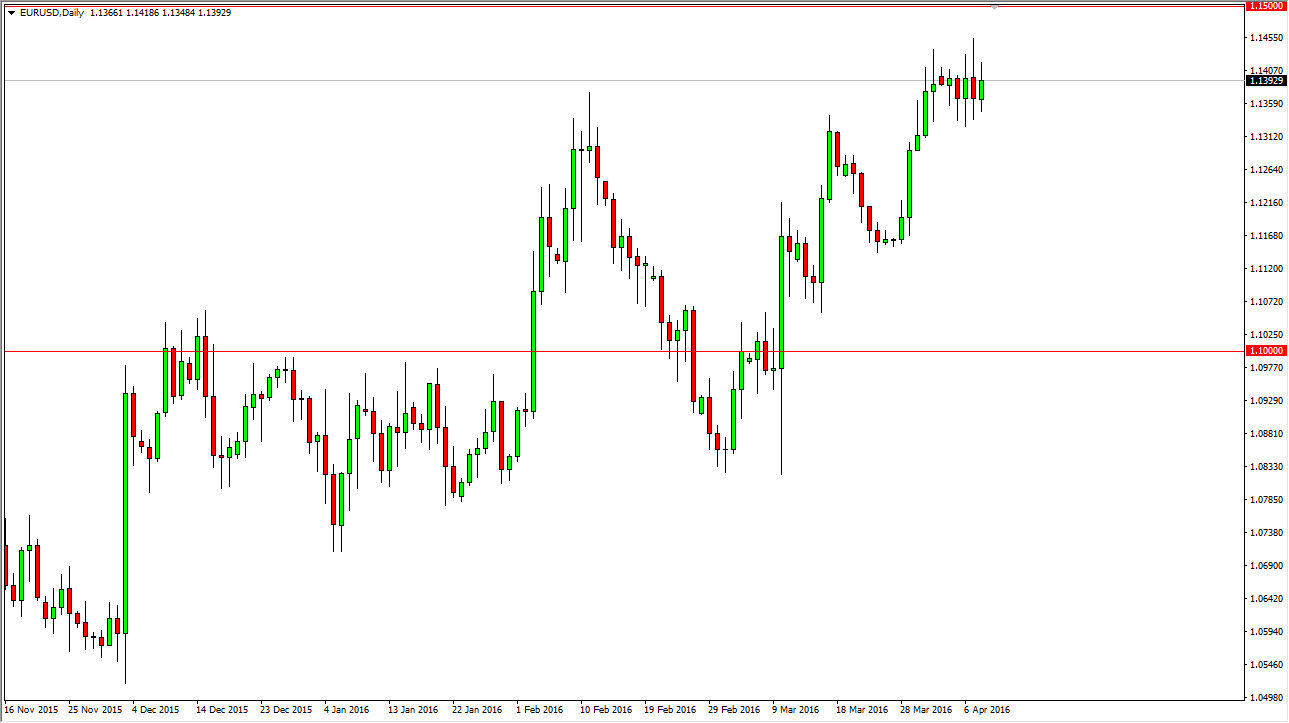

EUR/USD

The EUR/USD pair rose slightly during the course of the day on Friday, as we continue to bang up against the 1.14 handle. That is the beginning of a significant amount of resistance that extends all the way to the 1.15 level, and with that being the case although I believe that we are going to go higher, I think that we need a pullback in order to build up enough momentum in order to finally make that move. Because of this, even if we fall from here I have no interest in selling as there are more than enough reasons to think that the buyers will return. The Federal Reserve stepping away from interest-rate hikes during the year 2016, or at least some of them of course will work against the value of the US dollar. Ultimately, this is a market that will break out but I don’t know when.

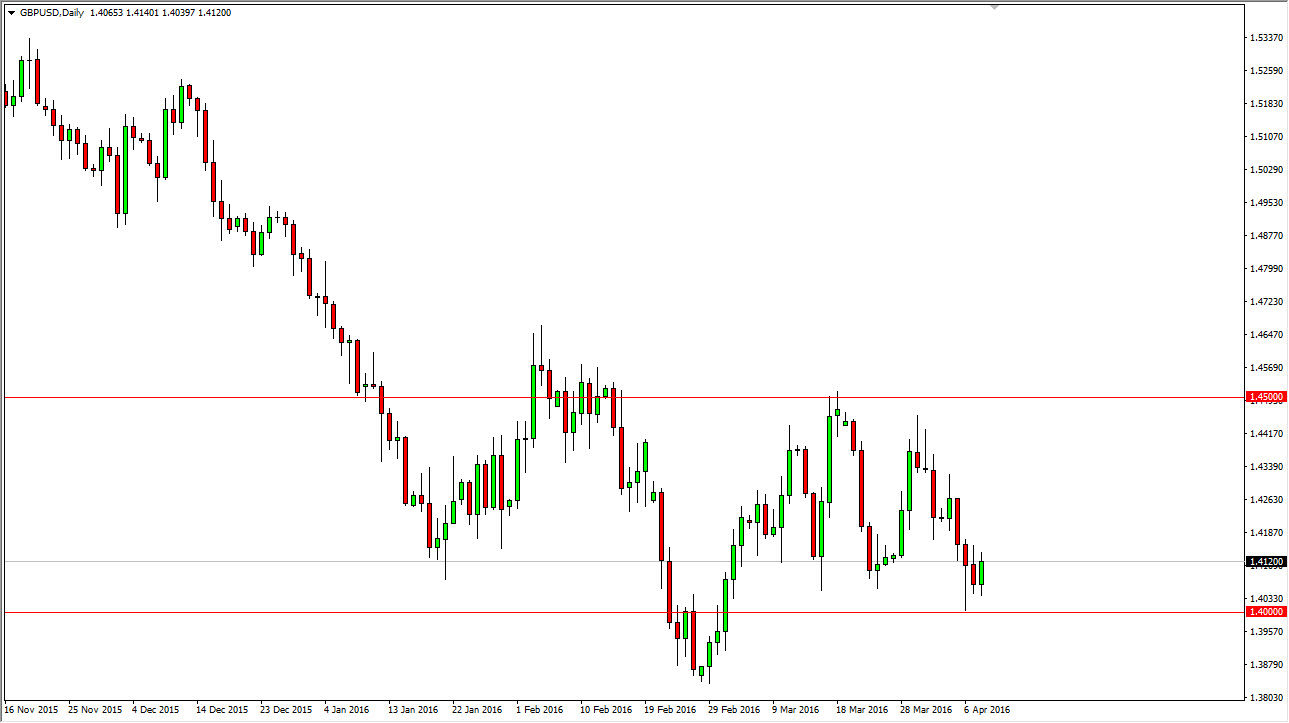

GBP/USD

The GBP/USD pair rose during the course of the session on Friday, as we continue to see quite a bit of support near the 1.40 level. This is a market that continues to find consolidation overall, with the 1.40 level being the support, and the 1.45 level being the resistance. Also, at this point in time it appears that if we can break above the top of the hammer from the session on Wednesday, it’s very likely that this market will then reach towards the 1.44 level. The 1.44 level is the beginning of significant resistance, which of course extends to the aforementioned 1.45 handle.

It is going to be a very volatile market, but nonetheless we continue to go back and forth again and again. If you can handle the volatility, the market should continue to climb, but at this point in time the choppiness will continue to make a lot of traders nervous. With this, you may perhaps find it easier to trade a smaller than usual position.