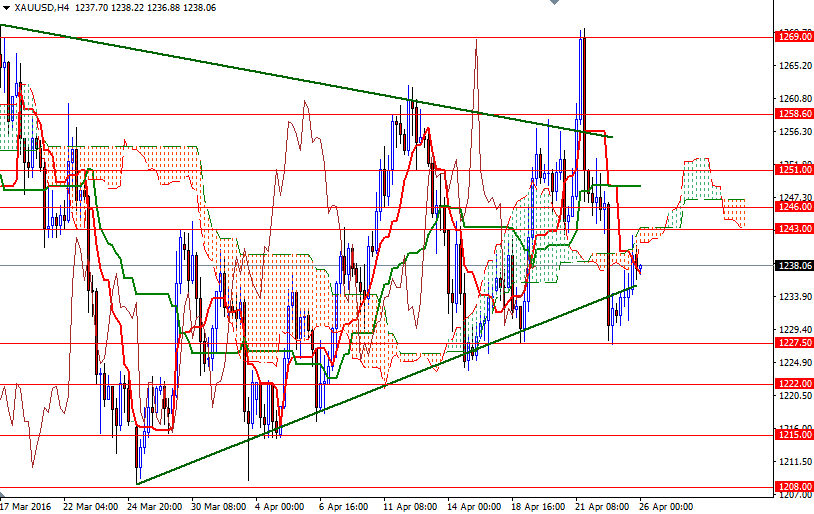

Gold prices ended Monday's session up $5.68, benefiting from a retreat in the dollar and falling equities. The XAU/USD pair traded as high as $1242.16 an ounce before pulling back to the current levels. The key levels -which I underlined in my weekly analysis- all remain the same as 1227.50 wasn't invalidated and 1243.25-1239.60 held as resistance.

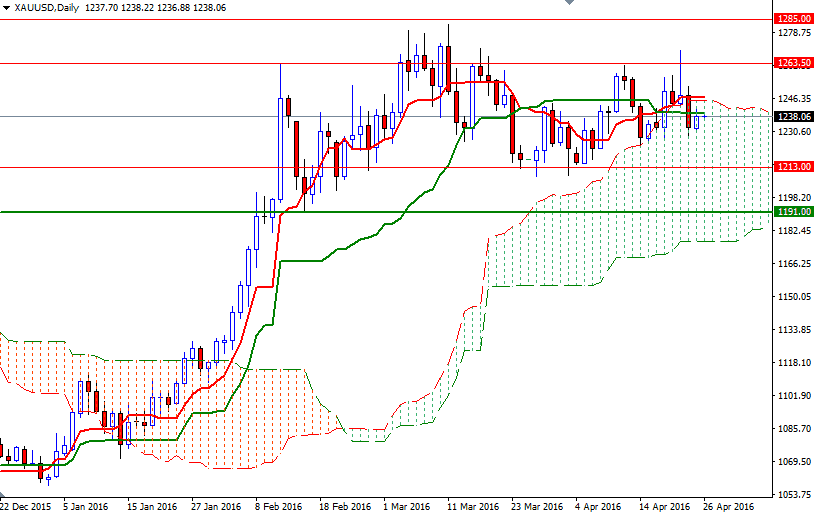

Trading within the boundaries of the Ichimoku cloud on the daily chart suggests that XAU/USD will be range bound over the short-term. In addition to that, the daily Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines are completely flat, indicating lack of a real momentum. The 4-hourly Ichimoku cloud currently occupies the area between 1141.20 and 1243.25 so I wouldn't be surprised to see some selling pressure if prices approach there. Negative Tenkan-Sen - Kijun-Sen cross on the same chart supports this view as well.

If the market can't penetrate the cloud and prices reverse, keep an eye on the 1234-1233.70 area. The bears will have to demolish that support so that they can proceed to the 1227.50 level. Breaking below 1227.50 could see a test of the 1222 support. On the other hand, passing through 1243.25 could give the bulls a chance to reach the next barrier at 1248/6. If it is broken, then it is likely that the market will pay a visit to the anticipated resistance zone that stretches from 1251 to 1253. A daily close above 1253 paves the way towards 1258.60-1256.50.