Gold prices fell for a second straight session on Wednesday and settled at $1242.62 an ounce, weighed down by the strength in the dollar and equities. Stock markets around the globe rose after data showed China’s exports jumped the most in a year, stoking hopes that Asia's biggest economy is stabilizing. Increasing demand for the greenback and the risk on attitude across global markets tend to weaken the appeal of gold.

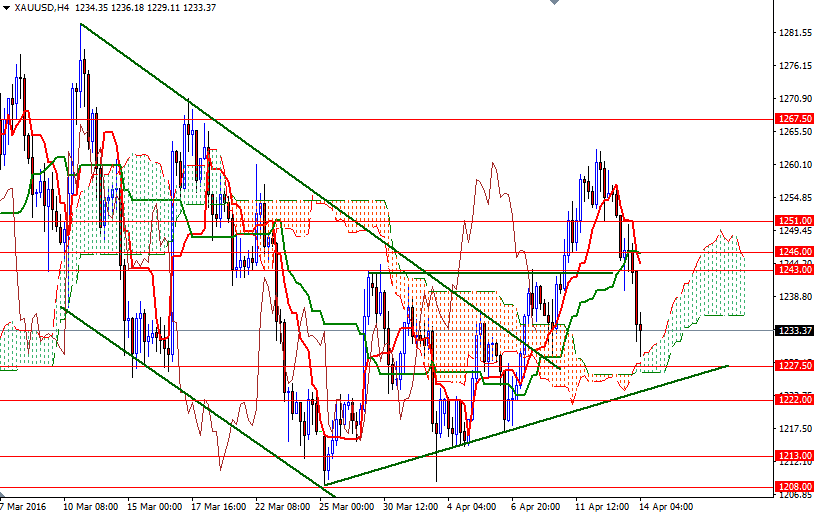

Technical selling was also behind gold's 1.04% drop yesterday. The market initially dropped through 1251/0 and tested the support around 1243. Later on prices returned to the 1251/0 area but encountered a stronger pressure. Confirming that this region flipped to resistance encouraged sellers and prices broke down below 1243 eventually. As a result, the XAU/USD pair headed back to the Ichimoku cloud on the 4-hour chart.

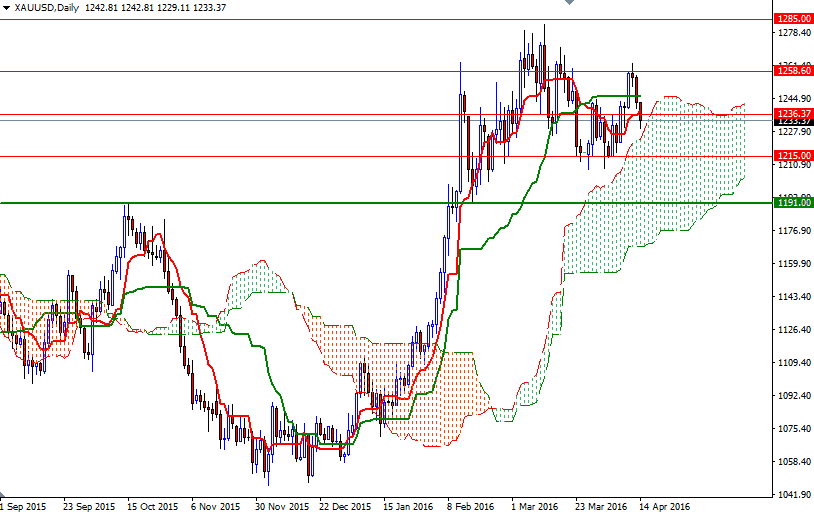

Not too far from the current levels, there is a critical support area between 1227.50 and 1222. So, we need to get down below there in order to continue to the downside. If the XAU/USD pair makes a sustained break below 1222, then look for further downside with 1215/3 and 1208 as targets. However, if the aforementioned support (1227.50-1222) area -where the top of the daily cloud and short-term bullish trend line converge- remains intact, expect a rebound towards 1236.37-1239.50. Beyond that, sellers will be waiting in the 1246/3 region. The bulls will have to push prices back above 1246 so that they can retest the 1251 level.