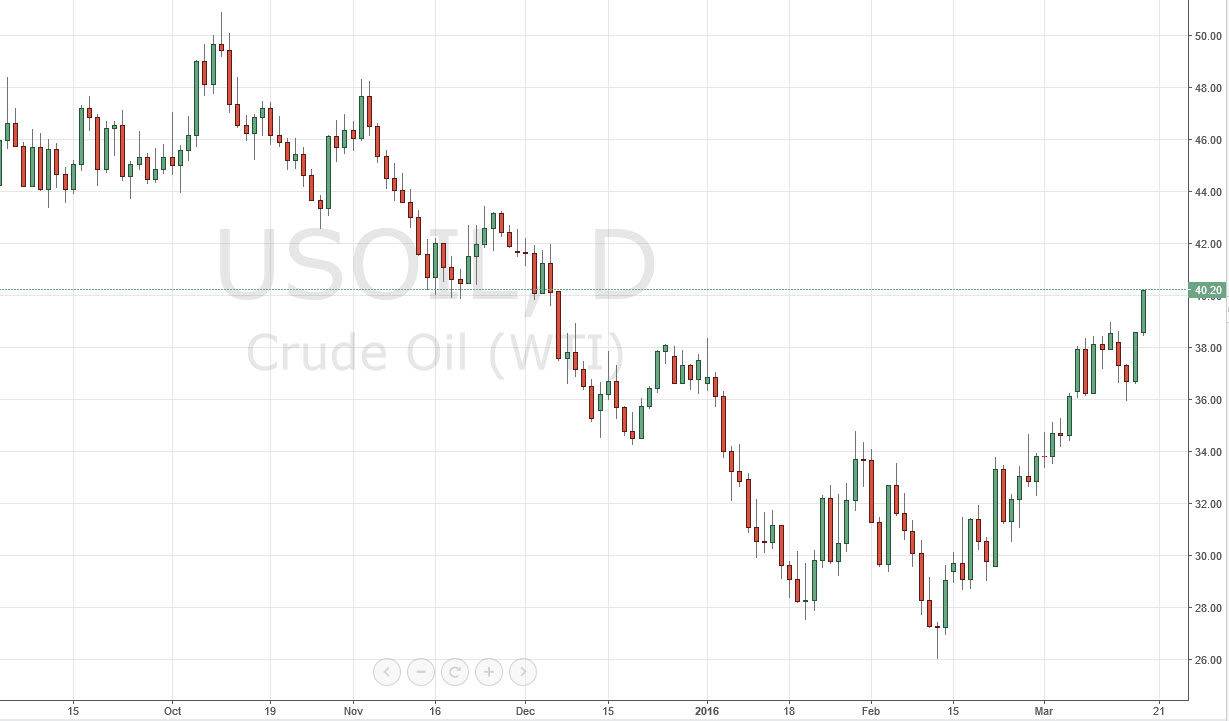

WTI Crude Oil

The WTI Crude Oil market rose during the course of the session on Thursday, breaking above the $40 level. This is a very interesting move, because we know that shale oil producers are looking to enter the market somewhere around the $40 level. Because of this, it’s hard to imagine this market going higher without too much trouble, but at this point traders are looking optimistic as the production freezes seem to scare people that supply could be an issue. With this being the case, the market will more than likely find resistance above, but right now there are no signs of it. An exhaustive candle would be reason enough to start selling and with that I’m simply waiting. I have no interest in buying this market, because it's only a matter time before supply overwhelms demand.

Natural Gas

The natural gas markets initially fell during the course of the session on Thursday, but then turned right back above the $1.90 level. The market looks as if it should continue to go little bit higher, but it’s only a matter of time before the $2 level comes into the frame and turns things back around. This is a longer-term downtrend, so with that we believe that sooner or later the sellers will continue to drive this market.

Ultimately, this market should test the lows again, but right now we have a lot of American drillers stepping away from the fields as supply is so overwhelming. With this, I expect quite a bit of volatility but over the longer term, we believe that the markets will break down given enough time as there is simply far too much in the way of natural gas out there to demand high pricing. On top of that, we are exiting the cold weather season in the northeastern part of the United States which of course has in effect.