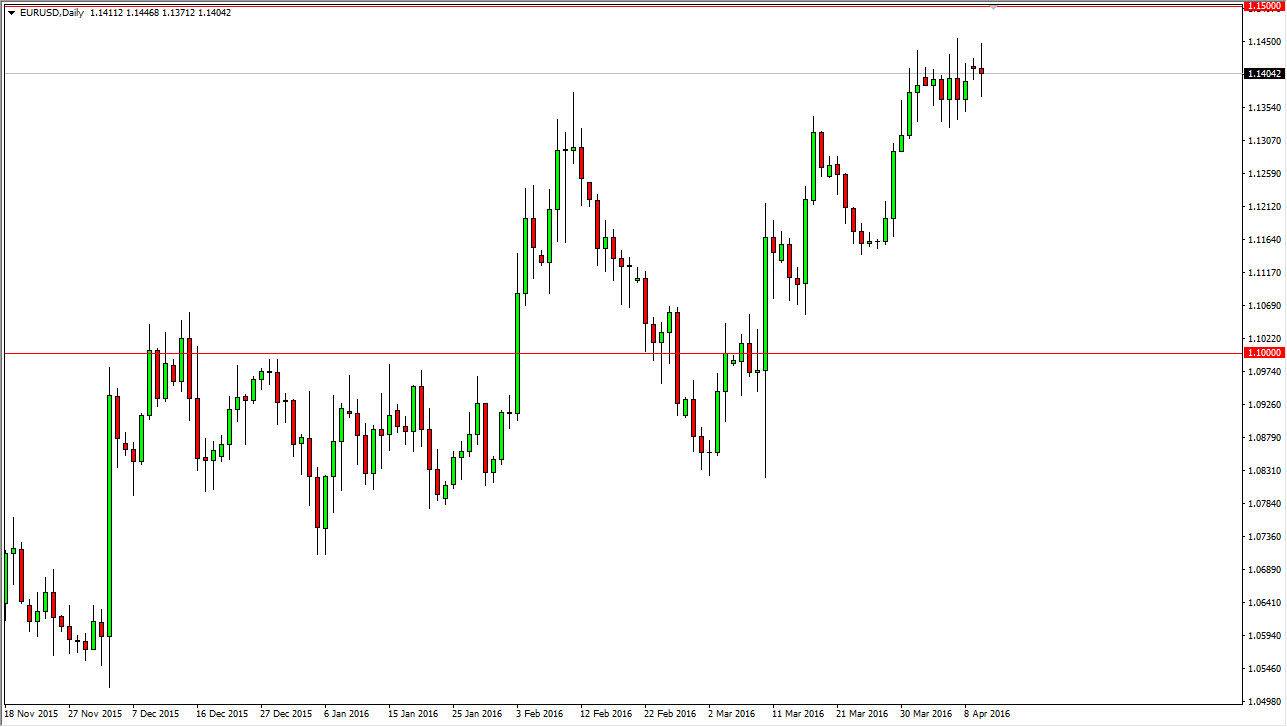

EUR/USD

The EUR/USD pair went back and forth during the day on Monday yet again, as we continue to see a basic stagnation in this market. I do think that eventually we will break out to the upside in with that being the case it’s only a matter of time before we do get the breakout. However, I think that there is a massive amount of resistance between the 1.14 level and the 1.15 level above there. If we can break above there, the market could go much higher, more or less a “buy-and-hold” type of situation. At this point, I believe the pullbacks will continue to offer value that people take advantage of. Keep in mind that the Federal Reserve has recently suggested that perhaps we are not going to see as many interest-rate hikes has recently thought, so eventually the Euro should prevail.

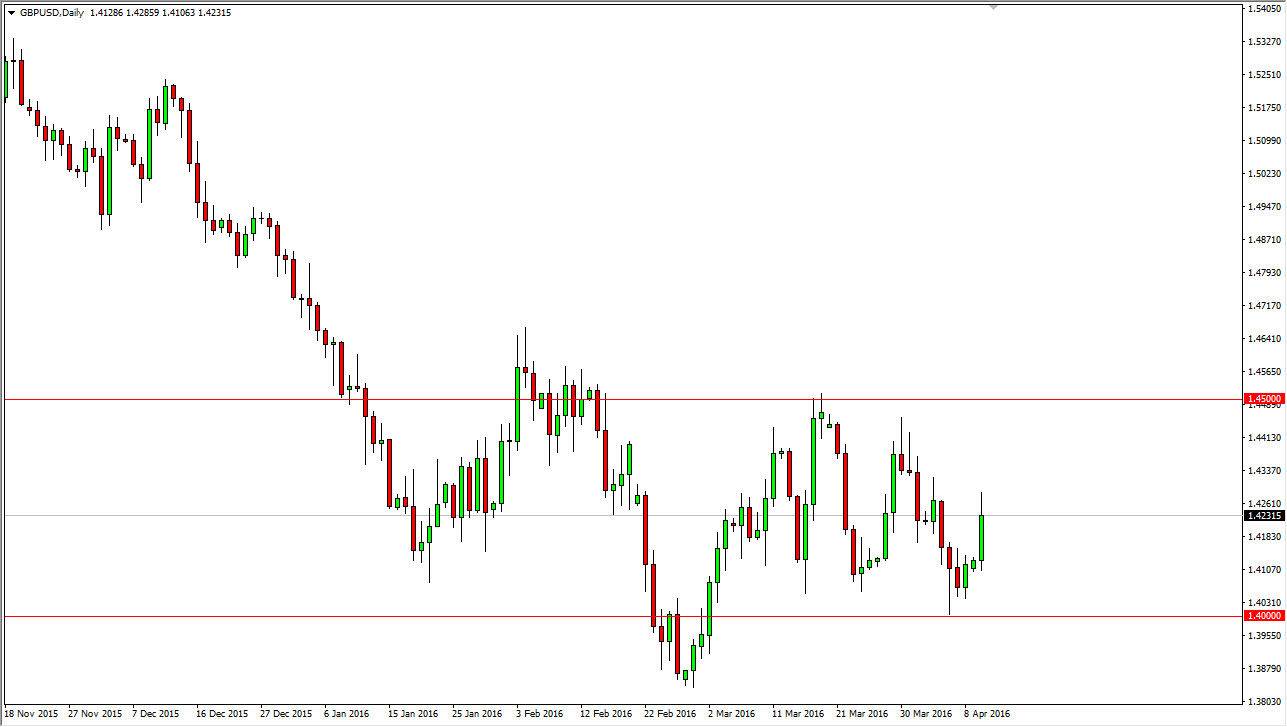

GBP/USD

The GBP/USD pair broke higher during the course of the session on Monday, showing quite a bit of resiliency. However, the reality is that this market is still very much in the previous consolidation, so I don’t think that were going anywhere of a longer-term yet, considering the fact that the Federal Reserve looks very unlikely to do all of the interest-rate hikes that we had once anticipated for the 2016 year, but at the same time we have the United Kingdom getting ready to vote upon whether or not they want to stay in the European Union. Because of this, the market has plenty of reasons to be bearish on both the British pound and the US dollar. In other words, this is a market that’s going to be very difficult to pick up any real momentum in one direction or the other 4, just simply because there so many negative factors for both sides.

The candle for the session was fairly strong, but at the end of the day we are still very much in the range of acceptable consolidation, and it’s not until we break above the 1.45 level or below the 1.40 level that I feel we are finally broken out of it.