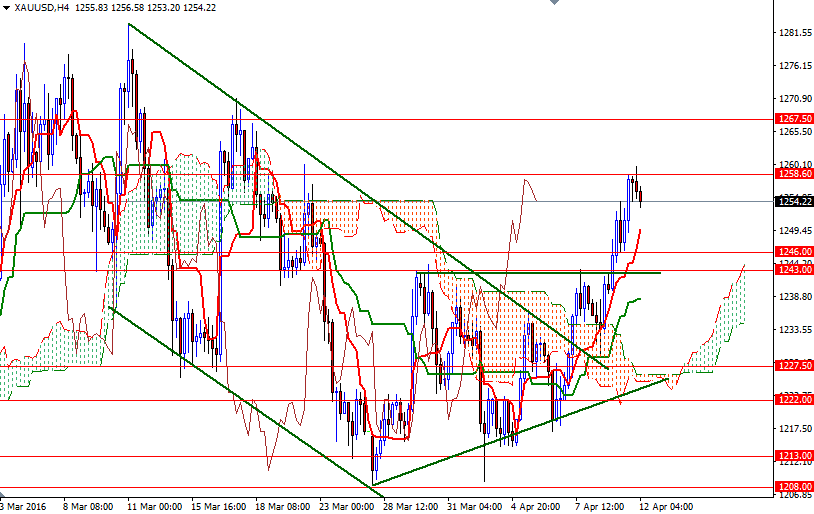

Gold rose to a near three-week high on Monday as the greenback continued to weaken and equities surrendered earlier gains. The market was finally able to cleanly break the anticipated resistance in the 1246/3 region which I had pointed out as a key for higher prices. Later on the 1246 level acted as good support and pushed prices to the 1255-1258.60 area afterwards.

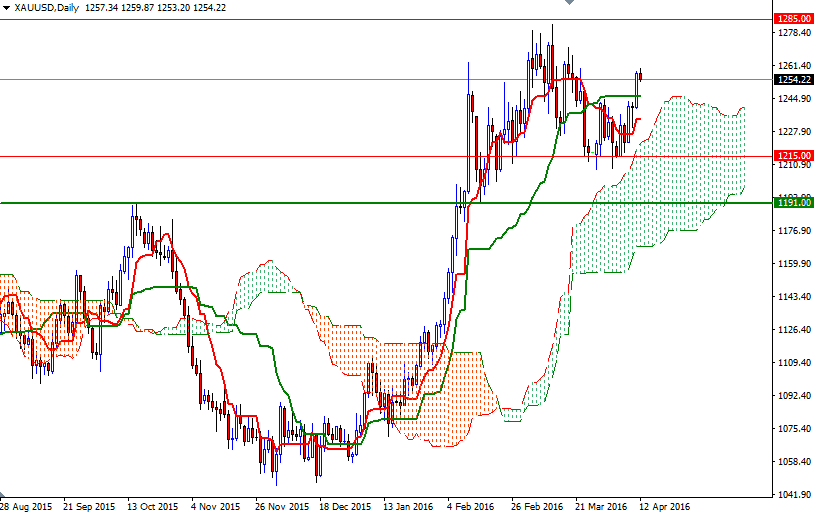

Lately, I have been repeating that the technical picture was improving. breaking out of the ascending triangle is a bullish sign, especially when the XAU/USD pair is moving beyond the Ichimoku clouds on almost all time frames. Positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on both the weekly and 4-hourly charts, along with Chikou Span/Price cross in the same direction, give buyers an advantage over the medium-term.

However, the market has to climb above the 1255-1258.60 zone where prices had trouble yesterday in order to prolong the current momentum. Penetrating this barrier could foreshadow a move towards the 1272-1267.50. If this resistance is broken, then the 1285/0 area could be the next port of call. If the bears successfully defend the 1255-1258.60 barrier and increase the downward pressure, prices may revisit the 1250 level. Below that, 1246/3 stands out as obvious resistance flipped to support. Closing beneath 1243 would open up the risk of a fall to 1238/5.