USD/JPY

The USD/JPY pair fell initially during the course of the session on Wednesday, but turned back around to find a nice-looking hammer. The hammer of course suggests that we are going to rally from here, so if we can break above the top of the candle for the session, it’s very likely that the market will grow to the 114 level. At this point in time, it would not surprise me at all to see this market rally, simply because the nonfarm payroll numbers are coming out tomorrow, and with that being the case it makes sense that the market normalizes in the meantime. I think short-term buying is possible on a break above the top of the hammer, but I would be out of the market by the end of the session later today as the NFP can cause havoc in this particular pair.

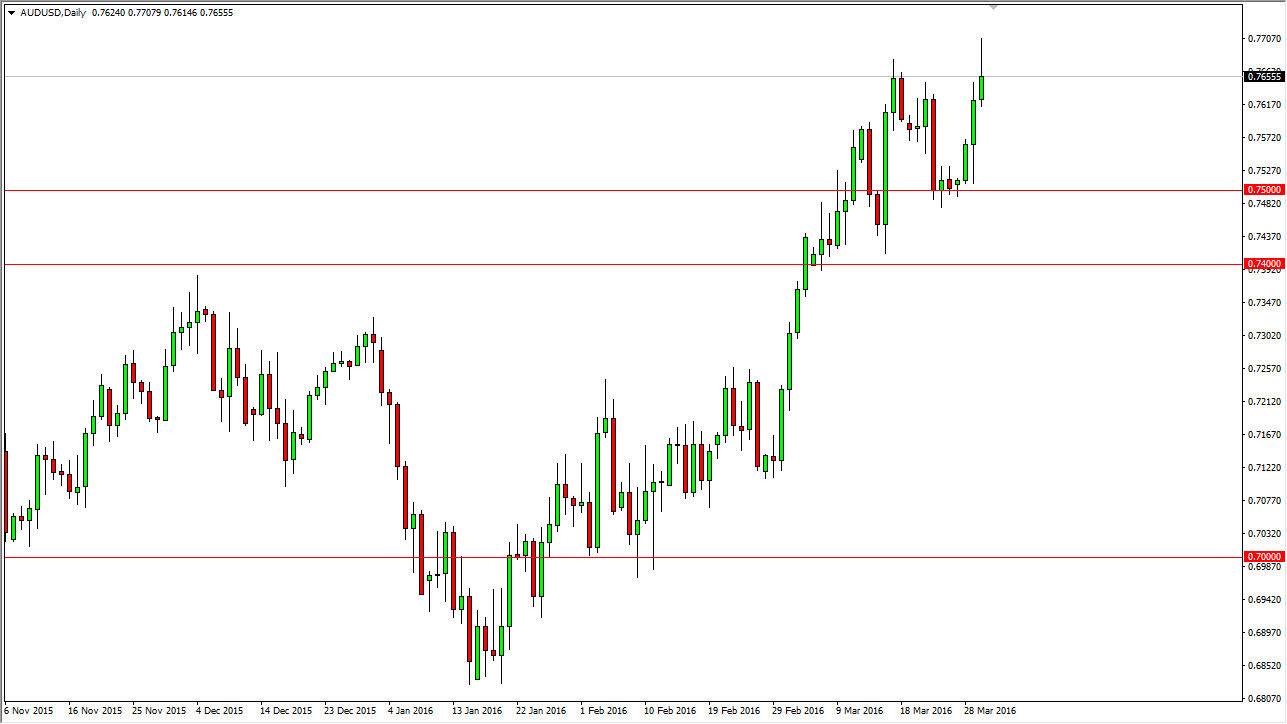

AUD/USD

The Australian dollar rallied on Wednesday, but gave back about half of the gains during the day. With this, the market looks as if it isn’t quite strong enough to go higher and with that being the case, I believe that the market could very well pull back from here and try to find support below. I believe that supportive candles below could be buying opportunities, just as a break above the top of the shooting star like candle that had formed during the course of the day.

I believe that the 0.75 level below will continue to be supportive, as we not only have support there, but we have a large round number there, and of course it seems like we have a fairly large zone that extends all the way down to the 0.74 level below. Ultimately, even if we fall from here I’m not willing to sell this market, because I think that gold has quite a bit of support underneath it, and that of course can put a lot of pressure on the Australian dollar to the upside.