USD/JPY Signal Update

Yesterday’s signals were not triggered.

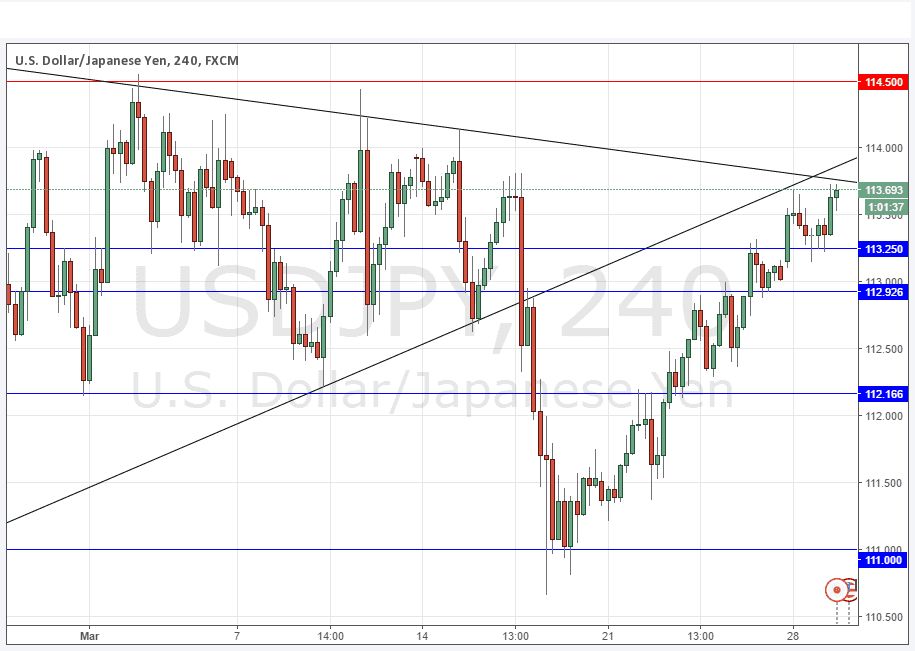

Today’s USD/JPY Signals

Risk 0.75%

Trades must be entered between 8am New York time and 5pm Tokyo time only.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of the higher broken trend line currently sitting at around 113.85.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Long entry following extremely bullish price action reversal on the H1 time frame immediately upon the next touch of 113.25.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Long entry following extremely bullish price action reversal on the H1 time frame immediately upon the next touch of 112.93.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

The price remains at the same crucial area: the confluence of two trend lines that formed the previous consolidating triangle, as well as key resistant round number at 114.00. The lower trend line is ambiguous and so it is better to focus on the higher trend line which has not yet been hit. If there is a bearish turn, it will probably not happen until a time close to the end of the London session (5pm London time) or later.

There is nothing due today concerning the JPY. Regarding the USD, there will be a release of CB Consumer Confidence data at 2pm London time, and the Chair of the Fed will be speaking at an event at 4:20pm.