Gold settled slightly lower on Monday as investors continue to digest last week's strong employment data and the cautious tone of Fed Chair Janet Yellen over raising interest rates. Although Yellen is not in such a hurry to normalize policy, some of her colleagues are ready to raise rates for the second time. Federal Reserve Bank of Boston President Eric Rosengren said yesterday that "As I see it, the risks seem to be abating that problems from abroad would be severe enough to disrupt the U.S. recovery. Financial-market volatility has fallen, and most economic forecasts do not reflect expected large spillovers from continued headwinds from abroad."

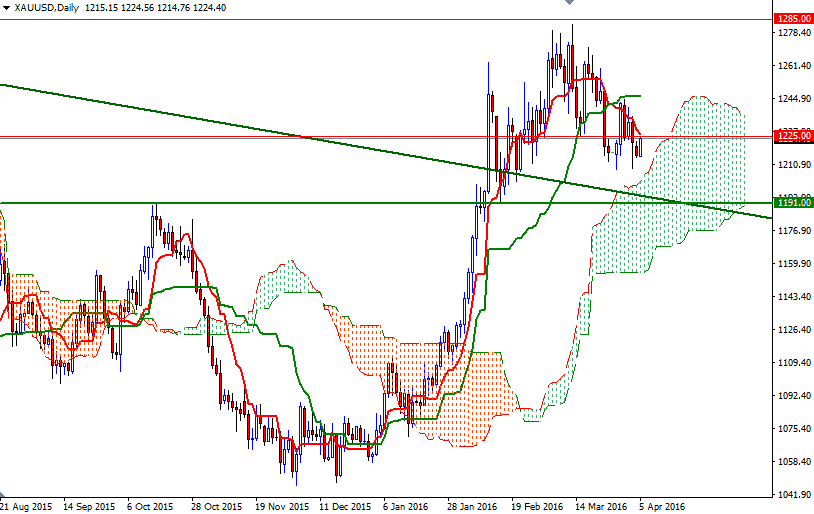

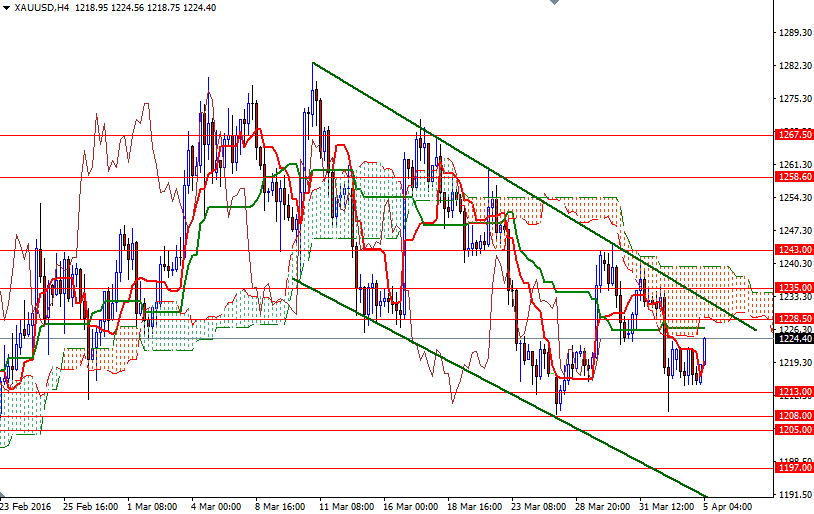

Apparently market participants are giving more weight to Yellen. The XAU/USD pair is currently trading at $1224.40 an ounce, higher than the opening price of $1215.15, as the $1215.30-1213 support zone remains intact - as I pointed out last week, this is a strategic camp for bears to capture in order to pull prices towards $1208/5. The medium-term directional bias remains bullish, with the market trading above the weekly and daily Ichimoku clouds, but the 4-hourly chart suggests that the market is not out of the woods yet.

Up in the 1235-1233.50 area we have a confluence of a horizontal resistance and a bearish trend line - and just below that we have the first hurdle the bulls have to jump in the 1228.50-1225 region. Once above 1235, we could possibly see the bulls make a run for 1243. However, if the bears increase the downward pressure and invalidate the aforementioned support (1215.30-1213), it is likely that XAU/USD will march towards the 1208/5. A successful break below 1205 would imply that the bears are firmly in control and aiming for 1199/7.