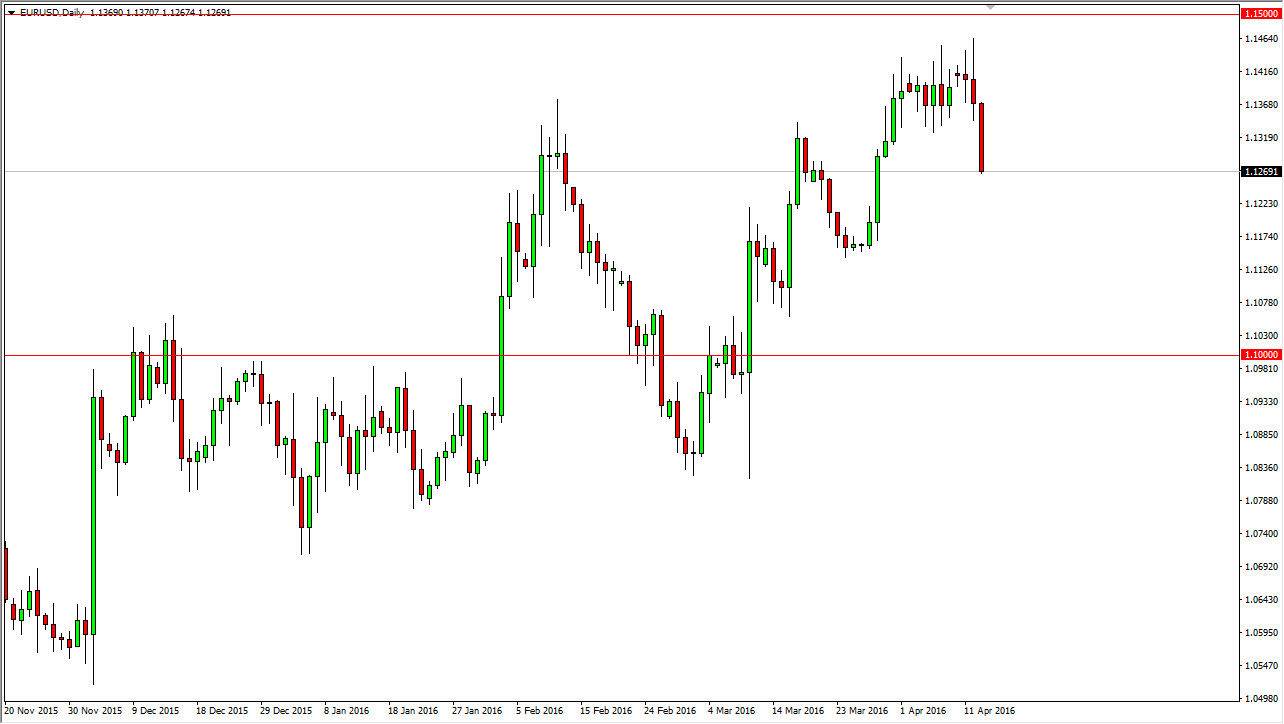

EUR/USD

The EUR/USD pair broke down significantly during the course of the session on Wednesday, breaking down below the 1.13 level. Of course, there is quite a bit of support below, especially at the 1.12 level, so I’m waiting to see whether or not we get a bounce in order to start buying again. Short-term traders will more than likely will continue to sell this market for the short-term, especially considering how negative the candle was. However, I do believe that the longer-term uptrend will resume, it just simply is a market that has run out of momentum for the short-term. Ultimately, if we can break above the 1.15 level, it’s very likely that the market will go into a longer-term buy-and-hold mode. I’m a bit hesitant to sell, at least at the moment.

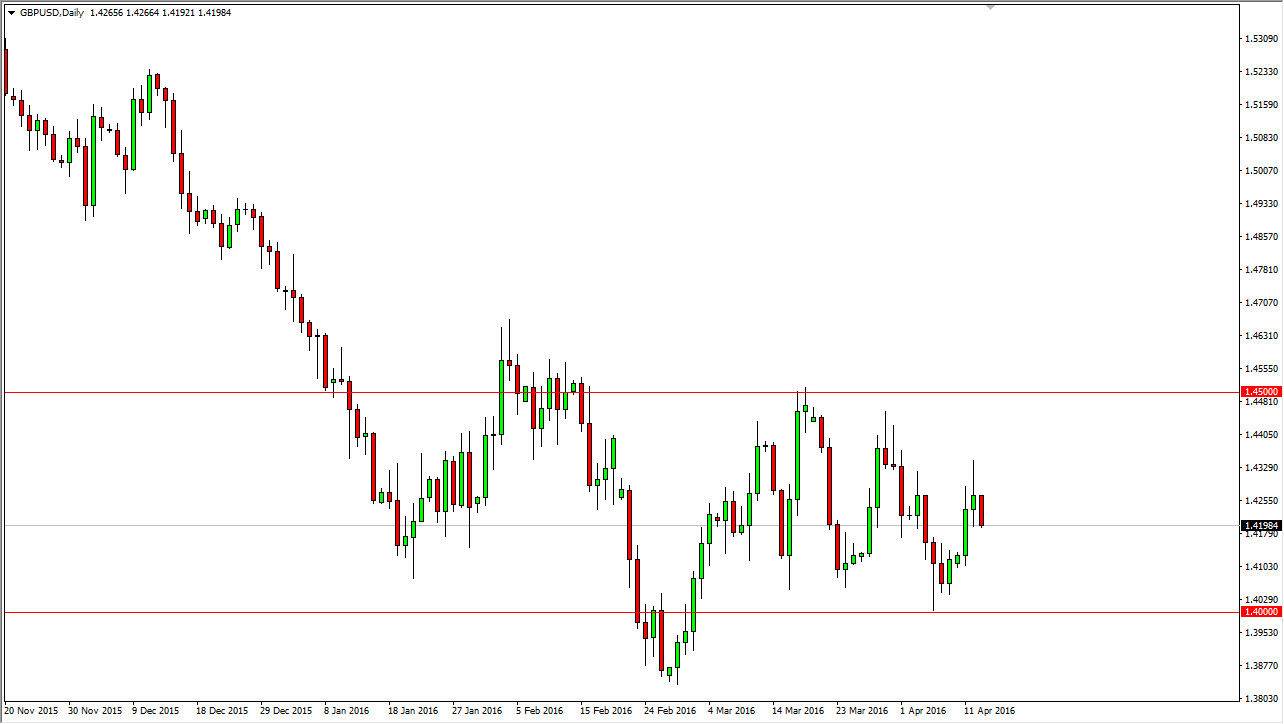

GBP/USD

The GBP/USD pair fell significantly during the course of the session on Wednesday, testing the bottom of the shooting star from the Tuesday session. We are essentially sitting at the 1.42 level, and as a result it looks like we are going to continue to go lower. The 1.40 level below is of course a target, as it was a massively supportive level, and with that being the case, the market will more than likely be attracted to it. The market has been consolidating between the 1.40 level on the bottom, and the 1.45 level on the top.

The one thing that I do notice is that the buyers are getting a little bit lower within the consolidation area, so having said that I have to believe that the market will continue to bounce around, but ultimately has more bearish pressure than bullish. At this point in time, it’s very likely that the market will continue to be difficult to trade, but having said that I believe it still is going to be easier to sell than buying. On a break below the bottom of the range for the day on Wednesday, I am a seller.