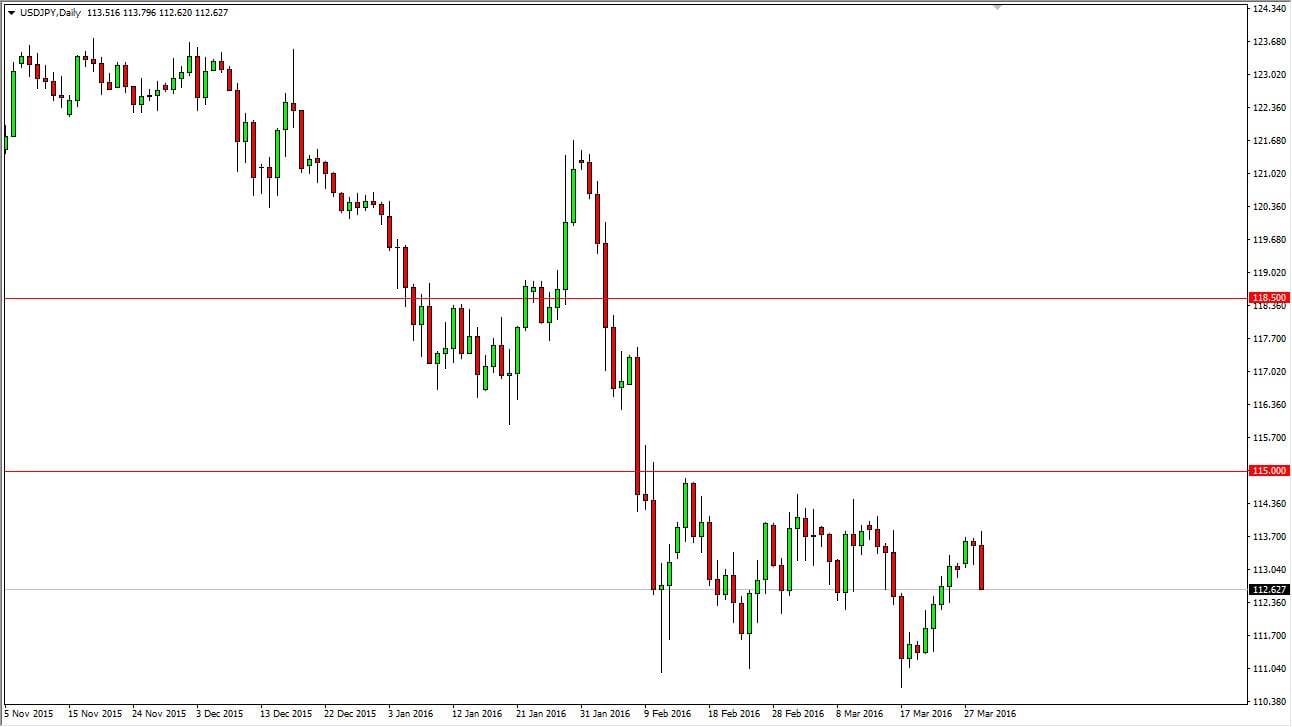

USD/JPY

The USD/JPY pair initially rallied during the course of the session on Tuesday, but turned back around to form a massively red candle. We are testing the 112.50 level below, which of course has been somewhat important recently. If we break down below there, we could go as low as the 111 handle, which was recently massively supportive. Keep in mind that the Nonfarm Payroll Numbers come out on Friday, so this market will probably trend fairly carefully between now and then. Nonetheless, it looks as if we are going to go lower in the meantime, so if you have the proclivity to sell this market, you can do so with great care. At this point time though, it’s probably better to wait until the announcement comes out on Friday.

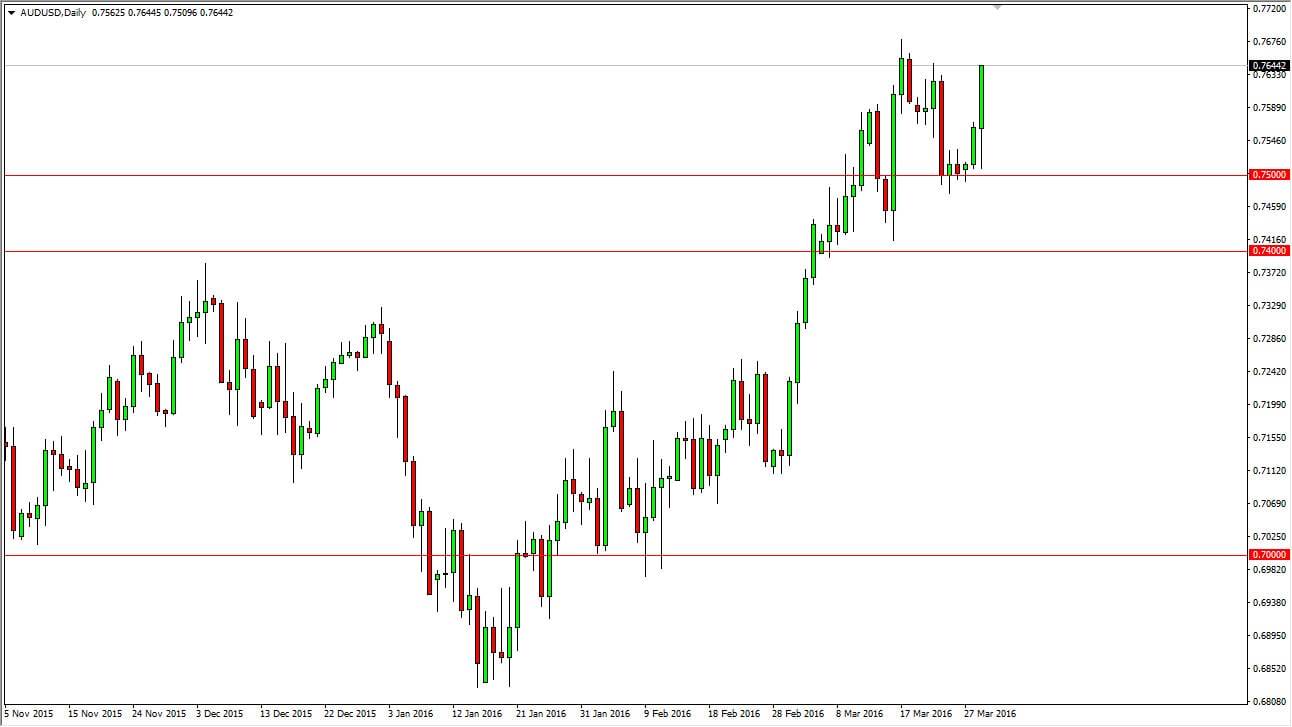

AUD/USD

The AUD/USD pair initially fell during the course of the session on Tuesday, testing the 0.75 level for support. There is a massive amount of support between there and the 0.74 level below, so I feel that the market will more than likely find buyers in that area. We also turned back around to form a massively bullish candle, as we are testing the 0.7650 level again. I believe personally that we are going to the 0.80 level, so pullbacks will be buying opportunities as we continue to see quite a bit of bullish pressure in the Australian dollar, not only due to the Federal Reserve stepping away from interest-rate hikes, but we also have the gold markets rallying significantly, which of course is a massive driver of the value of the Australian dollar.

I believe that the 0.80 level above is massive resistance though, so having said that it’s probably going to take several attempts to break out above there. Ultimately, this is a market that should continue to see buyers, and eventually we will go above there and reach to much higher levels.