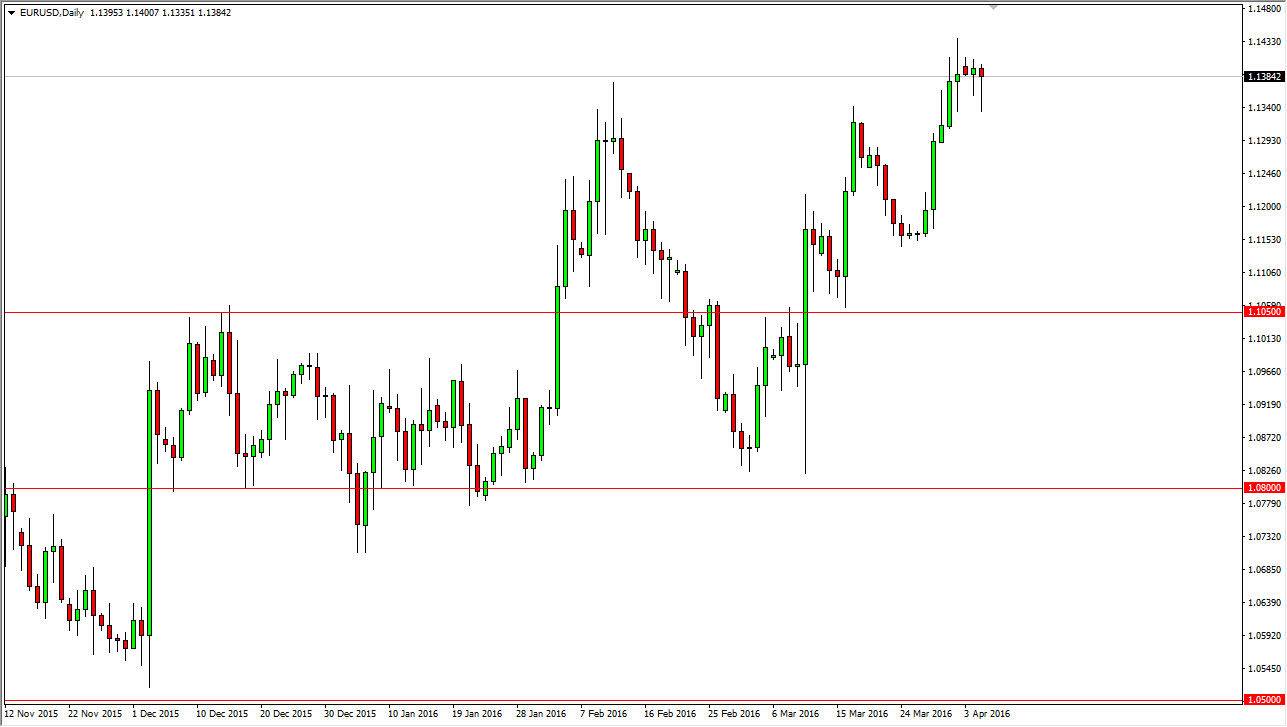

EUR/USD

The EUR/USD pair initially fell during the day on Tuesday, but turn right back around to form a bit of a hammer. The hammer of course is a bullish sign, and the fact that we formed this hammer at the very top of an uptrend tells me that the buying pressure is still very much significant in this market. On top of that, we have the FOMC Meeting Minutes today, and it is very likely that the market may find out that the Federal Reserve is even more dovish than once thought. If that’s the case, the Euro normally is the beneficiary on a weak US dollar. Because of this, we very well could find yourselves testing the 1.15 level by the end of the session. Even if we do fall from here, I believe that the buyers will return sooner or later.

GBP/USD

The GBP/USD pair fell during the course of the day on Tuesday, as we remain very consolidative. I think that the market will continue to find buyers near the 1.14 level, extending all the way down to the 1.40 level. While the US dollar may soften overall during the day today, the reality is that most traders are concerned about the United Kingdom leaving the European Union, and have been punishing the British pound for that recently. If we rally in this pair, I would be willing to start selling somewhere near the 1.44 level, because of the massive amounts of resistance all the way from there to the 1.45 handle.

Regardless, this is going to be very choppy market so I believe that any trade you take at this point in time is going to have to be of the shorter-term variety. I don’t see a longer-term move until we break either above the 1.45 level, or break down below the 1.40 level, and on a daily close it back.