USD/JPY

The USD/JPY pair fell during the day on Tuesday, as we dropped down to the 112.50 handle. The market should have support for closer to the 112 level though, so I feel that this particular pair will more than likely offer a supportive candle we can start buying. Once we get that, I’m willing to hang onto the trade to roughly 114.50 or so, recognizing that the 115 level will be a massive resistance barrier.

Because of this, I think that short-term traders will continue to flock to this market, which looks as if it is stuck in this particular consolidation area, so therefore it gives us an opportunity to trade short-term in a back-and-forth fashion until the market decides which way it wants to go.

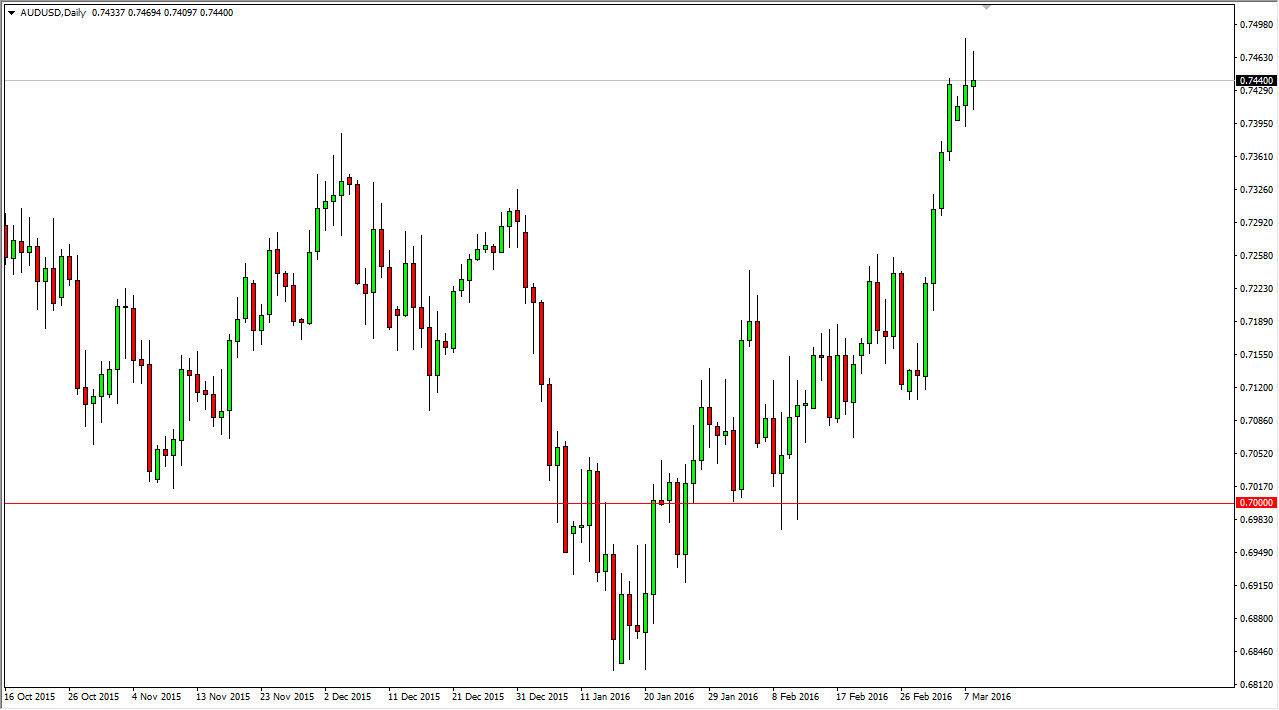

AUD/USD

The Australian dollar had a slightly positive session during the day on Tuesday, as we broke higher and attempted to break above the 0.75 level yet again. If we pullback from here, it’s likely that the market will find buyers below somewhere, as the gold markets have been fairly well supported. Alternately, if we break above the 0.75 level, I’m a buyer up there as well as it should send this market to much higher levels.

The reality is that the Australian dollar has shown quite a bit of strength lately, and as a result we might be a little bit overbought at this point. However, that simply should attract more buyers on the pullback as people will begin to look at the pullback as potential “value” in the Australian dollar. On the other hand, if we break above the top of these couple of shooting stars, that could really lead to a major influx of buying orders in this pair.

It’s not really less the gold markets fall apart that I’m thinking about selling this pair now, because most obviously we have broken out and certainly the rest the world knows this. When that happens, it’s difficult for the markets.