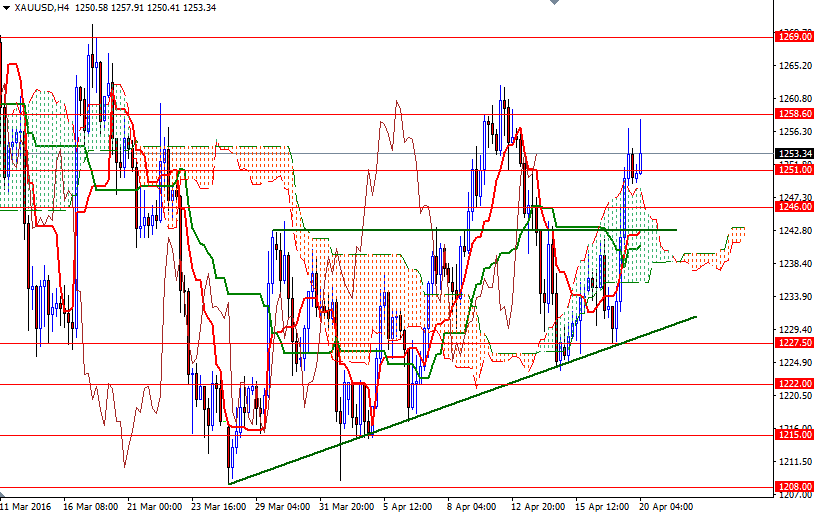

Gold prices rose $17.51 an ounce yesterday, benefiting from a weaker dollar and downbeat economic data. The bullish trend line that the market has been following held prices yesterday and helped produce a nice bounce as expected. Not surprisingly, breaching the resistance at 1243 improved the short-term picture and extended gains. In economic news on Tuesday, the Commerce Department reported that housing starts fell 8.8% to a seasonally adjusted annual pace of 1.09 million units and building permits decreased 7.7% to a 1.09 million-unit rate in March.

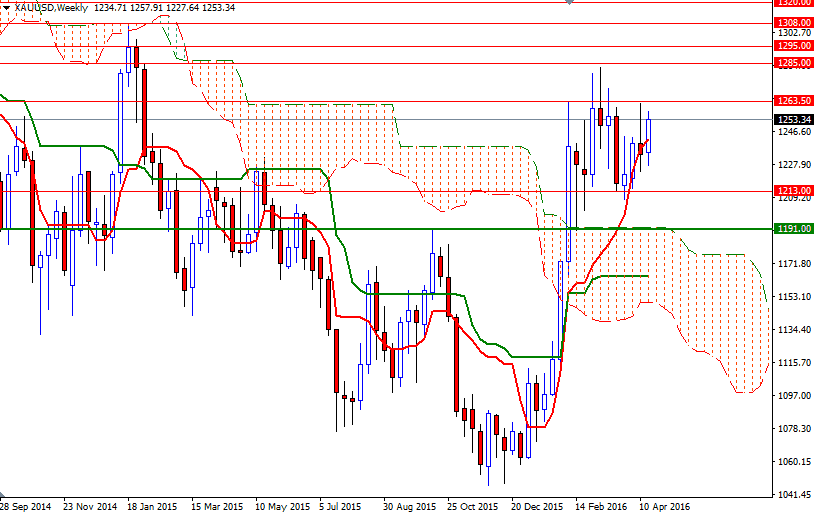

The XAU/USD is currently trading at $1253.34 an ounce, slightly higher than the opening price of $1249.98. Although trading above the weekly and daily Ichimoku clouds show that the medium-term outlook still points to a upwards bias, the daily Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-day moving average, green line) are flat.

The area between 1263.50 and 1258.60 has been resistive so, unless it is convincingly broken, it could hinder the bulls' advance. In that is the case, expect prices to return the 1243 level, which happens to be the top of the 4-hourly cloud. If the fall doesn't stop there, then it is likely that the 1243 level will be the next stop. The bears will have to drag prices below 1243 so that they can make an assault on the 1239-1235.75 region. To the upside, keep an eye on the 1258.60 level. Clearing this resistance would give the bulls a chance to challenge 1263.50. Closing beyond 1263.50 on a daily basis paves the way towards 1269.