The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 17th April 2016

Last week I highlighted long EUR/USD and short USD/CHF and USD/JPY as the best possible trade for this week. Unfortunately, each pair moved in the opposite direction by an average of 1.03% during this past week.

This week I see long AUD/USD and short USD/JPY and USD/CAD as the best possible trades.

Fundamental Analysis & Market Sentiment

Fundamental analysis is becoming less useful in Forex markets at the moment.

The feature that really stands out right now is the strength of the Japanese Yen, and this is seen as contrary to both fundamentals and even the desire of the Bank of Japan and the Japanese Government.

The weakness of the U.S. Dollar is also not really supported by economic data, but is rather a product of sentiment that the Federal Reserve is going to take a more cautious approach regarding any forthcoming rate rises.

The Australian Dollar also remains resilient on the back of a fairly high interest rate in global terms and bullish recent economic data, even though the Reserve Bank of Australia has signaled that it does not want to see the currency move high. However the currency has recovered back to the level it was at when this statement was made a couple of weeks ago.

Technical Analysis

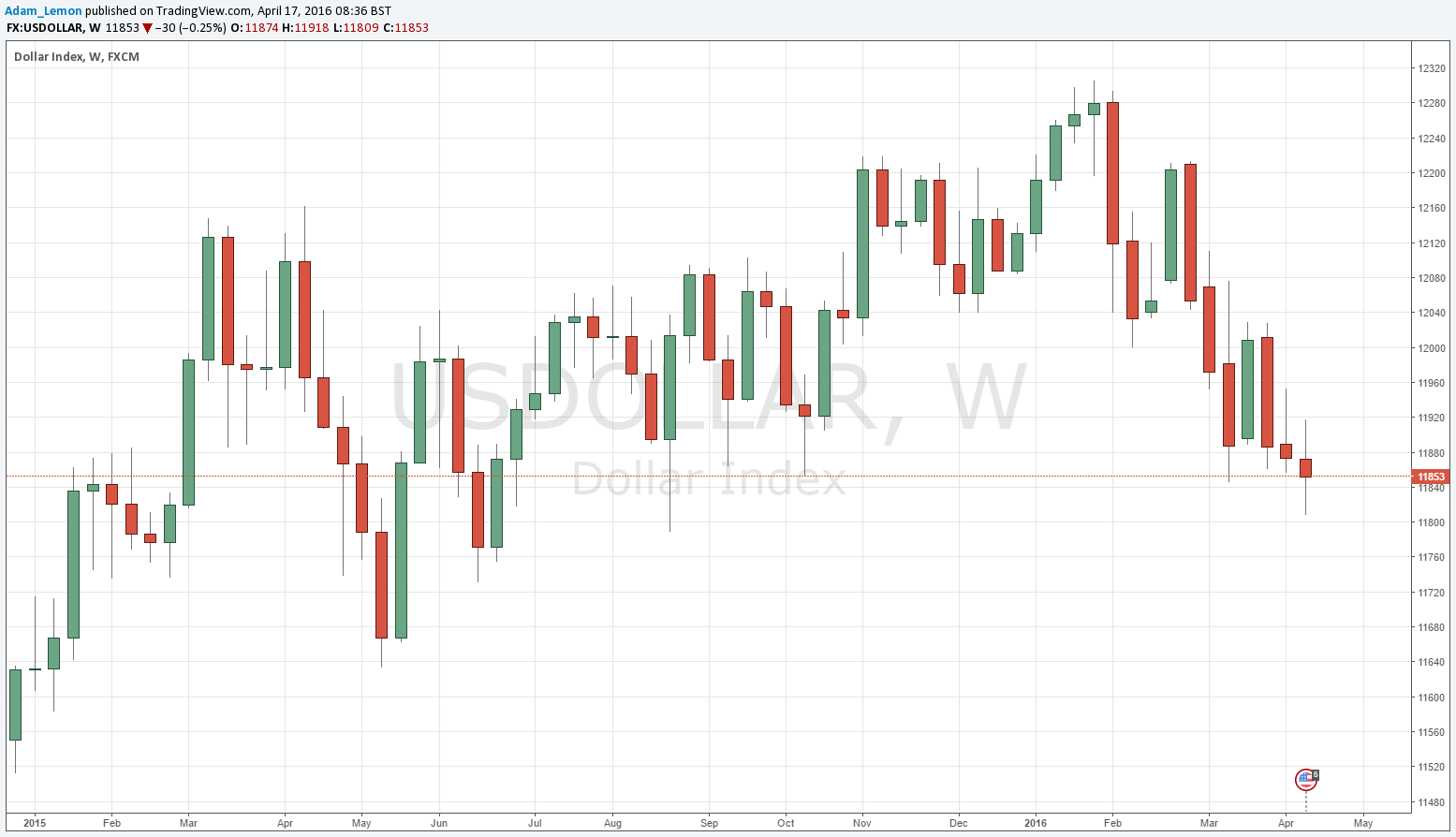

USDX

The U.S. Dollar Index fell again last week, closing at a price lower than the prices from both three months and six months ago, suggesting the greenback is in a downwards trend. This suggests that the best trend trades are likely to be against the U.S. Dollar in the near future. However the Index still really needs to break below recent support from about 11800 to 11600 before the fall will start to look very strong.

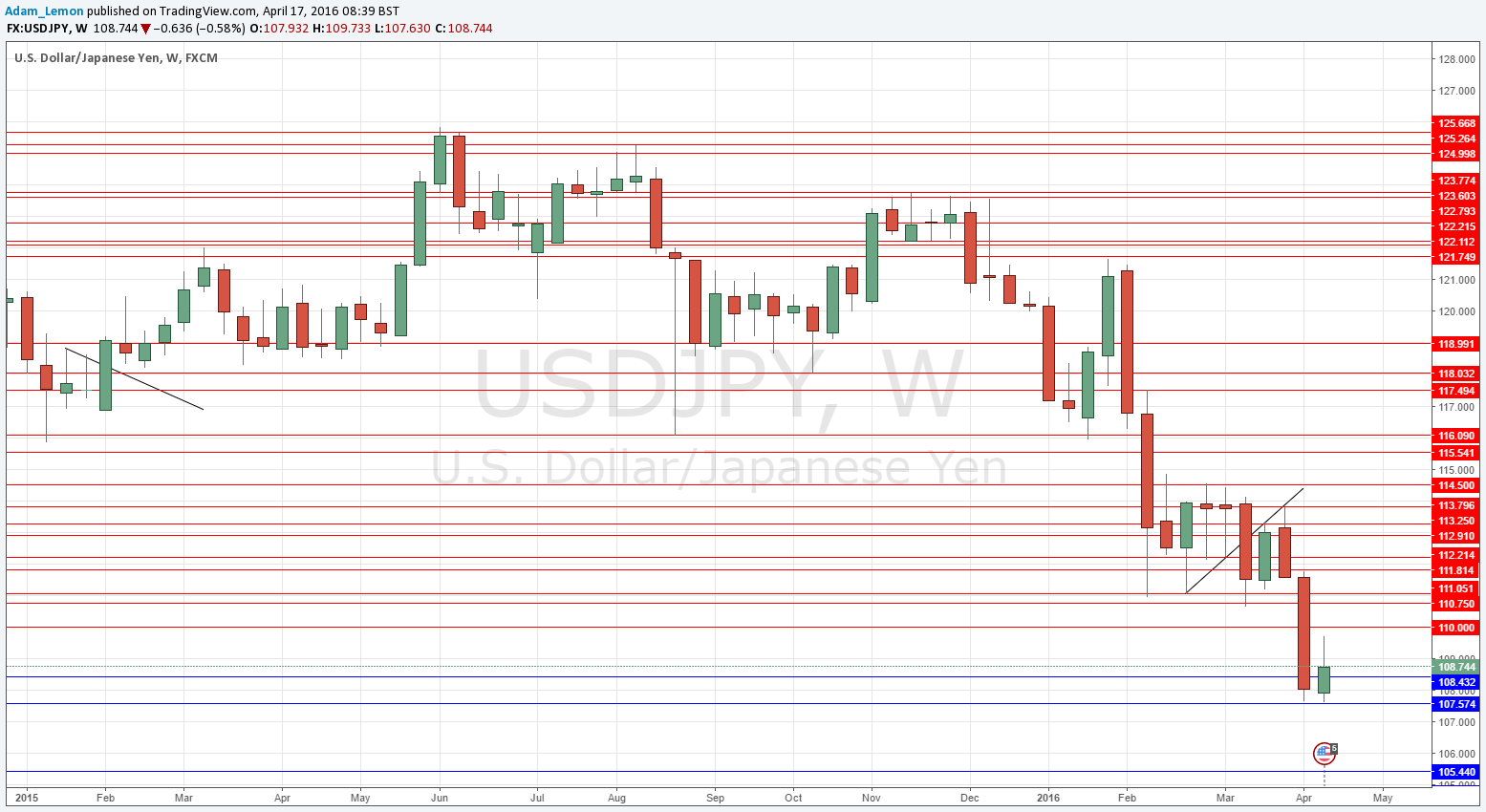

USD/JPY

This pair rose last week, but ended up falling from its high that was quite close to 110.00 to close within the lower half of its range. However there is new support at 108.43 that might hold.

USD/CAD

This pair has been falling very strongly, with only one week closing up in all the previous 13 weeks. There is support at 1.2750 which is also a key psychological number, but on sheer momentum alone there is a good case to look for short trades here, especially as we are now below the price levels of 3 and 6 months ago.

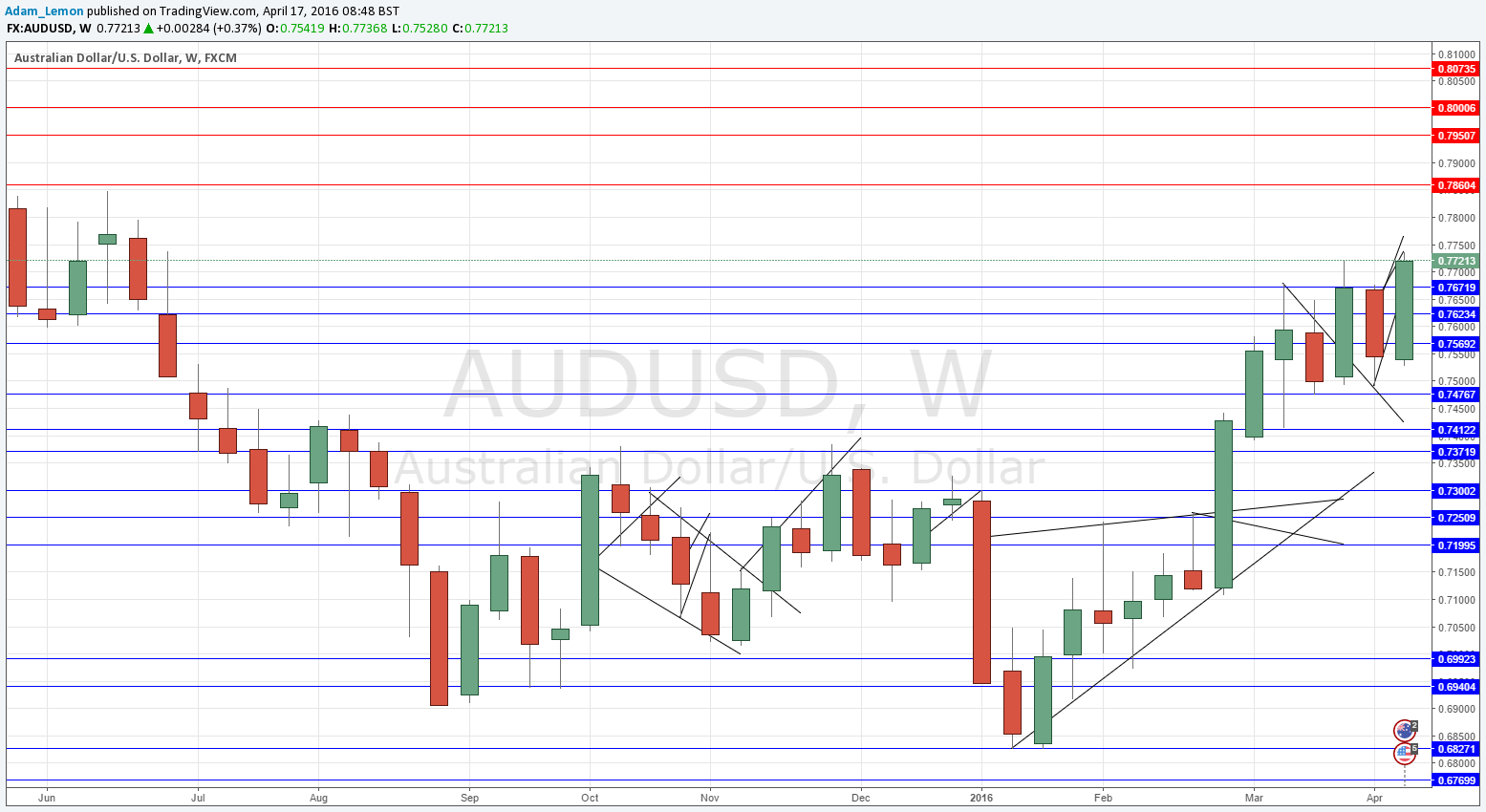

AUD/USD

The weekly chart below shows we have just had the highest weekly close since last June, with a solid bullish breakout structure having been formed over the past 5 weeks. Technically the picture looks bullish now, with no obvious strong resistance before about 0.7850. However the RBA has hinted strongly that it does not want the price to continue to rise, so may cut rates on receipt of any further very bullish economic data.